Latest News on Mobile Banks – June 2021

Advertiser disclosure

N26, Bunq, and Holvi have once again impressed with new products and updated benefits for customers. this month, the features’ updates cater mostly to small businesses, providing products that allow owners to focus less on banking and more on growing. Mobile and flexible banking are what most small businesses and sole traders need, and these new products and features offer precisely that.

N26

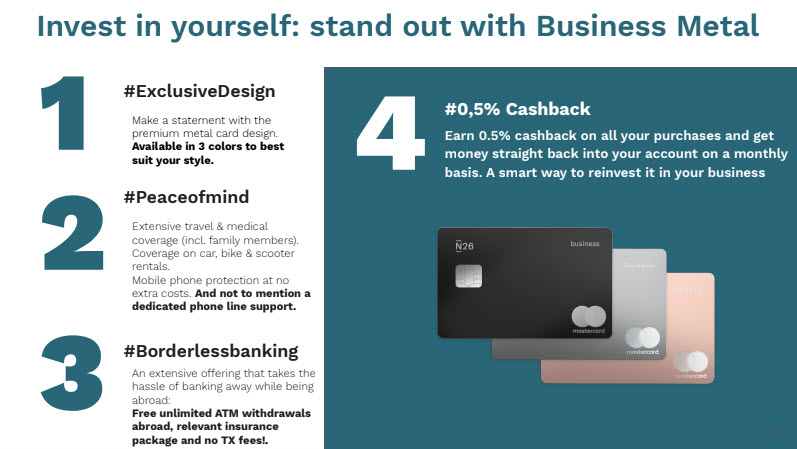

N26 has launched a Business Metal account, which improves on its current standard account. There are a lot more free features and new benefits aimed towards international banking and travel. It’s a premium plan from N26 and offers unlimited free withdrawals in any currency around the world.

It features a host of other benefits for travelers. These include medical travel insurance, trip insurance, luggage cover, and flight insurance. It also allows for car rental insurance if you get stuck away from home. A useful perk is that it also covers your cellphone, which means you don’t need separate insurance cover for your phone.

Furthermore, in case of emergencies, you can contact customer support 24/7 through a dedicated line. A bonus is that you earn cashback on all your purchases, which, if you travel, could add up to a nice sum after some time. All of this is additional to the great banking features that the account already offers.

Holvi

Another fantastic innovation from Holvi is the tax bundle designed for sole traders. If, as a sole trader, you earn less than £85k per year and aren’t VAT liable, then you are eligible for this package. The package includes a Holvi Business Current account and a tax self-assessment signed off by an accountant.

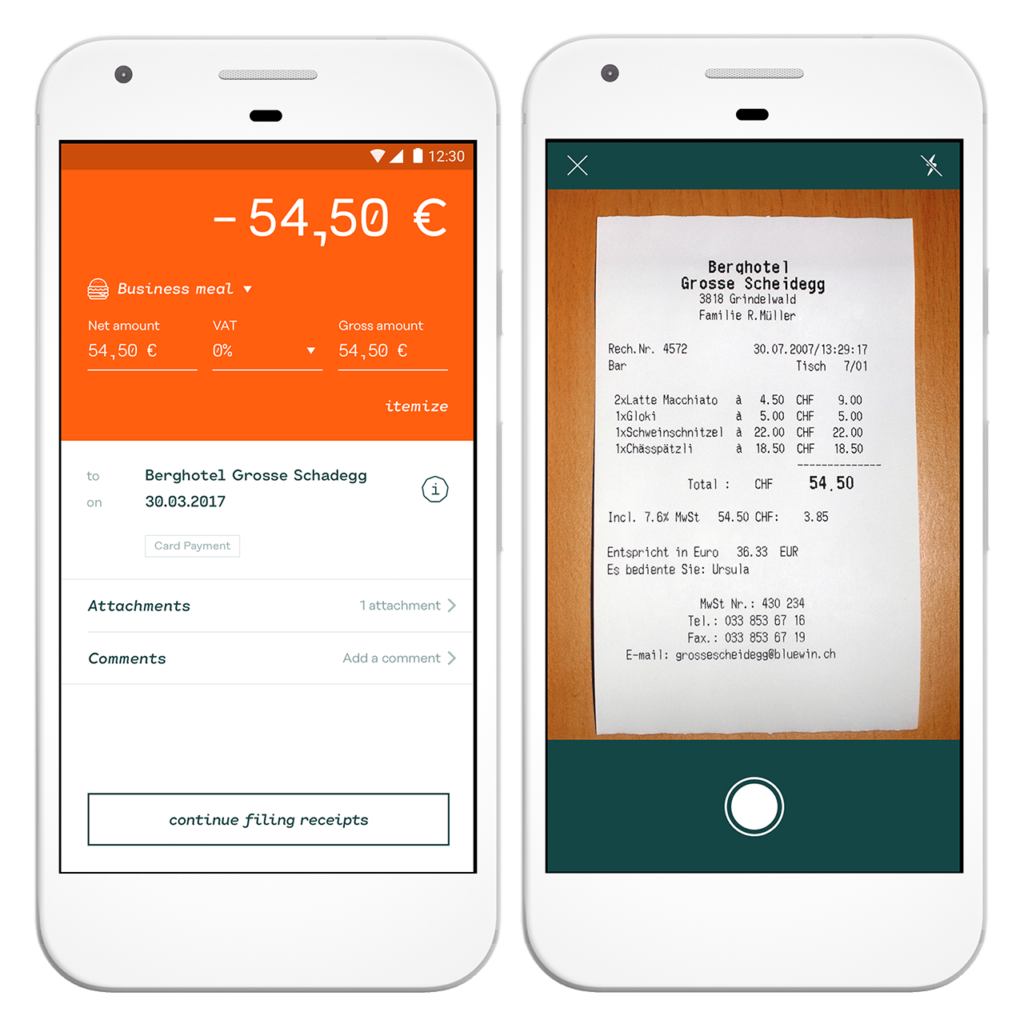

It takes the hassle of tax out of your hands so you can concentrate on your business. It’s beneficial for people who work a day job and have a side hustle that also earns them an income. The Holvi app allows you to track your financial ins and outs, and in May, the tax consultant will proactively start the tax return, so you will know what you are liable to pay in January.

The most significant advantage of this package is that you’re assigned an accountant right from the outset. If you have any queries, you can talk to a real person in customer support, who can assist you with general requests. For the more complicated tax queries, you will be able to speak directly to your accountant and get guidance.

Bunq

Bunq has a unique feature that allows you and your family to save for a common goal. It works almost like a group funding setup, whereby once you’ve created the goal you’re aiming for, you can share it with friends and family. They can, in turn, donate towards the target so you can reach it faster.

It could be anything from a study fund for your children or an upcoming wedding. Through the Bunq app, you will see how much you’ve raised for your goal. You can also see the total donations given by the whole community.

Some of the common goals created on Bunq are public interest goals, so if you don’t have personal objectives, you can always contribute to charitable causes. In the same way, you can share this within your social circles to encourage others to donate towards the same cause. The common goals are designed with individuals and families in mind, but organizations are also welcome to create goals via Bunq to streamline donations.

Compare the best mobile banks