Latest News on Mobile Banks – December 2019

Advertiser disclosure

This month, Monese, Revolut and bunq are making the news with incredible new developments!

Mobile banking is the preferred channel for personal and business use. Dramatic advances in mobile banking functionality are taking place as we speak, with FinTech companies carving out an increasingly larger share of the market. Traditional banks vs. mobile banks, struggle to keep pace, given that they are limited by physical constraints and high fixed costs of operations. With mobile banking, customers have maximum flexibility and convenience. With mobile banking, it’s easy to download an app and conduct all of your financial transactions at the click of a button.

Nowadays, mobile banking serves as the ideal channel for transactions purposes. Ironclad security features, on-the-go functionality, and cost-effective transactions are but a few of the many reasons why mobile banking has taken the world by storm. FinTech companies are investing heavily in their mobile operations, and customers are lapping it up in their droves.

The age of mobile banking is upon us, as evidenced by scores of new entrants to the mobile banking arena. This month, we examine the developments taking place with Monese, Revolut, and bunq.

Monese

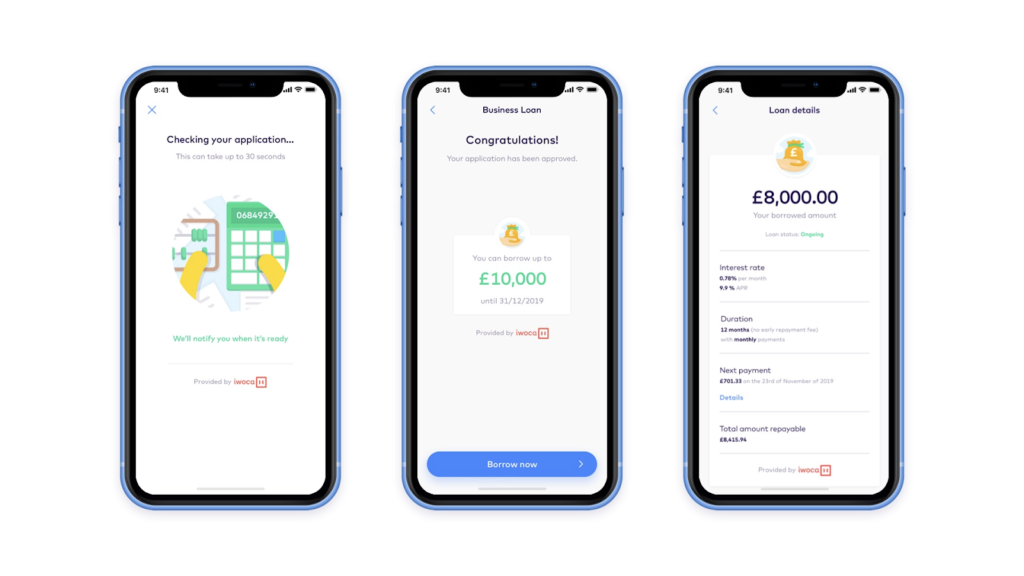

Monese needs no introduction to UK and European customers. This leading mobile payment solution now allows its customers to access business credit via partner company iwoca. Monese Business was crafted with self-starters in mind. No-hassle business accounts are now available for free, courtesy of the partnership with iwoca. This means that SMB owners can easily apply for flexible loans online. This service is available to clients through Monese Business accounts for quick and easy management of personal finances.

Thanks to Monese’s latest mobile banking offering, customers can access loans up to £15,000, with decisions being made in minutes. The loan application process is quick & easy to complete. A business account is needed, with annual turnover of at least £10,000, and a business that has been registered for at least 3 months +. With those three checkmarks in place, account holders can simply power up and choose Business Account and follow the prompts for business loan applications. This offer is ideal for UK-registered business owners seeking lines of credit.

Read more about Monese in our Monese Review.

Revolut

Revolut is fast-tracking its range of mobile business banking solutions with the introduction of GBP Direct Debits. Now, Revolut clients can easily manage all regular payments activity, including petty cash, paying vendors, and settling recurring bills courtesy of local UK GBP account details. This makes it easy to pay all GBP Direct Debits. Currently, this innovative feature is exclusively available to clients with local British Pound account information such as sort code and account number.

The Direct Debit feature offers greater convenience for account management and thanks to Revolut Connect, it provides seamless integration with your FreeAgent, QuickBooks and Xero accounts. Setting up a Direct Debit is quick and easy. Clients simply need to navigate to the Revolut Business Account where sort code and account number information is displayed. Next, Direct Debits can be set up with any service, and once the information has been saved, it features under Scheduled Payments.

Read more about Revolut in our Revolut Review.

bunq

Bunq has just launched its latest eco-friendly, technological breakthrough – the ‘Green Card’. This innovation is a metallic card which makes a tremendous difference to the environment. At €99 per year, ‘Green Card’ account holders contribute to environmental preservation by having trees planted for every €100 that is spent on the card. By engaging in regular spending activity, clients are actually combating the scourge of deforestation by planting new trees.

No additional effort is required on behalf of clients with bunq mobile banking app other than conducting regular expenditures. Since the card is made from metal, its lifespan is 50% longer than traditional plastic credit cards, meaning that it’s also better for the planet. The ‘Green Card’ from bunq works with any bank – no switching needed.

Thanks to bunq’s ‘Freedom of Choice’, clients can determine their own investments and choose eco-friendly European companies that support environmental protection initiatives. As a Premium user, additional bonuses are offered on all expenditures – double the trees are planted with every €100 spent. The solution ensures effortless payments, ZeroFX when abroad, complimentary global ATM withdrawals, spending insights, and instant push notifications.

Read more about Monese in our bunq Review.

Top 10 Mobile Banks is reviewing and comparing the top mobile bank services based on the most important parameters and features, such as fees & rates, features, user experience, and safety.

We publish thorough reviews on the leading Fintech startups in the field and provide comparative information so our users can make smart choices and informed decisions.