- Get your salary paid directly into your account

- Up to 56 days’ interest-free credit

Cashplus Review

Cashplus Review

Advertiser disclosure

Introduction

The UK-based challenger to traditional banks specializes in improving customers’ credit scores. Additional Cashplus services include a debit Mastercard, free currency cards, iDraft borrowing feature and Post Office branch deposits.

- EN

- Free Account

- Plans from £5.95

Banking Features

Cashplus offers several services for individuals and businesses. Its resources are ideal for those with a poor credit history since no credit check is necessary for signup. The company even provides ways for you to improve your credit score.

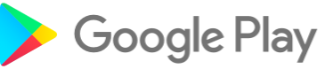

The Creditbuilder

Cashplus offers a 12-month loan to enable you to better your credit rating. Here’s how it works: You borrow the equivalent of 12 months of account fees (that’s £119.40 with a Deluxe account or £71.40 with Activeplus). Cashplus withholds these funds for you, so you can’t spend them. The money won’t even show up in your account. You pay your account fee each month, and Cashplus deducts it from your loan amount. Cashplus reports your payments to the appropriate Credit Reference Agencies. After 12 months, you no longer owe anything, and the fact that you made all payments on time will likely have improved your credit score. Since this is a 12-month loan contract, make sure you can commit to paying all fees on time for a year. Otherwise, you could worsen your credit rating instead of improving it.

Contactless Debit Mastercard

The Cashplus Contactless Debit Mastercard gives you all the functions you expect from a debit card. You can pay in stores, on the phone, or online. It works in over 200 countries, anywhere you see the Mastercard symbol.

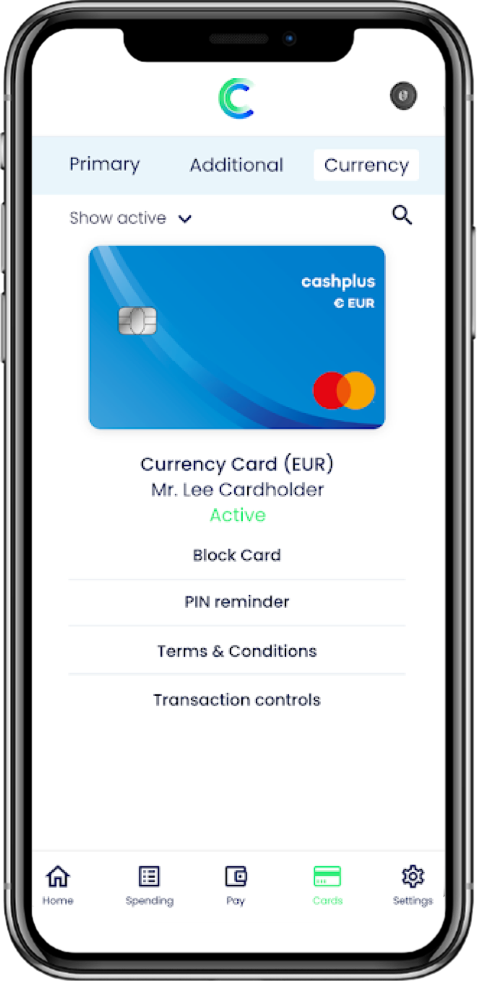

Borrowing money

The Cashplus iDraft service offers a safeguard should you run out of money. If you choose to add this feature to your account, you’ll have a line of credit that you can use as needed. You can take advantage of it to cover bills or withdraw cash, then pay it back into your account when you have it.

Direct Debits & Standing Orders

Cashplus offers easy setup of direct debits and standing orders. You’ll need to provide your account details, which are available in the app.

Cashplus provides insufficient funds alerts to let you know if you’re not going to have enough to cover a scheduled payment. They’ll advise you of the potential problem before the direct debit is due. In this way, you’ll have time to provide the funds.

You can choose to schedule recurring payments using your Cashplus debit card. This function is useful for monthly expenses like gym memberships.

If you have a Deluxe account, there are no charges for standing orders. With an Activeplus account, you get up to nine free per month, and after that, they cost £0.99 each. Flexiplus account holders must pay £0.99 for each standing order.

Post Office Branch Services

Cashplus partners with the Post Office to allow clients to pay into their accounts at any branch in the UK. To deposit cash, you’ll need your card and the money, which will immediately credit online.

Pricing and fees

Fees apply to all personal accounts, whether you select Deluxe, Activeplus, or Flexiplus. Flexiplus accounts have no monthly fee, but there are more charges for specific services. Regardless of the plan you choose, deposits are free at Post Office branches, and you’ll pay a once-off fee for card issuance.

| FLEXIPLUS | ACTIVEPLUS | DELUXE | |

| Price per month | Free | £5.95 | £9.95 |

| UK Purchases (£) | £0.99 each | Free | Free |

| Direct Debits | £0.99 each | Free | Free |

| ATM withdrawals (UK) | £2.00 | £2.00 | Free |

| ATM withdrawals (Non UK) | £3.00 | £3.00 | £3.00 |

| Electronic Payments | £0.99 each | Free – up to 9/m | Free |

FLEXIPLUS

ACTIVEPLUS

DELUXE

The Business Account

While Cashplus isn’t a bank, it can provide your business with all you’d need from one. You can set up direct debits and obtain a debit card to withdraw cash and make payments. Additional funding for your business is available through the following services:

- iDraft (overdraft credit)

- Direct debit protection – Notifies you and offers a loan if you don’t have enough funds for a scheduled expense.

- Business cash advances

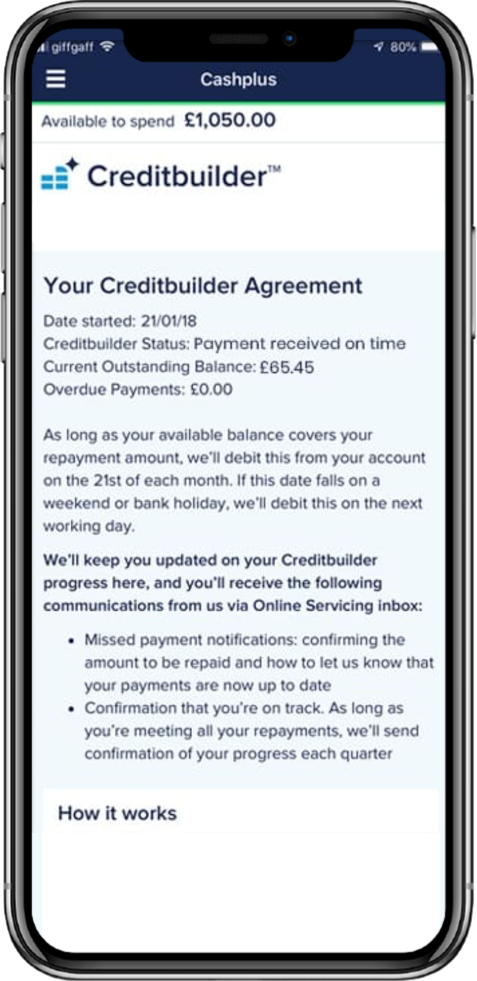

As with the personal account, you can add up to £1,000 per month through deposits made at Post Office branches in the UK. It’s easy to obtain additional cards for team members and set spending limits on each one through the app. To make payments while abroad, you can request a free currency card in euros or dollars.

The Cashplus business account has an annual fee of £69 a year. It includes three free bank transfers per month. After that, you’ll pay a fee for each one.

Security

Cashplus follows the Electronic Money Regulations (EMRs), ensuring that all customer funds stay in a segregated bank account that the company cannot use. If they become insolvent, they can’t use clients’ e-money to pay creditors. Thus, customers will get their funds back.

Since Cashplus isn’t a bank, the Financial Services Compensation Scheme (FSCS) doesn’t cover prepaid accounts. However, there are protective measures that apply to e-money issuers like Cashplus.

These regulations state that if the issuer reaches a financial threshold that suggests possible failure, they must notify the Financial Conduct Authority (FCA). If the FCA determines insolvency is imminent, then Cashplus must develop a plan to return customer funds.

Using the Cashplus App Abroad

The versatile app provides access to many different services, such as:

- Account overview, including recent transactions and balances

- New payment and payee setup

- Account number and sort code

- Printing and exporting statements

- Existing payment management

- Secure message access

- Payment history

- New card setup

- Credit offer signup

- Activation and blocking of existing cards

You can use the Cashplus mobile app anywhere in the world, as long as you have an internet connection. Be sure to use only secure wifi networks, and check with your mobile provider to be aware of any applicable data charges.

Support

The Cashplus online help centre is available 24/7. You can search the FAQs to find answers to any issues you may encounter. The mobile app and website are also replete with helpful information.

If you lose your card or someone steals it, you can temporarily block it from the Online Servicing Account.

If you have problems that you can’t resolve through the app or website, you can call the contact centre. Staff is available by phone during the following hours:

- General customer service – Monday through Friday from 8 am to 8 pm; Saturday from 8 am to 4 pm.

- Credit management – Monday through Friday from 9 am to 6 pm; Saturday from 9 am to 1 pm.

- Lost or stolen cards – 24 hours a day, seven days a week

- Agile registration process with no credit checks

- Online account management

- Add money to your account at any UK Post Office branch

- Tools to help improve your credit score

- Free international currency cards

- Fees on all ATM withdrawals

- “Free” account involves charges for almost all individual services

- Higher costs than many online banking services

Conclusion

Cashplus provides convenient ways to add money to your account through a partnership with the Post Office. The Cashplus online app enables you to manage your transactions from anywhere in the world. The business account can also support small companies that need additional funding.

If you lack a credit history or have a bad one, the Creditbuilder can help improve your financial situation. It’s an excellent alternative to taking out a credit card. If you’d like to improve your credit score and don’t mind paying the necessary fees, Cashplus may be a viable solution.