- Spend in 180 currencies with a competitive FX rate

- Connects to your existing UK bank account

Currensea Review

Currensea Review

Advertiser disclosure

Introduction

Currensea Ltd is registered in England and Wales (#11413946) and regulated by the FCA (Financial Conduct Authority) as an official payment services provider, per Payment Services Regulations 2017. As a direct debit travel card, Currensea acts as a layer in front of your bank account. This means no top-ups, pre-pays, or new bank account management is required.

This UK-based debit card confers multiple benefits, including savings, convenience, security, and sustainability.

Available for personal and business use, Currensea allows spending in 180 currencies with three pricing plans geared towards increased savings on bank charges. There are no fees, and all payments are made in local currency, with notifications for all transactions.

- EN

- Free Account

Banking Features

Linked Directly to Bank Account

Currensea cards are linked directly to client bank accounts in the UK. Currensea does not hold any client funds, and all transactions are posted using Open Banking with much lower fees than high street banks.

Risk-Free Spending

Currensea is regulated and authorized by the FCA to ensure financial transactions’ effectiveness, transparency, and integrity. It’s also a MasterCard principal member and an Open Banking regulated provider.

Money Transfer

There are no bank fees on Currensea money transfers. A flat fee of 0.5% is applied when transferring to bank accounts in HUF, USD, PLN, or EUR. Clients can send a minimum of £100 – £20,000 per transaction from a UK bank account to a foreign account.

Giving Back

Currensea supports environmental organizations by allowing clients to contribute a percentage of savings to charitable causes. Clients set the donation percentage and determine whether to support EdenProjects.org or PlasticBank.com, or both. The company has a carbon-neutral footprint, and debit cards have a lifespan of 3-5 years to reduce waste.

Singapore Airlines

Currensea has partnered with Singapore Airlines to provide clients with 2 KrisFlyer miles for every £1 spent. Increased savings are available with higher-tier Currensea memberships.

Currensea Accounts and Fees

Currensea cards are free, but three pricing plans are available for clients. These include the Essential Plan which is free, the Premium Plan, and the Elite Plan. There are no hidden fees with plans, and all payments are made in local currency. In addition, customers receive spending notification alerts and a fixed percentage contribution to charitable causes.

Details of each personal plan are presented in the table below.

| Essential Plan | Premium Plan | Elite Plan | |

| Price per year | £0 | £25 | £120 |

| Savings on bank charges | 85% | 100% | 100% |

| Foreign exchange rate | 0.5% | 0% | 0% |

| ATM withdrawal fee abroad | 2% FX rate over £500 per month | 1% FX rate over £500 per month | 1% FX rate over £750 per month |

| Purchase protection | ✓ | ✓ | ✓ |

| Spending in 180 currencies | ✓ | ✓ | ✓ |

| Free card delivery | ✓ | ✓ | ✓ |

| Preferred Hotels & Resorts | X | ✓ | ✓ |

| Premium Offers | Elite Offers | ||

| Car Hire Benefits | Exclusive Car Hire Benefits | ||

| Concierge Service | |||

| Airport Lounge Worldwide | |||

| Luxury Hotels & Resorts Perks |

Essential Plan

Premium Plan

Elite Plan

Details of the business price plan are featured below

The Currensea business plan has a fee of £0 per month per card. Plus, there are 0% transaction fees and a zero FX card. With Currensea, business clients get to enjoy the following complimentary benefits:

- Up to £500 per month in free ATM withdrawals. After that, there is a 1% charge levied.

- All transactions are free, with no hidden fees on foreign payments, including on weekends.

- A complimentary plastic debit card for foreign exchange transactions or a virtual card is provided.

- Clients can set up complimentary spending limits as required.

- Business clients can auto-connect to accounting packages for free

- Complimentary access to the real-time interbank rate is offered to UK clients

Eligibility for the business account is based on preset criteria, notably:

- Excellent credit history

- Must be at least 18 years old

- Must have a UK business bank account

- Must have registered mobile account

- Clients must have a UK-based home address

- Clients must have a valid mobile telephone number in the UK

Security

Security is ensured by way of FCA licensing and authorization. The Financial Conduct Authority regulates all Currensea activity with the debit card for all travel-related payments. All email addresses and mobile numbers are thoroughly verified before accounts are opened. If your debit card is lost, stolen, or compromised, linked bank accounts remain 100% secure.

Currensea endeavors to refund fraudulent transactions within a business day. Thanks to the Open Banking Register and FCA framework, bank-level safety and security standards are always maintained. Currensea is a MasterCard principal member. This means it can issue cards, just like an FCA-licensed financial institution. MasterCard chargeback protection is also offered to clients.

Currensea Support

Currensea offers multiple support options for clients, notably on-site request forms. This makes it easy for customers to send questions, comments, or complaints to support representatives. As a result, response times are quick and professionalpowered by Zendesk – live support services.

Other contact options include dedicated social media pages for Currensea on Facebook, LinkedIn, and Twitter. The FAQ section is handy since it provides pre-populated questions and answers across 13 topics. These include security, specific plans, frequent flyer miles, and money transfer.

- Debit card for travel

- Cards are free

- FCA-licensed and regulated

- Connects to your existing UK bank account

- Personal and business cards

- £100 – £20,000 per transaction

- Low fees for currency exchange

- Not supported by all banks

- Not available in certain countries

Conclusion

Currensea is next-generation banking technology for UK international personal and business travellers. This FCA-licensed financial service allows you to link your bank account to your Currensea card for low-cost charges on international payments. These include EUR, PLN, USD, and HUF, among others.

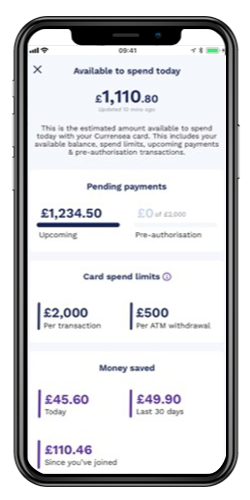

Currensea is fully mobile-ready on Android and iOS devices. In addition, the mobile bank apps showcase account management features, security elements, transaction alerts, and balance information in real-time.

The card is free, and there are three different plans, each conferring enhanced benefits to clients. No challenger bank accounts are needed, no card top-ups are required, and Currensea stores no funds. A low-cost structure ensures a competitively priced product with many practical applications for travelers.