Latest News on Mobile Banks – January 2021

In January 2021, Monese, N26, and Revolut are making waves with innovative features and online banking developments!

A prominent banking journal recently ran the following headline, ‘Anything that’s not mobile-first is facing potential extinction.’ The mobile banking arena is the go-to solution for personal and business users across the board. Mobile banking offers many viable solutions to customers, thanks to quick-click functionality, on-the-go banking with deposits, withdrawals, forex transactions, remittances, and a complete suite of banking facilities.

With online banking, businesses can stay up-to-date with debits and credits, payments and deposits, and account management quickly and easily. Nowadays, customers are taking to mobile banks over traditional banks and finding that their disruptive services are better suited to their needs. Online banking options like Monese, N26, and Revolut are cutting a swath with customers across-the-board. They offer cost-effective solutions to all things banking, and their exclusive focus on the mobile banking arena is winning over customers in large numbers.

It comes as no surprise that mobile banking is preferred by growing numbers of customers all over the world. Our tech-savvy generation expects nothing less than full-service banking on the go. The days of frequenting land-based banks for rudimentary transactions are over. Mobile is the preferred medium. We now explore the options available at these leading mobile banks.

Monese

Customers in the United Kingdom and across Europe value the services provided by Monese. This online banking service has released several key features , including a Virtual Card, and the new Monese Joint Account. Anyone with a Monese account can now set up a virtual card at the click of a few buttons. This is the safer and easier way to manage your finances, thanks to a unique 16-digit card number that performs all the same features as a traditional card.

Customers can use the virtual card for making online payments, purchasing via Google Pay or ApplePay, and receive instant notifications when transacting online. Virtual cards provide additional security layers to your account, and they can easily be locked after each use to prevent fraud. The 2-step process to setting one up requires opening your Monese app and then swiping right to the virtual card option.

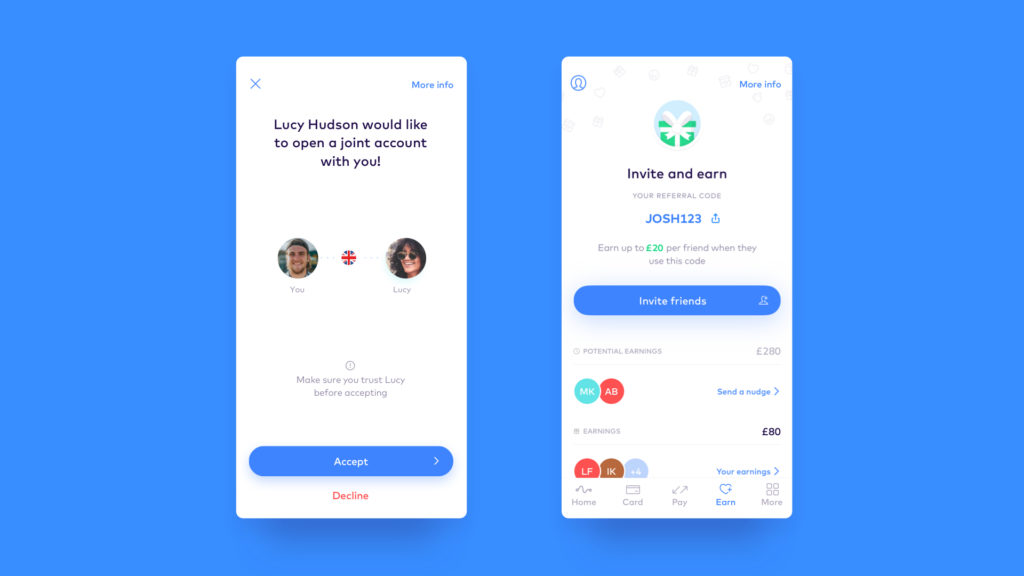

The Joint Account is expressly tailored to EEA and UK customers. If you live in France, you’re out of luck, but in time to come it will be available too. Shared accounts are ideal for couples, friends, or roommates who want to manage finances together. Joint account holders share the same account number, the same balance, and the same allowances. It is easy to set one up – simply send an invitation to a fellow Monese account holder and invite them to open an account with you. The 3-step process can be completed quickly and you’re done.

Read more about Monese in our Monese Review.

N26

N26 online bank is eager to showcase its latest online banking features to clients. Now, customers can easily set up their own rules on N26 Spaces. This in-app feature allows account holders to shift funds back and forth between the Main Account and Spaces, as well as sub-accounts. These rules are put in place to guarantee funds availability for important obligations like rental payments, utility payments, medical bills, et cetera.

Once you get paid, rules can be set up to ensure that rental money is moved from your main account to one of your Spaces, precisely for this purpose. N26 permits up to 10 rules across your Spaces, and you can easily edit (change, create, or delete) these rules as you see fit. The rules will be activated on the proviso that you have funds available in your account.

Read more about N26 in our N26 Review.

Revolut

Revolut has released a powerful online banking feature known as Smart Pension. Now, you can easily set up a business account and a pension plan within minutes. The Smart Pension is designed for anyone, at any stage of life. Thanks to the Revolut banking platform, it’s easier than ever to set up reliable pension services and stay abreast of your pension program. Once you have a business account opened your employees will get a preferred rate for their pension fees. Note that automatic pension enrolments are mandatory for businesses in the UK.

Now, it’s easy to set up auto-enrolment for eligible employees at companies. Smart Pension provides preferential rates, and everything can be completed within minutes. This, on top of 24/7 customer support, and free accounts for business account holders makes Revolut the preferred mobile banking solution for the New Year.

Read more about Revolut in our Revolut Review.

Top 10 Mobile Banks is reviewing and comparing the top mobile bank services based on the most important parameters and features, such as fees & rates, features, user experience, and safety.

We publish thorough reviews on the leading Fintech startups in the field and provide comparative information so our users can make smart choices and informed decisions.