Travel Card

A travel card allows you to load money into the card in advance, typically in multiple currencies, and then use it for purchases, ATM withdrawals, and payments during your trip. It can be a convenient and secure way to manage your money abroad since they often offer features such as competitive exchange rates, lock-in rates, and currency protection.

Advertiser disclosure

This all-in-one app offers a free current account along with a variety of travel benefits:

Revolut allows you to hold over 35 different currencies and lets you manage them in one simple account. The advantage of this is that you can avoid currency conversion fees when traveling to various countries. It also offers great transparency with exchange rates, allowing you to see the current rates and make informed decisions about when to exchange your money.

The app provides instant notifications for each transaction, helping you stay aware of your spending and any potential unauthorized activity.

FairFX offers a multi-currency card and international payment services focusing on providing competitive exchange rates and a convenient way to manage your money abroad.

The card is accepted in over 190 countries at millions of Mastercard locations. It allows you holding 20 currencies on one card, eliminating the need to carry multiple currencies.

You can load the card with your budgeted amount to track and control your spending abroad. If your card is lost or stolen, you can instantly freeze it.

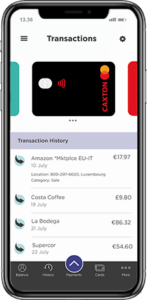

The Caxton card is a versatile multi-currency prepaid card tailored for travelers. It provides competitive exchange rates and fee-free transactions abroad, including ATM withdrawals. With the ability to instantly freeze the card if lost or stolen via the app, it offers enhanced security.

The Caxton mobile app allows users to manage their funds, check balances, and track spending in real-time. It’s a practical option for managing money while traveling internationally.

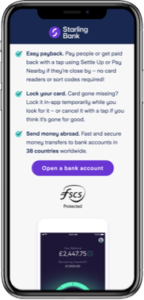

The Starling travel card is associated with Britain’s Best Bank and a UK current account. It is a no-fee travel card, which provides quick and easy banking anywhere you travel.

Travellers preload the Starling debit card with the required amount of funds before going abroad. Among the many benefits of a Starling travel card are real-time exchange rates, minimal fees (ATMs may charge you) and instant spending notifications.