Top 10 Digital Banking Apps in 2022

Advertiser disclosure

Traditional brick and mortar banks were the only options for consumers when it came to financial transactions. However, In the past 10 years, there has been an introduction to a new way of banking. Online, also called mobile or digital, banks were introduced in Europe and the UK and have been taking the financial world by storm.

The advantage of this form of banking is that they have fewer overheads than their traditional high street counterparts. This benefit means they can pass these savings onto you in the form of lower fees. All of these accounts are operated by smartphone and desktop apps 24 hours a day, 7 days a week. There is no more waiting around for them to open their branches.

There are a number of digital banks on the market, here is a round of the top 10 in 2021.

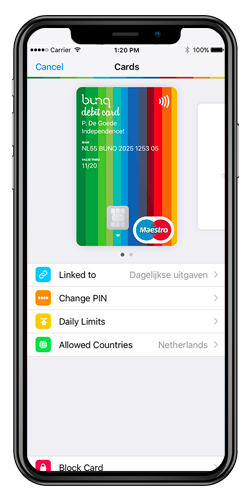

Bunq

The Netherlands based Bunq launched its banking product for personal customers in November of 2015. A year later, their business banking offering was released. It offers accounts to all the countries of the European Union, Iceland, and Norway, with more coming.

bunq accounts offer debit MasterCards, free payments and transfers, and no charge for transactions via Apple, Google, and Fit-Bit pay applications. Premium accounts include unlimited free direct debits. Business accounts provide up to 3 debit MasterCards for free plus €9.00 each for additional cards. Transaction fees begin at €0.10 per payment.

What sets Bunq apart from its competitors is its fierce commitment to saving the planet. In a banking world first, for customers of its Supergreen product, it offers to plant trees in your names for every €100.00 spent.

Monese

In only 5 years, British digital bank Monese has almost 1 million customers and has earned a 9.2/10 Trustpilot score. Based on this, Monese is one of the most trusted and most popular banking services across the UK and Europe. They claim to have around 3,000 new sign-ups every day.

Monese offers accounts to everyone, students, ex-pats, and foreign nationals included. It doesn’t perform credit checks or requires you to have a UK address. All that’s necessary to open an account online is a selfie and a photo of your national ID card or passport.

All its accounts offer free transactions via Apple and Google pay, as well as zero-fee direct debits. For a low monthly charge of £14.95, all ATM withdrawals are free too. A second account in EUR or GBP is also available.

Customer service is provided in 14 languages directly from the app, or via phone or email.

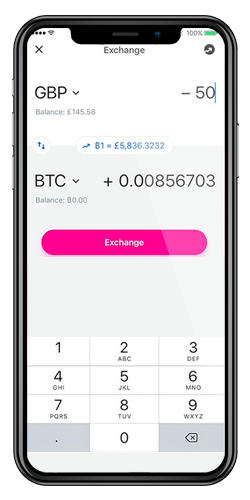

Revolut

Over 1 million customers have rated UK digital bank Revolut with 5 stars for its consumer and business products. A Revolut account is available to residents of the 32 countries of the European Economic Area (EEA), including the UK. In addition, it can offer accounts to those based in Australia, Canada, Singapore, Switzerland, and the United States. Account-holders must be aged 18 years and over.

Revolut offers both personal and business banking products. Personal accounts range from £0 to £14.99 in monthly fees, with the latter offering a metal card and junior accounts for up to 5 kids. Business customers also start at £0 monthly fees for sole traders. Larger corporations can get a tailor-made package with a negotiated charge per month.

Revolut’s significant point of difference over its competitors. No matter the account, it offers trading in cryptocurrency, with up to 5 different ones on offer.

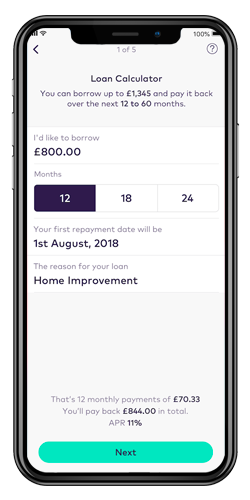

Starling Bank

Winner of Best British Bank for the last three years and recently, the Best Business Banking Provider 2020, Starling Bank is one of the UK’s entrants in the mobile banking scene.

Starling has over 1 million customers, with more than £1 billion in deposits. Customers have a choice of opening a personal, business, joint, or even a euro account. The latter allows you to receive, hold, and send euros for free.

Personal and business account holders benefit from no monthly fees, free withdrawals locally and overseas. Debit MasterCards are provided with all accounts.

Unlike some of its European competitors, Starling also offers personal and business loans and overdrafts. You can also send money to bank accounts in 38 countries in currencies that include South African Rand and Thailand Baht.

Another point of difference is its Teen Account available to 16 and 17-year-olds. Most other digital banks require their customers to be over 18.

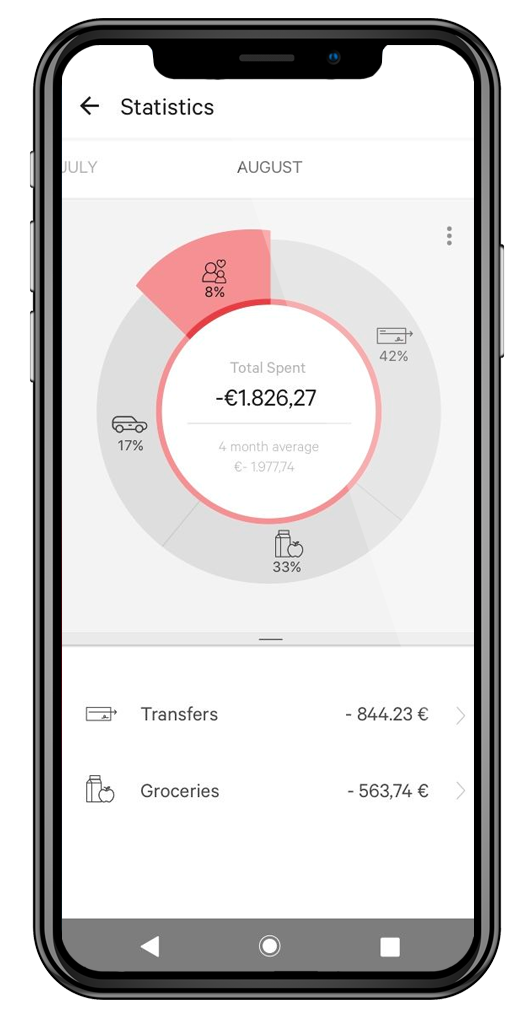

N26

Established in Germany in 2015, N26 Mobile Bank was one of the pioneers of the mobile banking concept. 5 years later, they have an excess of 5 million customers in 25 different markets. N26 offers both personal and business banking options. Its accounts provide a debit MasterCard, free transfers and payments, and up to 5 fee-free atm withdrawals every month. Its basic account starts at €0.00 per month.

Anyone can open accounts as long as they have a physical address in one of 17 different European countries. N26 provides excellent customer support via its app in 5 languages, English, French, German, Spanish, and Italian.

Premium account holders get added benefits like an insurance for medical, travel, and car hire, as well as offers and discounts from N26’s business partners..

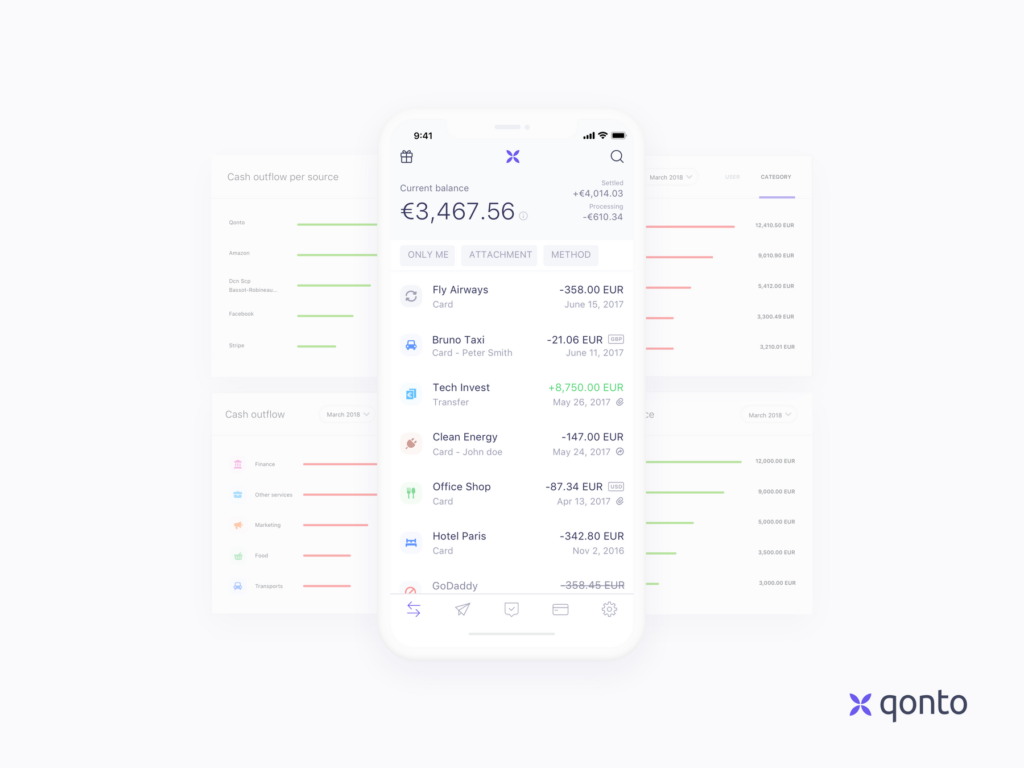

Qonto

French entrant Qonto offers 3 different types of business banking products. Currently, with 75,000 French organisations as customers ranging from sole traders to large companies.

Freelancers and sole traders benefit from a business account that gives them 1 debit Mastercard and a French, Italian, or Spanish IBAN. Monthly charges range from €9 to €20, with the latter offering unlimited ATM withdrawals fee-free.

Organizations can choose an account based on the number of team members. For up to 5 users only, the monthly fee is €29, and you get 2 debit MasterCards and 100 fee-free transfers and direct debits. The corporate plan for €299 per month gives you 15 cards and 200 transactions before a fee of €0.15 each kick in.

Qonto has this neat little account designed for business startups. To assist with the finalisation of a company, capital investors can deposit their funds here. Qonto will provide a deposit certificate within 3 business days. When the registration is completed, the funds are released into your Qonto business account.

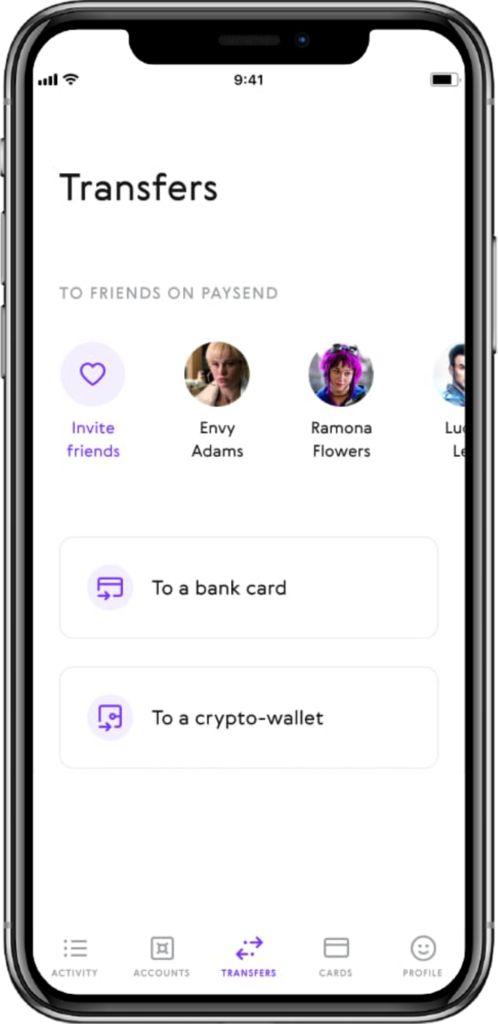

Paysend

Paysend Global Transfers has over 1.5 million customers who take advantage of its money transfer program. It makes sense for them to branch out into digital banking.

A Paysend Global account can be opened in one of 31 European countries and the UK. Its prepaid MasterCard can hold currencies in GBP, CHF, CNY, EUR, RUB, or USD. Link one of these to the card initially, and switch it as you travel. The card can be used at any ATM or store displaying the MasterCard logo.

You can transfer money to friends’ bank accounts all over the UK and Europe for free. Convert currencies at the live exchange rate with no hidden fees.

Paysend has partnered with these merchants to offer a PayLater program. Purchase a good or service and pay for it up to 14 days later, with no interest:

- Amazon

- Airbnb

- Booking.com

- British Airways

- Deliveroo

- John Lewis

- Marks & Spencer

- RyanAir

Supported by devices with iOS 11 and above and Android 5.0 or newer. Get customer assistance via email or Whatsapp.

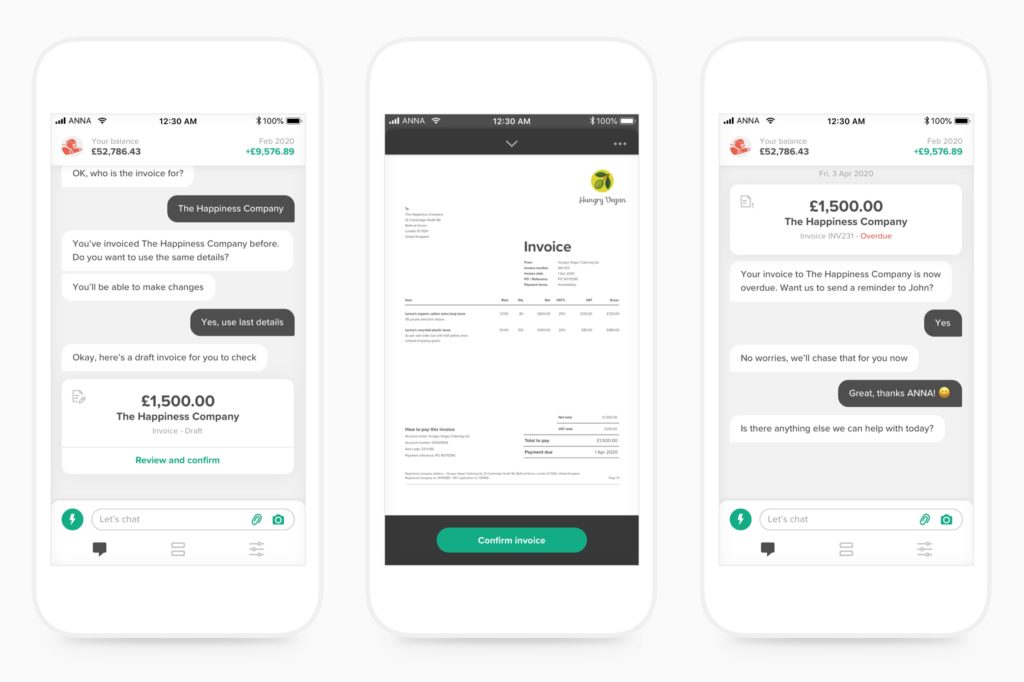

ANNA Money

Relatively new digital banking entrant, ANNA, stands for Absolutely No-Nonsense Admin. This business banking product wants to take the burden of paperwork off your hands. The accounts are designed for sole traders, registered partnerships, and limited companies based in the UK. ANNA business account can also track your expenses, do your invoicing, and sort your company taxes.

Open an account online within 10 minutes and receive your debit MasterCard in 5 business days. Customer service is provided directly from the app, 24/7, from its base in Cardiff.

The monthly fee structure is based on your business’s income. Starting from £0 for monthly income under £500, to £19.90 for turnover of up to £500,000.

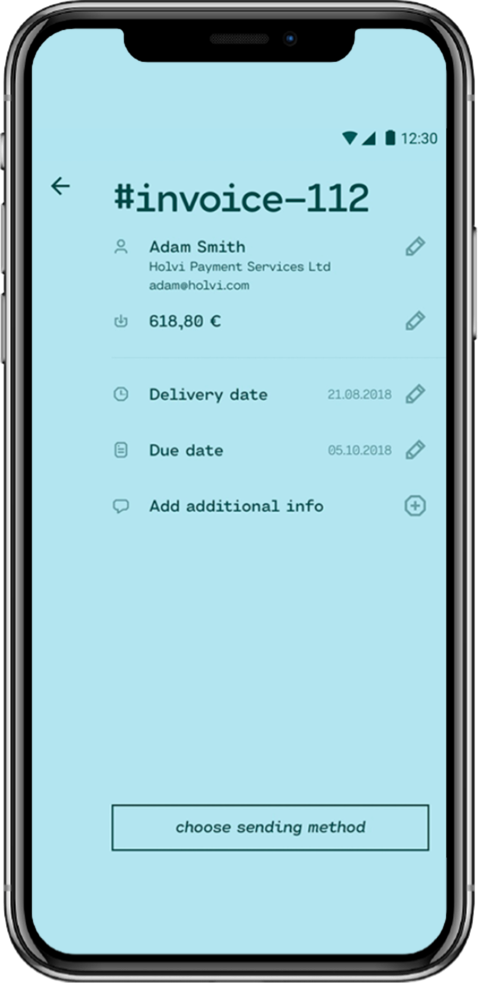

Holvi

Holvi was founded in Finland in 2011 primarily to offer business banking services to sole traders, freelancers, and entrepreneurs. It has 3 products: Starter, Grower, and Unlimited.

The first is designed for sole traders. It provided 1 account, 1 debit MasterCard and a zero monthly fee. ATM withdrawals are charged at 2.5% of the transaction, and transfers are unlimited at no cost. The Grower account, at €12 per month, is for small businesses. The offering is 1 account, 3 cards, free digital invoicing, and ATM fees of 2% per transaction. The Unlimited account is as good as its name. The monthly fee is €98, but for that, you can have as many debit MasterCards as you want, and unlimited ATM withdrawals.

Holvi’s accounts users love its digital invoicing feature. This function enables you to create an invoice for your customers on-the-spot, straight from the app. This encourages faster payment from your clients.

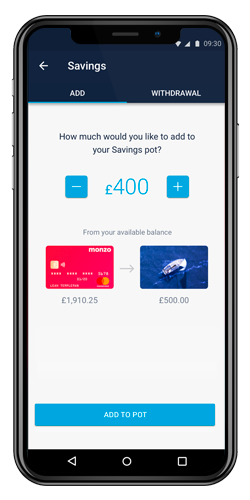

Monzo

UK digital bank Monzo offers accounts for personal and business use. They have over 4 million customers in the UK and are looking at expanding internationally soon. Potential customers need to reside in the UK and be aged 16 and above. Monzo has one of the most diverse ranges of accounts of all the online banks.

Its current account for personal use has no monthly fees, and all withdrawals and payments in the UK are free of charge. You get a debit MasterCard and also interact with Apple and Google Pay.

The business pro account for only £5 per month offers multi-users, invoicing, integrated accounting, and partner offers.

Joint accounts offer customers a way to split or combine funds for paying bills or setting up savings. The account has 2 debit MasterCards with different card numbers.

Online banking is the future, why not start now. Review and compare the top mobile banks: