Why Open a Mobile Bank Account Especially During COVID-19?

Advertiser disclosure

Right now, the world is under siege by a pandemic that nobody saw coming. The Coronavirus, also known as COVID-19, has forced most of us indoors and has changed the way we live. At least for the immediate future.

Governments have ordered businesses to close down and almost all of us to stay in quarantine. The fear of coming into contact with other people who could give you the virus is a legitimate feeling.

Digital online banking, also known as mobile banking, is the solution for everyone during this time. Without needing to meet with people, visit a branch, or handle items that others have touched. There is no need to close your existing bank account; instead, it’s a savvy idea to open a digital account to work side-by-side with your current ones.

How can a mobile bank help? Here’s how:

Fast, Paperless Approval

An online account can be opened, usually within minutes, directly via the digital bank’s app or web-app. For identification purposes, you’ll need to scan copies of your ID and possibly your residential information.

Opening an account like this is especially helpful for anyone who is in a foreign country and can’t go back to their home country right now. N26 Mobile Bank, for example, will allow you to open an account if you reside in the EEA or even the US.

No Branches – Access Everything from Your Mobile or Web-App

When comparing Mobile Banks VS. Traditional Banks, then unlike traditional banks, where in order to open an account, you will have to attend a meeting in a physical branch, mobile banks offer all their banking services via a mobile app or a web-app. you can open and manage your account, set saving goals, watch your spendings and control them right from your home. No need to go to a branch and risk your and your family’s health during this time.

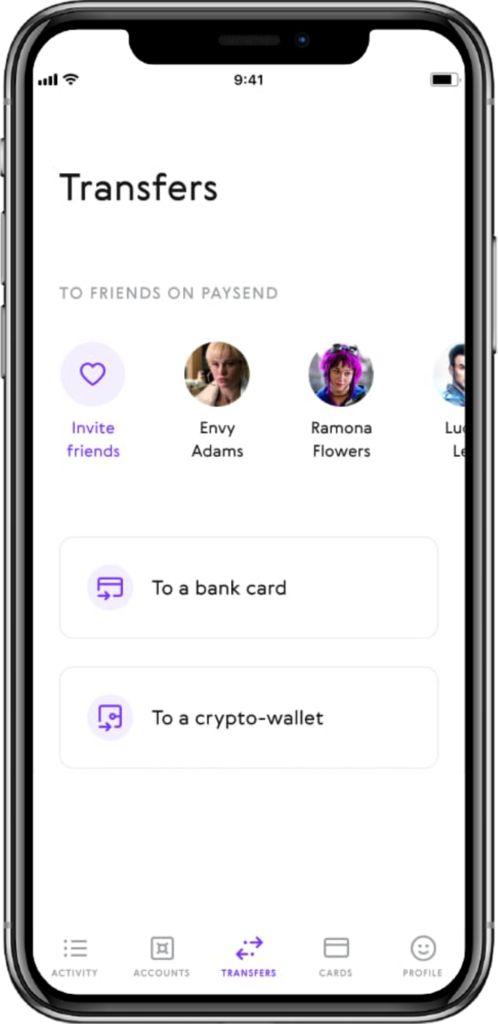

With mobile banks, you can access all your banking services 24/7: deposit your account, transfer money (locally and internationally) make payments, lock your card in case of loss or theft and much more. Mobile-only banks give you this flexibility especially now when flexibility is very limited.

Pay Contactless

The handling of money is a daily, even hourly, occurrence for everyone. The WHO recently stated that “Money changes hands frequently and can pick up all sorts of bacteria and viruses and things like that.”

To avoid handling notes and coins, the obvious choice is to go contactless. These types of money transactions are the way of the future, so why not make them the primary way now. Applications like Apple Pay, Google Pay, and Samsung Pay have already paved the way for this feature, with many others joining in. Bunq, for example, offers both Apple Pay and Google Pay as payment options and Paysend Global Account offers a virtual card that you can use immediately after generating it.

Online banks all provide their clients with debit cards that get linked to these and other digital wallets. Contactless means you use your phone app to pay for the transaction. Remember to hold your device away from the electronic reader, as that too has been touched by many people.

Simple and Low Fee Money Transfer

Digital banks are gaining momentum for many reasons. The foremost being their low fees. As these kinds of financial institutions don’t have branches, they have significantly lower overheads than traditional bricks and mortar banks.

For this reason, their transaction fees are also considerably lower than their high-street counterparts. Online banks like the Bunq account take it one step further by having no fees on direct debits, payments transfers, or transactions via Apple or Google pay. Instead, you pay one small monthly fee, which is much less than adding together all of those extra fees charged by other banks. Another example is Paysend, in which you can enjoy low fees and competitive exchange rates and transfers are completed usually within a few minutes.

Mobile Banks Are Safe and Regulated

If you don’t already have a mobile bank account, you may ask yourself – is it safe to use a mobile bank? and question the safety of your funds. Well, your money gets protected in several ways.

Firstly, unlike most high street banks, your money isn’t reinvested. Most digital banks deposit your money with large global banks, separate to their business funds, so if anything was to go awry, you still have access to yours.

Next, no matter what country the registration of the digital bank is in, there is a government authority that protects you. Revolut’s clients, for example, are covered by the Financial Services Compensation Scheme (FSCS).

Lastly, online banks rely on the latest digital technology. PCI DSS standards protect your data with integrated fraud prevention and AML-risk management and monitoring systems. Your Mastercard transactions get conducted through its 3D second step process.

Customer Support Is Always Available

Digital banks have been lauded publicly for their remarkable customer service. Bunq can look after customers worldwide. Their staff come from more than 30 different countries and can speak up to 7 languages. Contact can be made via phone, email, or online chat.

In this current uncertain climate, many of their support staff work from home, keeping business hours so that any questions or issues can be answered and solved. N26 are still operating their customer service online chat service from 07:00-23:00 seven days a week.

Conclusion

The coronavirus forces us to change the way we do our everyday banking tasks. Receiving and paying out money is one of those tasks. With the risks associated with handling notes and coins, and the need to visit bank branches, there needs to be an alternative solution.

Digital banks, which provide most of the services of your traditional bank, offer this solution. Open an account online in minutes, benefit from low to zero transaction fees, and get familiar with contactless payment methods. No need to have either a traditional bank account or a mobile bank account, you can have both, and have the advantage of managing your money quickly and safely. You may realise that once the world returns to some sense of normalcy, that you no longer need your old way of banking.

Online banking is the future, why not start now.