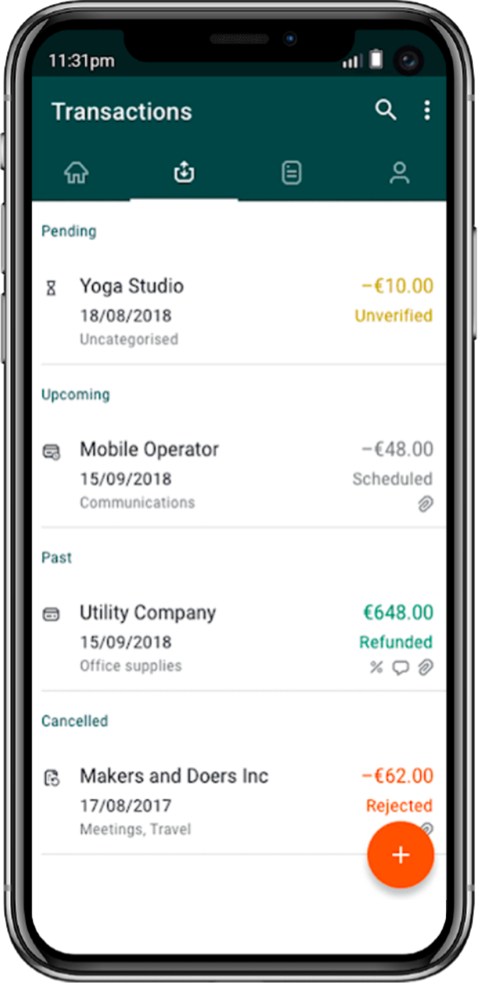

- Instant Tracking of Cashflow

- Easily Generate Detailed Reports

Holvi Review

Holvi Review

Advertiser disclosure

Holvi sports the slogan, ‘Work Nice Balance’ and that’s precisely what this innovative business banking solution provides. Holvi helps business owners to grow their SMEs by simplifying the most important business functions like invoicing, account management, reporting, and receipts. With Holvi, businesses get to enjoy detailed insights instantly.

- EN

- DE

- FI

- FR

- Free Account

- Plans from €6/m

Holvi is owned by Holvi Payment Services Ltd, and regulated by the FSA (Financial Supervisory Authority) of Finland. Customers in Germany are served by Holvi Payment Services Oy Zweigniederlassung Deutschland under the supervision of the German Federal Financial Supervisory Authority (“BaFin”) and the Federal Ministry of Finance (“BMF”). As a fully accredited payment institution, Holvi segregates business funds from customer funds. Holvi was founded in Helsinki, Finland back in 2011. It features a suite of digital banking options for business customers across the European Economic Area (EEA), and Finland (FIN -FSA).

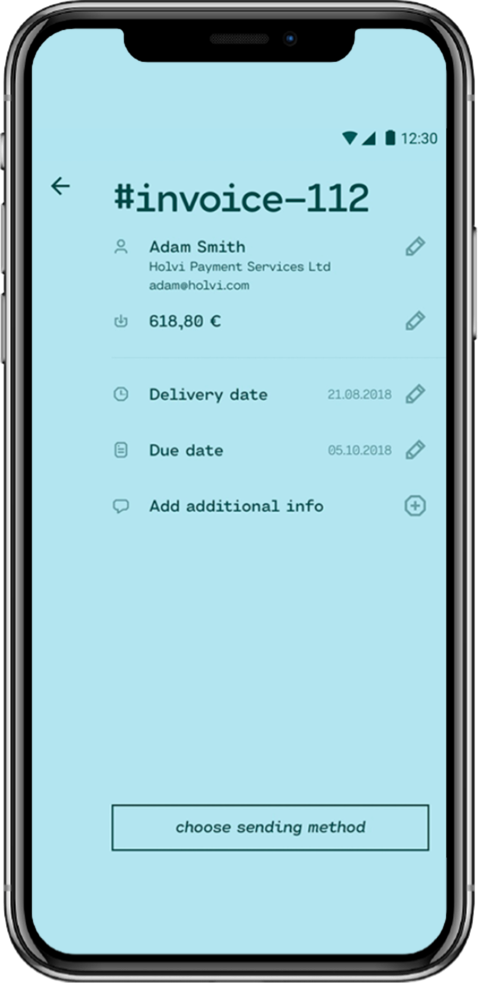

The product includes a complete set of solutions for managing your finances on desktop or mobile. This includes the creation of professional-looking invoices in seconds, managing invoicing data, and storing recipient information. Added to that are easy-to-use expense management options and effective bookkeeping services. Business owners can use the Holvi MasterCard to withdraw money, or to safely and securely make purchases.

Banking Features

The Holvi business banking solution is available to customers on desktop and mobile devices. Among others, clients can enjoy access to current accounts with a full suite of accounting and bookkeeping tools, standard banking features such as bank transfers and payments, with VAT calculations provided. Clients will be issued a complimentary MasterCard debit card for their business usage.

Payments

The payment solution available through Holvi covers a wide variety of options, including expense claims, outbound payments, IBAN and SEPA, inbound payments, and international payments. Outbound payments are possible, courtesy of Holvi’s BIC and IBAN numbers. For payments outside of the European Central Bank-SEPA, Holvi recommends using TransferWise. Since only EUR is accepted as payment for SEPA, no other currencies can be held.

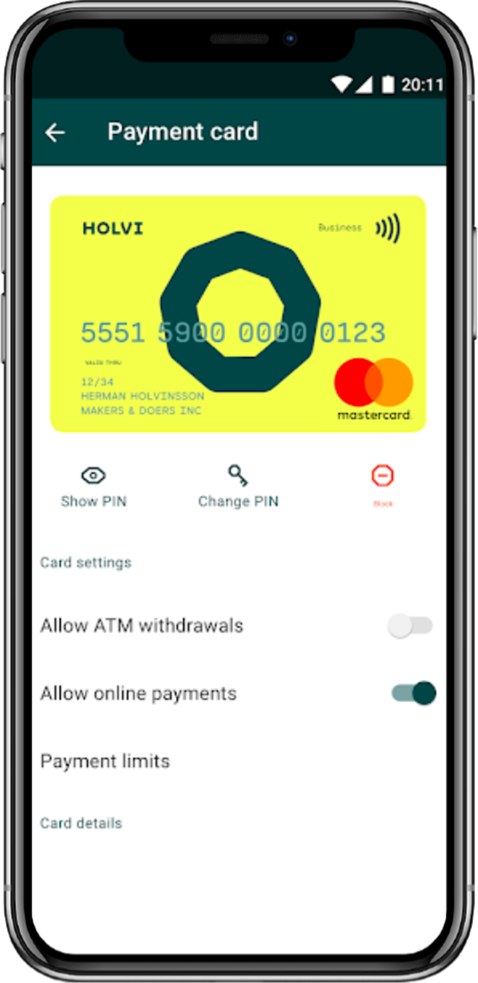

Corporate Card Management

Holvi offers business clients a prepaid MasterCard. The card comes standard with a usage policy, limits, and added security features. The Holvi Business Prepaid MasterCard® can be issued by anyone who has admin or creator roles at the company. Depending on your pricing plan, the number of corporate cards that can be issued will vary. By using the mobile application, account holders can easily attach payment receipts and VAT too.

Accounting Tools

The accounting tools are listed under the bookkeeping section. Business users can easily manage recurring invoices with these accounting tools. Among the many benefits of the service include inventory management, by selecting the invoice item directly from Holvi. This makes it easy to pick products and services, with reduced errors, and business to business (B2B) customer billing options too. The bookkeeping preparation work for incomes and expenses can be created in the Holvi account. This means that budgets can be created for categories, and all money movements can be easily tracked. Full details of VAT payments are provided for added convenience.

Users & Permissions

It is easy to manage other users if you are a creator. By navigating to account settings, users can be added or removed. Depending on your subscription plan, the pricing options will vary. To invite others to the account, the Creator must open the account information from the ‘Home View’ and then click on ‘Manage Users’ from account details. Provided the Creator extends an invitation to the accountant (or bookkeeper) – in-house, or consultant, the invitation can be accepted and access to the business account can be granted.

Holvi Account Types & Plans

Holvi offers a wide range of account options for business users. These include The Builder Account, The Grower Account, The Complete Account, and The Unlimited Account. Each account option features a variety of business services tailored to your needs. The following table compares the options available to business users:

| Holvi Lite | Holvi Pro | |

| Price per month | €6 | €12 |

| ATM withdrawals | 2.5% per withdrawal | 2% per withdrawal |

| Free payments (EUR) | ✓ | ✓ |

| Account users | Unlimited | Unlimited |

| Invoicing | X | ✓ |

| Bookkeeping | X | ✓ |

| Income & expense reports | X | ✓ |

| International payments | 2% fee per transaction | 2% fee per transaction |

Holvi Lite

Holvi Pro

Fees

Fees will vary depending on the type of business account that you have. For example, the Starter Account (the most basic account) is €0 per month. There are free bank transfers, and cash withdrawals from an ATM are subject to a 2.5% withdrawal fee. If you upgrade to a Grower Account, the cost of that service is €12 per month. There are Free Bank Transfers with the Grower Account, and cash withdrawals are subject to a 2.5% withdrawal fee.

The unlimited account which is ideal for businesses seeking an all-encompassing solution costs €98 per month and features Free Bank Transfers and Unlimited Free Cash Withdrawals from any ATM.

There are optional features which can be selected according to need. For example, as a business creator, you can apply for extra business MasterCards at a cost of €3 per month per card. Of course, value-added tax (VAT) is not added to any of the pricing options listed above. A complete fee schedule is available for multiple countries across the EEA.

Security

Safety and security are front and center with Holvi. To this end, all of your personal information is protected at all times. The site is secured by the safety and security standards as implemented by FIN-FSA, and the secure Amazon Web Services in the EU region. All personal information is safely stored with bank-level security (SSL encryption) and firewall protection measures. Additional information is provided to customers to ensure that they maintain safe usage practices at all times. This business banking solution is fully authorized by the Finnish authorities, and a strict policy of segregated accounts is rotate.

This protects business customers in the event of bankruptcy of the business, and it guarantees that client funds are held separately to business funds. The company uses the most innovative security solutions including 2 FA (two-factor authentication). Other encryption systems include TLS/SSL, and MasterCard® identity check 3D Secure Authentication protocols. In the event of a security breach with a client’s account, Holvi’s support representatives will take care of the issues.

Holvi Support

Business clients can contact customer support service representatives via telephone from Monday through Friday.

Other customer support options include callback functionality. The Help Center is a useful resource for finding a wealth of information related to business account types, costs, benefits, and options. The main categories at the Help Center include: Getting Started, MasterCard, Payments, Invoicing, Bookkeeping, Pricing, Legal, FAQ Pages, and Contact information.

Customer support is highly attentive to registered customers, and the customer-centric focus is evident throughout. The listing of available languages includes English, German, and Suomi.

- Fully Segregated Accounts

- Powerful Invoicing Functionality

- Mobile and Desktop Platform Access

- Free Unlimited Bank Transfers Available

- Cash Withdrawal Fees Diminish as You Move Towards the Unlimited Account

- Fully Licensed and Regulated in the EEA (Finland).

- Extra Holvi Cards Cost More Money

- No APIs and Integrations Currently Available

- There are Fees Levied on Businesses Using Different Currencies

- Current Accounts are the Only Account Types that are Available to Account Holders

Reviews

Conclusion

Holvi certainly ranks among one of the most innovative business banking startups to come out of Finland in recent years. It is a powerful business FinTech solution for SMEs across the board, and it includes a wide range of features – in both the free and premium plan options. Business customers get to enjoy a range of benefits including invoicing, ATM cash withdrawals, a MasterCard debit card, rapid payments processing, quick and easy accounting, and real-time analytics for making smart business decisions. There are many reasons why Holvi is the preferred choice for businesses, and there is certainly room for upgrades with APIs and integrations, et al.

Pricing ranges from free to 98 EUR per month, and there is plenty of latitude to upgrade or downgrade plans based on expectations. As far as safety and security are concerned, Holvi is SSL secure with bank-level encryption protocols in place. It operates according to a fully-licensed framework with FIN-FSA, and secure Amazon Web Services in the EU region. Additional security measures include Two Factor Authentication (2FA) to ensure that transactions are processed by the legitimate account holder. Overall, Holvi delivers on expectations, and it is cost-effective too.