- Free payments in different currencies, no foreign exchange fees

bunq Review

bunq Review

Advertiser disclosure

Introduction

bunq is an Amsterdam-based, international mobile bank, founded in 2015 by Ali Niknam, the original founder of the IT company TransIP.

Being officially permitted and insured by the Dutch Central Bank, bunq, however, is a totally independent borderless European bank, without any branches, queues, or paperwork whatsoever. The bank is a mobile app itself.

bunq is fully international with the app and website being available in over 30 languages for both operation and customer support. By opening a bunq account, one get access to 25 bank accounts (multicurrency), up to 3 physical cards (Mastercard / Maestro) and up to 5 virtual Debit Mastercards.

- NL

- DE

- EN

- IT

- ES

- FR

- 25+ languages

- bunq Free – €0.00/month

- bunq Core – €3.99/month

- bunq Core – €9.99/month

- bunq Core – €18.99/month

Banking Features

Budgeting

Automatically categorizes payments and deducts money from the correct Bank Account based on your preset budget. Also, this feature automatically distributes incoming salary into designated accounts, simplifying budget management.

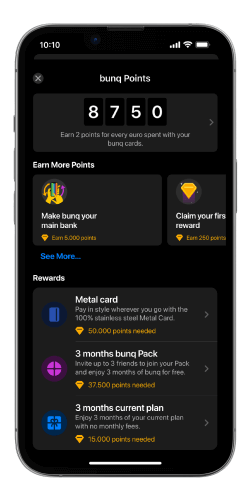

Rewards

Users can earn exclusive rewards by using their bunq card. These points can be redeemed for free months of bunq, a Metal Card, and other perks.

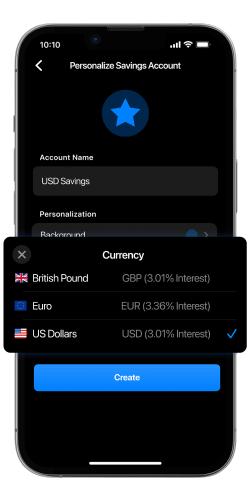

Savings

Users can earn up to 2.67% interest on EUR savings, which is paid out weekly. For those interested in saving in other currencies, bunq provides even higher interest rates of 3.01% on USD and GBP savings.

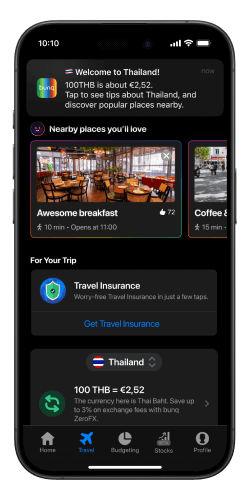

Finn Travel

Finn provides practical travel information, including local tipping customs, currency exchange rates, and necessary device adapters for your destination. Also, can help users set up and use the eSIM feature, which allows travelers to save up to 90% on roaming costs.

Multiple bank accounts:

Open a bank account for any need, straight from the bunq app. Whether it’s for groceries, your holiday or going out with friends, you can open bank accounts in seconds, each with a unique IBAN.

Up to 25 sub-accounts:

Open a subaccount for any need, straight from the bunq app in seconds, each with a unique IBAN.

Personal payment links:

bunq.me link is the easiest way to get your money back or split your bills with friends. It works with any European bank client, and you can set it up in seconds. They don’t need to be bunq users, or even install the app).

Apple Pay and Google Pay:

Add your bunq card to your Apple Pay or Google account and enable contactless in-store payments as well as instant, secure online payments with a higher level of security (Touch ID, Face ID).

In-app card control:

Enable foreign payments, activate paying online, set CVC codes to change, create virtual cards, block/unblock cards.

Fingerprint login:

A choice of preferred login method: a password or a fingerprint.

Savings Goals:

Helps save up for your next dream purchase, or experience, with the current status of your progress. Savings Goals are shareable with friends, family or partners.

Auto Save:

Achieve your goals faster by setting your bunq app to save automatically on every payment, and round up your spendings to €1, €2, or €5.

Interest rate:

bunq claims to provide customers with an interest rate of 2.67% and will apply to savings and checking accounts of both personal and business users.

bunq Points

bunq Points allow users to earn and redeem points for added benefits.

bunq Jackpot! 3 chances to win €10,000 every month:

There are several ways in which you can hit the Jackpot:

- Invite your friends to join bunq, so you can enjoy it together

- Keep money in your bunq account – with every euro you add, your chance to hit the Jackpot

- Increases. every card payment you make, anywhere in the world and online.

Markets:

- You’re a Dutch or German resident with a personal or business account

- You’re a French resident with a personal account

Taxes:

- Netherlands – You receive €7,100.00, bunq is paying the rest as tax

- Germany – You receive €10,000.00, you should handle the taxes yourself afterward

- France – You receive €10,000.00, no taxes applied

bunq Accounts and Fees

Personal account types

| bunq Free | bunq Core | bunq Pro | bunq Elite | |

| Price per month | €0.00 | €3.99 | €9.99 | €18.99 |

| Card fee | X | 1 card free of charge | 3 cards included | 3 cards included |

| Free ATM withdrawals (EUR) | X | X | 6/month | 6/month |

| Instant and schedule payments | ✓ | ✓ | ✓ | ✓ |

| Open bank account in foreign currencies | 22 global currencies | 22 global currencies | 22 global currencies | 22 global currencies |

| Split payments | Travel Insurance | ✓ | ✓ | ✓ |

| Zero foreign exchange | €1,000/year | Unlimited | Unlimited | Unlimited |

| Google Pay & Apple Pay | ✓ | ✓ | ✓ | ✓ |

| Multi-currency savings accounts | ✓ | ✓ | ✓ | ✓ |

| Deposit protection | ✓ | ✓ | ✓ | ✓ |

| eSIM | ✓ | ✓ | ✓ | 4*2GB free/year |

| Travel insurance | X | X | X | ✓ |

| 24/7 online support | ✓ | ✓ | Priority | Priority |

bunq Free

bunq Core

bunq Pro

bunq Elite

Business accounts

- The direct connection between bunq and bookkeeping software

- The VAT set aside and transfer to a designated VAT sub-account automatically

- All receipts in one place

- Own IBAN for each sub-account

- Realtime API

- Employee access

| bunq Free Busines | bunq Core Business | bunq Pro Business | bunq Elite Business | |

| Price per month | €0.00 | €7.99 | €13.99 | €23.99 |

| Employee cards | X | X | 3 included | 10 included |

| Virtual cards | 1 included | 1 included | 25 included | 25 included |

| Foreign IBANs | X | X | NL, DE, FR, ES or IE | NL, DE, FR, ES or IE |

| Free ATM withdrawals (EUR) | X | X | 10/month | 10/month |

| Instant and scheduled payments | ✓ | ✓ | ✓ | ✓ |

| Foreign currency payment | Fees apply | Fees apply | 5 free transactions/month | 10 free transactions/month |

| Split payments | X | ✓ | ✓ | ✓ |

| Request payments with bunq.me | ✓ | ✓ | ✓ | ✓ |

| In-store deposits | X | €100 free/month | €100 free/month | €100 free/month |

| Trade names | X | ✓ | €2.99 per month/trade name | €2.99 per month/trade name |

| Invoice Scanning | X | X | ✓ | ✓ |

bunq Free Business

bunq Core Business

bunq Pro Business

bunq Elite Business

Student accounts

Student accounts will now be more accessible, offering free bunq Pro accounts for eligible students aged 18-25 and bunq Elite for just €9 per month.

Family accounts

Family accounts now include up to 4 free bunq Pro accounts for children with Core, Pro, or Elite plans.

Security

Create virtual cards, block and unblock current cards if lost or stolen, view and change your PIN directly from your phone — total control over the cards and account in general, quickly from the app.

bunq has a full banking license issued by the Holland Central Bank, so the customers’ funds are protected and refundable up to €100k.

Card settings on-the-go

Changing your PIN, setting card limits, (de-)activating or blocking a card, all that in real-time, just from your mobile.

bunq’s patent-pending Dual PIN technology enables using 1 card for 2 accounts.

Mastercard rotating CVC code:

An extra safety layer making the CVC code refresh automatically every few minutes in the app, or letting users update it manually.

bunq Support

bunq offers standard means of contact: a built-in-app chat and Email.

Instead of a basic FAQ section on the website, bunq offers the clients a proprietary community platform “Together”, where users can ask for help, find answers, or just share experiences, and get ranked and promoted, for doing so. By sharing knowledge, the users earn points and can get a higher ranking.

Unfortunately, bunq doesn’t provide telephone support.

- Very quick and easy to sign up

- No fees for spending in Europe with Euros

- Multiple sub accounts

- Easy joint account option

- Just 10 Free ATM withdrawals per month

- Monthly fee

- Available only for permanent residents of the EEA

Conclusion

Opening a bunq account is fast and very easy, and even before the card arrives, you could use it with the card details in the app. Once opened a personal account, you can also have a joint account shared with someone else.