Latest News on Mobile Banks – May 2021

Advertiser disclosure

One of the many great reasons to choose digital banking is that they are always rolling out new features. This month brings some exciting new updates from N26 and Bunq, and a new player to the ever-expanding field of online banks, Paysend.

N26

N26 is the European digital bank that keeps on improving. This year they just reached the 5 million customer mark and show no signs of slowing down. This month they have two new functions added to their product.

Rules For Spaces

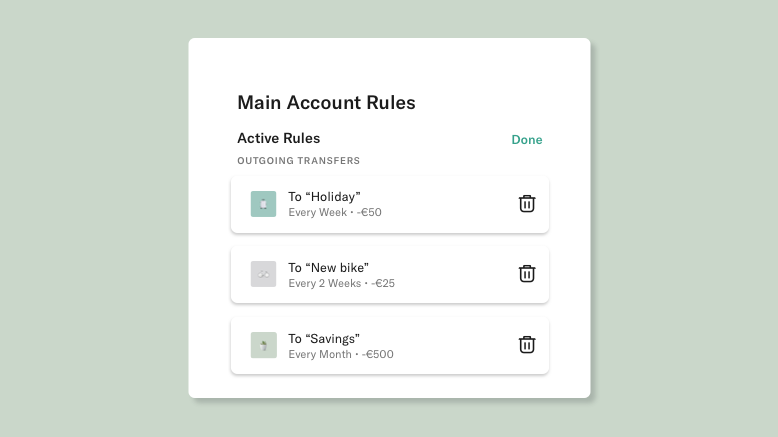

Spaces is the N26 online bank‘s function that allows you to create sub-accounts for the purposes of putting money aside for savings or bills. Add up to 10 rules, and edit or delete them at any time.

The added feature of adding rules, now lets you create automatic recurring transfers to and from these sub-accounts. Set the rule once, and forget it. Everything will be done for you.

Make Payments Before the Card Arrives

New bank account holders get frustrated by having to wait for their card to arrive in the mail before being able to access their funds. N26 has removed this negativity by enabling you to add your card number into your mobile wallet, right away, even before you physically have the card.

This function allows you to spend up to €200 a day, for up to 30 days, until your card arrives by mail. When it does get to you, activate it, and this feature then becomes permanent.

Read more about N26 in our N26 Review.

Bunq

For 6 years, Netherland’s online bank, Bunq, has been making headlines for its ‘firsts’ in the digital banking arena. In 2017 they were the first to introduce API functionality, which others have now adopted. In another first, they have developed a project to give back to the Earth.

New SuperGreen Product

New products from Bunq are the premium and business SuperGreen Bunq accounts. For every €100 that you spend, Bunq will plant a tree in your name. How’s that for giving something back? The other green benefit of this account is the metal card in place of a plastic card. it’s more sustainable and environmentally friendly.

- Premium SuperGreen

For personal users, with a monthly fee of only €16.99, you get all the features of the other accounts, a metal card, trees planted in your name, and purchase protection and extended warranty.

- Business SuperGreen

Business owners can also have a SuperGreen account. Also included is a metal card and trees planted in your name, for only €19.99 per month. This account also has an inbuilt VAT sub-account, which automatically calculates and holds VAT amounts for you.

Split Your Salary

Another new feature is the payment sorter. Automatically have Bunq split your salary into various sub-accounts on payday. There’s no more need for you to do manual transfers each month. Depending on your package, you can have this process work with up to 25 sub-accounts.

Read more about bunq in our bunq Review.

Paysend

Paysend is well known for its international money transfer business. Over 1.5 million people have benefitted from sending money to over 80 countries. It would make sense then that it is now opening a global digital bank.

Paysend Global Account

Now you can transfer money to over 80 countries directly from your own digital account. Hold up to 6 currencies at any time and link them to your virtual card. Open the account within minutes via their website, download the app, and start spending.

Virtual card

As soon as you open your account, you’ll receive a virtual prepaid MasterCard. You can use this card online wherever MasterCard is accepted worldwide. Link it to one of 6 currencies, and switch it to another currency when you travel, with no fees for using the card abroad.

Top 10 Mobile Banks is reviewing and comparing the top mobile bank services based on the most important parameters and features, such as fees & rates, features, user experience, and safety.

We publish thorough reviews on the leading Fintech startups in the field and provide comparative information so our users can make smart choices and informed decisions.

Compare the best mobile banks