Is it Safe to Use a Mobile Bank for Everyday Banking?

Advertiser disclosure

The finance world is moving away from your more traditional banks to online or mobile banks. Not to be confused with the online account connected to your standard bank, mobile-only banks are totally app-driven. They offer many benefits, like reduced fees, less waiting time, and fewer restrictions.

One of the added benefits of having a mobile-only account is that it allows for hassle-free borderless banking. With mobile banks, you don’t need to go to a physical branch, wait in line and have to deal with the long process of opening an account and its bureaucracy.

In this ever-changing financial world, mobile-only bank Revolut, for example, will even allow you to exchange currencies into 5 crypto-currencies, all via their app.

New banking solutions like this give many people concerns about the safety and security of their information, and more importantly, their funds. The number one question is: Are these mobile-only banks secure? We’re here to tell you that, yes, it is very safe to conduct your banking this way, and here are the reasons why.

Deposit Protection

How protected is your money? That is the question uppermost in most people’s minds when it comes to any bank. If, for some reason, the institution has problems and needs to close, what happens to the money? The answer comes from two different sources. Does the bank re-invest the funds elsewhere, and is there any government protection?

Re-invest

Most financial institutions re-invest any funds they receive from their customers, meaning that they don’t physically keep your funds handy. Should anything happen, they may not be able to recover the money.

Many mobile-only banks like Monese never re-invest the funds, keeping them totally separate even from the company’s own finances, so on the slight chance something goes wrong, the money is available for their clients to get it back.

Read our Monese Review to learn more.

Government

Most of the mobile-only banks have some form of government protection. All of these banks are based in the UK or Europe and as such have coverage from different organisations.

N26 account, for example, has obtained deposit protection for every one of their accounts, from the Compensation Scheme of German Banks, up to the value of €100,000. Bunq accounts are protected by the Holland Central Bank, also to the value of €100,000. Monzo, based in the UK has protection, up to £85,000 from the Financial Services Compensation Scheme.

Real-time account notifications

Any time you use your account, receive funds from another source (like your salary) or make any type of purchase online or offline, you’ll receive a real-time notification on your phone.

This is an extra layer of security. If for any reason, you get a notification of a transaction you don’t recognise, you are in a position to have it traced or stopped immediately.

Secure login

Perhaps the number one concern for new users to mobile-only banking is the security of logging in. These accounts are app-based, and you can log in with either a passcode, your fingerprint, or even facial recognition.

To make this security one step tighter, Monese and N26 only allow pairing to one smartphone at a time. This means that the accounts can never be accessed from a remote device or computer. Location-based security is also offered for smartphones. If the phone is stolen and a transaction is performed from a suspicious location, it could be blocked.

Read our N26 Review to learn more.

Online processes benefit from added security, and all transactions are protected by SSL encryption of at least 128-bit. However, In Revolut’s case, both Revolut business and Revolut personal accounts, it’s as high at 2048-bit.

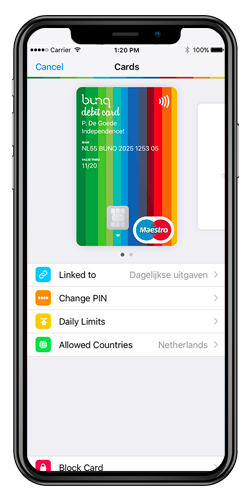

Card Blocking / Unblocking

There are several reasons why you may need to block or unblock your card again. It may have been misplaced, or worse, stolen. Then again, you may have visited a store that you no longer trust.

Lost or Stolen

If you notice that your card is missing, go online and block it immediately. It’s quite likely you may have just misplaced it. Once you find it, you can go back and unblock it again just as quickly. Try getting your standard bank to unblock a card – it’s nearly impossible!

Suspect Vendor

You may have just visited a store and made a purchase, but feel that they might have skimmed your card. No problem; you can instantly block the card and request a replacement directly from the app.

Set Limits & Restrictions

You can change your budgeting settings instantly via the mobile app. Adjust your spending and cash withdrawal limits at the touch of a key. This way, not only can you start controlling your money, but you also get to save money with a mobile bank by budgeting and categorising your spendings according to your preferences.

For overseas travel, you can set restrictions on the types of transactions you wish to use.

Mastercard 3D Secure

For purchases online, mobile-only banks add extra protection by using Mastercard 3D secure. All transactions have to pass through this second step of security. You may need to enter an OTP code (sent only to your mobile number) to complete the purchase.

Bunq offers a unique feature with its Mastercard product. They have a rotating CVC, which you can set to automatically refresh every few minutes, or choose the number yourself. If somehow another person gets hold of your card details, they’ll never be able to predict the CVC, making transactions impossible.

Mobile-only Banks are Safe

You can see now that if you choose to open a mobile-only account, you are benefiting yourself in many ways. Not only do you experience lower fees and fewer wait times than with a traditional bank, but your account is safe and secure.

Your money is protected either by the way the bank manages it, or by government assistance, or both. Online accounts provide instant, real-time notifications, so you can always be aware of every transaction. Encryption security enables login on one device only, by a pin, fingerprint, or facial recognition.

If the card is lost or stolen or you suspect third-party interference, your card can be instantly blocked via the app. For added security, you can also set personal restrictions on the account and feel safe from the added security of Mastercard 3D for online purchases.

Now is the time to consider a mobile-only account for your future banking needs. Find the best mobile bank now!