How to Compare Mobile Banks

Advertiser disclosure

Online Banks or Mobile Banks is no doubt the main trend in banking and finance world these days. Don’t confuse it for online or mobile access to your regular bank account though: what we are looking at now is online/mobile ONLY banks which have their own features and bonuses.

Mobile banks, unlike traditional banks, are paperless and borderless, meaning that the customers get to have all the normal banking features, but in a modern, lightweight, and handy digital form-factor of a mobile application.

To compare mobile banks and find the right app for your banking needs, there are a number of factors you should consider:

- Fees, including transaction & ATM withdrawal fees: Fully online business model means operating at a much lower cost than classic “bricks and mortar” banks. Thanks to frugal operational costs, customers are getting outstanding value for their money. However, there still are differences between each and every mobile bank. You may also want to check other fees such as card replacement, overdraft, and top-up fees before selecting your preferred mobile bank.

- Monthly Plans: The leading mobile banks offer free accounts, so you only have to pay a small fee for the services you use, and sometimes a one-time payment for the card issue and delivery. Many mobile banks also have premium plans, offering additional benefits such as free withdrawals, bigger limits, even lower fees, insurance and more.

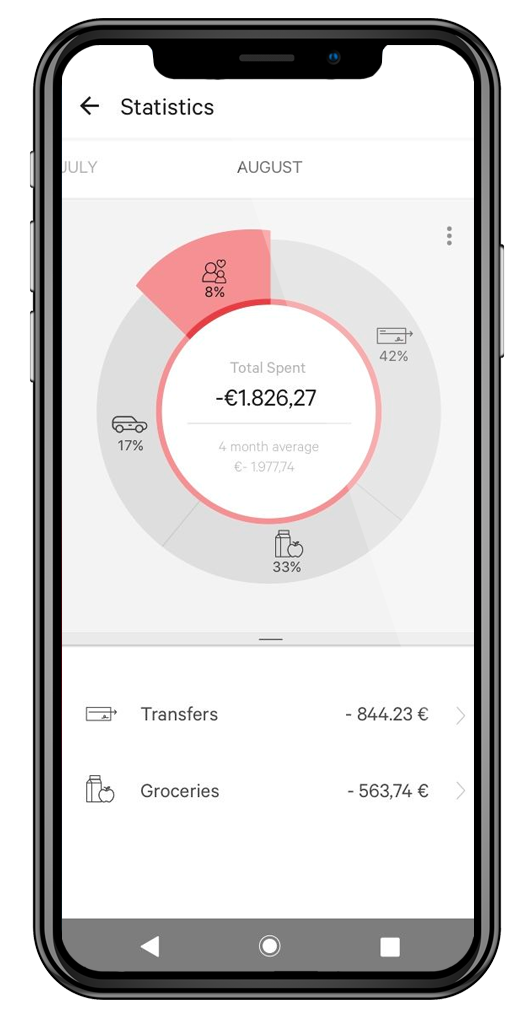

- Saving and budgeting tools: Some mobile banks offer stand-alone savings accounts, while others offer nifty features such as rounding up your purchases and placing the difference in a ‘piggy-bank’ in the app as well as budgeting goals and targets.

- Security: Is it safe to use a mobile bank for everyday banking? Despite operating fully online, the leading mobile banks, including those on this website, adhere to the highest safety standards, same as classic banks. Including the mandatory funds’ insurance, in order for your money and data to stay protected.

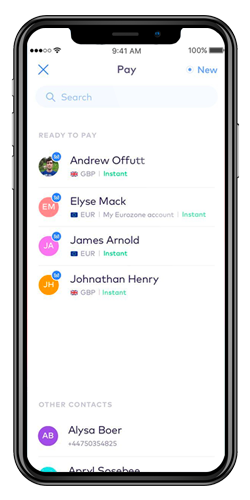

- Payments: All mobile banks offer a debit card for payments and withdrawals from your mobile bank account. In addition, many banking apps also offer e-wallets such as Google Pay or Apple Pay, making online and in-store payments even easier. Many mobile banks offer bill-sharing and money requests for fellow app users, so it’s a good idea to use it with friends and family.

- Efficiency. Some “challenger” banks choose not to reinvent the wheel, but rather outsource some services to the established experts. For example, N26 mobile bank is partnering with the best fin-tech brands, such as TransferWise (foreign exchange), Raisin (savings), Clark and Allianz (Insurance), Auxmoney (credit) and others, to be able to provide its customers with best & sterling products.

- Usability. Many mobile banks will still provide you with a real international debit card, sometimes with free ATM withdrawals worldwide or within some region. It means that you can pay, withdraw money, block or unblock your card, set permissions or limits, and make other security changes — in other words, do everything you can do with a traditional bank, except easier & directly from the app or a desktop web-account. Look for features fitting your needs.

Bottom Line

The mobile banks’ industry is hot and new and new brands appear like mushrooms after rain, so it can be overwhelming to research your options for mobile banking.

By finding the right service and tools, you can safeguard yourself a peaceful, handy day-to-day banking routine, and save a lot, whether home or abroad.

Use the checklist above, and our online banks comparison tables to choose the best mobile bank for you.