- Free withdrawals anywhere in Euros

- Mastercard SecureCode, fingerprint login & card-lock

N26 Review

N26 Review

Advertiser disclosure

Introduction

N26’s mobile app puts the control in your hands with real-time banking: categorize your spending, send money to friends, save and budget your money, enable/disable foreign payments, transfer money in 19 currencies, set payment limits, lock your card and more – all from the comfort of your phone.

N26, founded in 2013 in Berlin, is Europe’s first mobile bank. Its founders shared a vision of building a bank people would actually love using, fitting seamlessly into their mobile lifestyle. In 2015, N26 officially launched its online banking app, offering more transparency, flexibility, and control for the customer, and eliminating the interference and physical boundaries too-often characterized by a traditional bank.

Opening an account with N26 is easy and quick – all you need is proof of ID, an email address and a mailing address (to receive your Mastercard).

To date, over 7 million customers from all around the world use N26.

- EN

- FR

- DE

- IT

- ES

- Free Account

- Plans from €4.90/m

Banking Features

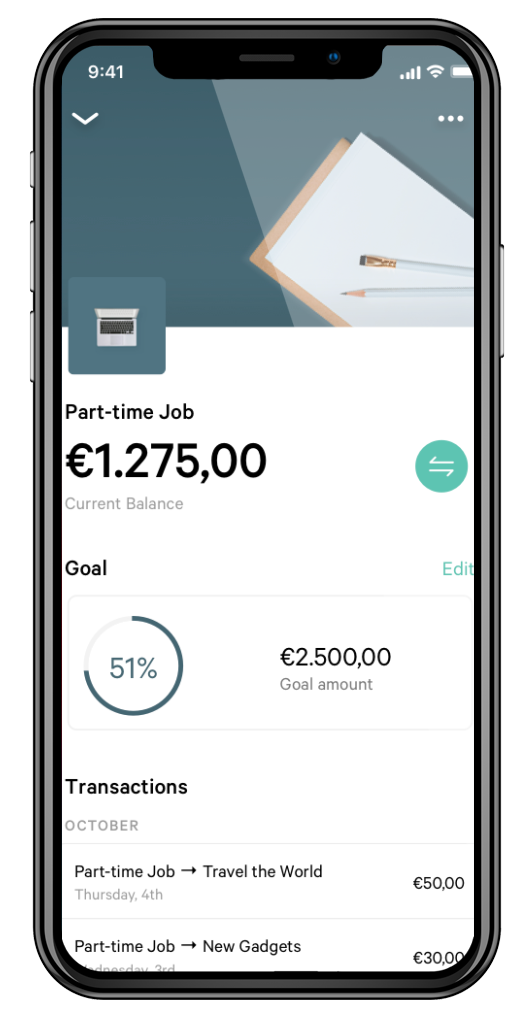

Spaces

Create sub-accounts to separate your money for different budgeting goals (e.g. savings, mortgage payments, holidays etc.). You can add, remove or move money between your spaces. Spaces are great for saving as the money can’t be used for spending.

MoneyBeam

With MoneyBeam, users can send money to contacts in their phone’s contact list without the need for bank details. N26 users will receive the money instantly; others get a link with which they can collect transfer within 2 banking days.

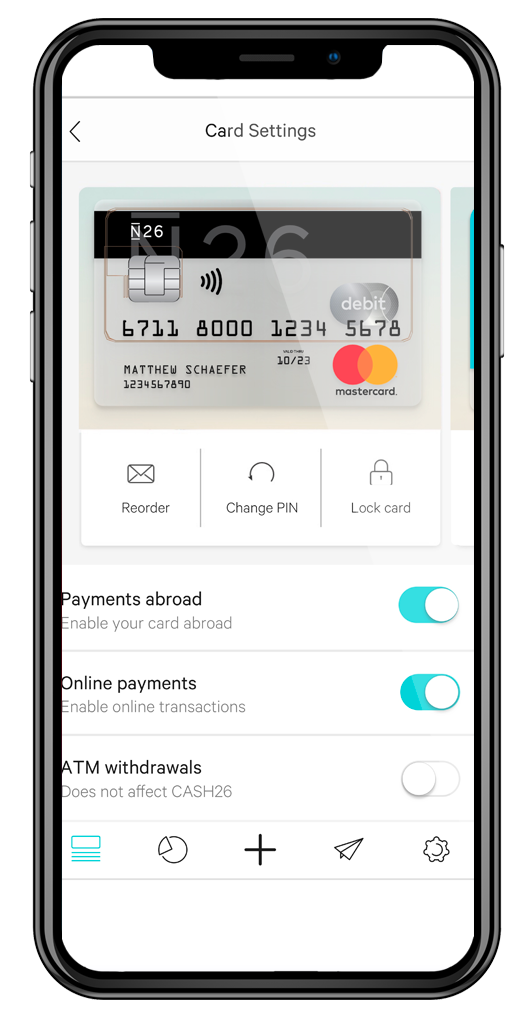

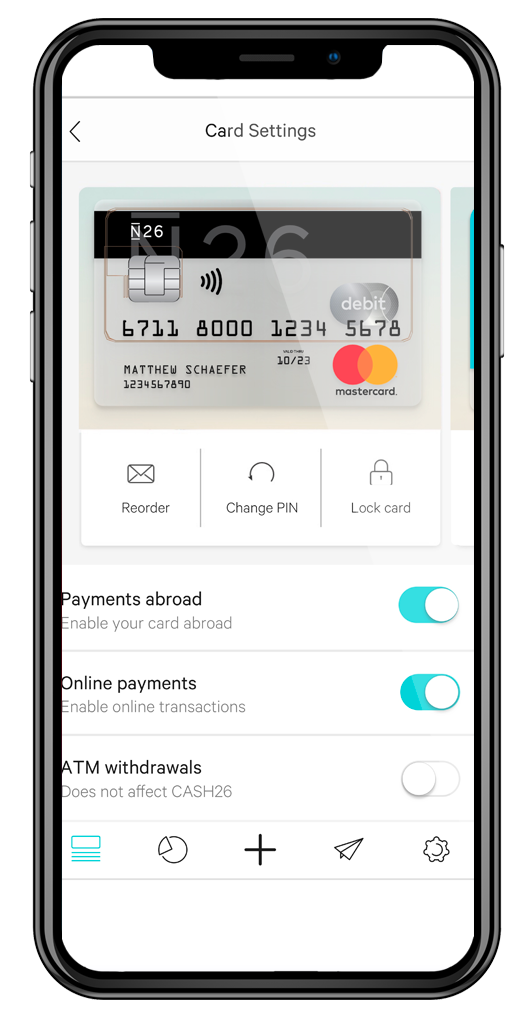

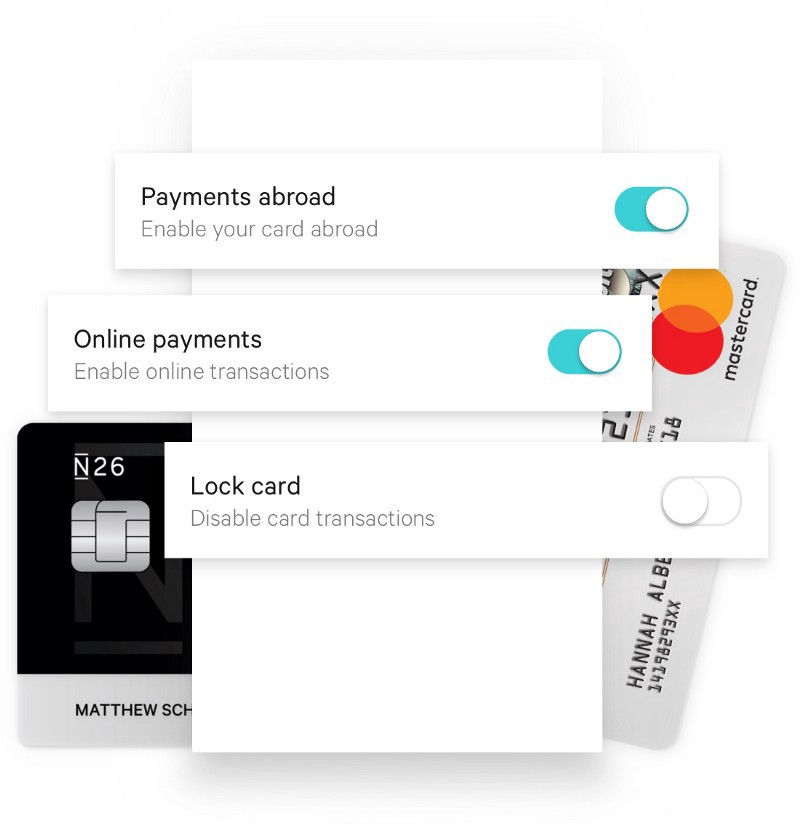

In-App Card Control

Enable foreign payments, activate paying online, set limits for withdrawals and payments.

Balance Tracking

Look through all of your transactions to see where and when you’ve spent your money.

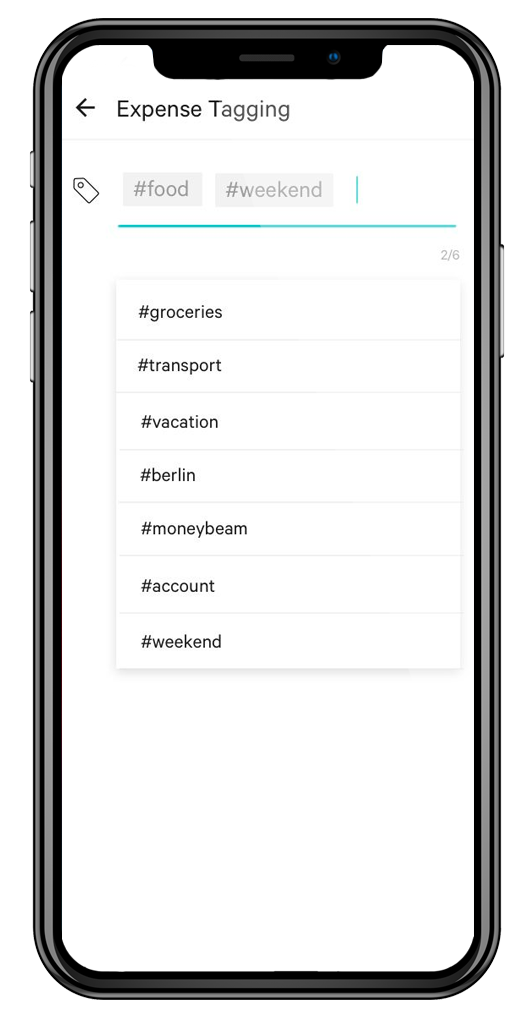

Transaction Tagging

#weekend, #friends, #gift — you can create your own personal hashtags to organize your transactions.

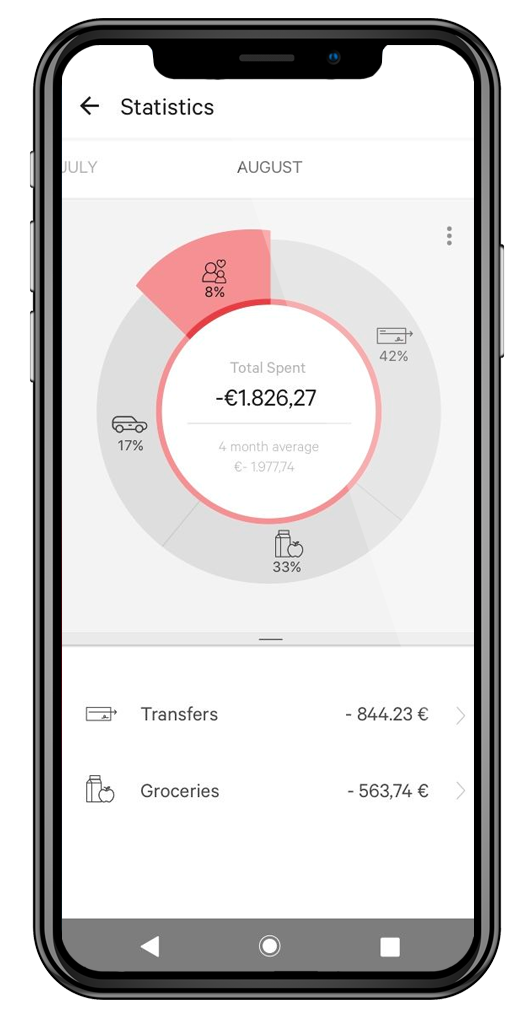

Spending Categorization

Get an instant breakdown of your spending. N26 uses artificial intelligence to automatically categorize your spendings.

Fingerprint Login

You have the option to choose your preferred login method, which is either with a password or with your fingerprint. Using fingerprint login can save time and the frustration of trying to remember your password.

TransferWise

Transfer money internationally via TransferWise, from within the N26 app. Transfers can be made in 19 different currencies, at a rate up to six times cheaper than traditional banks.

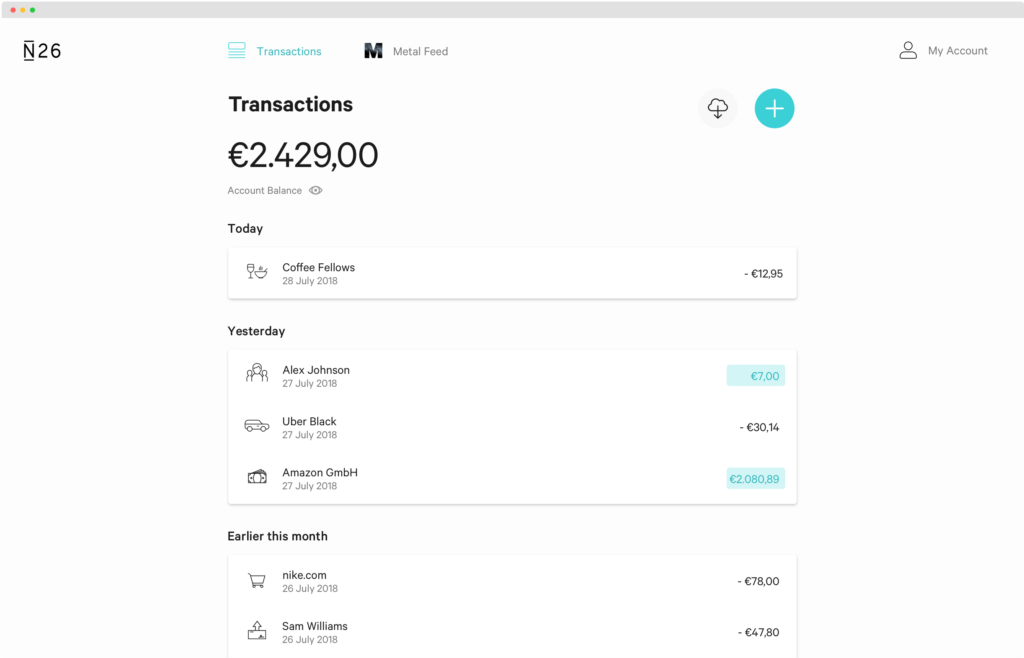

N26 Web

N26’s web app offers the same features and freedom as the mobile app, and because it is responsive, it can be accessed on any device. If your phone battery is empty, you can still access your account through N26 Web on a PC or other mobile device. N26 Web is a convenient addition that takes away the biggest vulnerability of mobile banking, which is not being able to access your money without your smartphone.

Cash26

Germany only: withdraw and deposit cash for free at any of N26’s approx. 11 thousand retail partners across Germany. Simply open the app on your phone, go to CASH26, choose deposit or withdraw, have the cashier scan the barcode the app generated and take or deposit your money. Note: N26 users outside Germany/ Austria can deposit funds using Sepa Transfer.

N26 Account Types

Depending on the country you live in, you either have two or three personal N26 account types and one or two business account types to choose from.

Personal account types

| N26 Standard | N26 Smart | N26 You | N26 Metal | |

| Price per month | €0.00 | €4.90 | €9.90 | €16.90 |

| Free ATM withdrawals (€) | ✓ | ✓ | ✓ | ✓ |

| Free payments | ✓ | ✓ | ✓ | ✓ |

| Google Pay & Apple Pay | ✓ | ✓ | ✓ | ✓ |

| Allianz insurance package | X | ✓ | ✓ | ✓ |

| Free withdrawals worldwide | X | X | ✓ | ✓ |

| Dedicated Customer Support | X | X | X | ✓ |

| Exclusive partner offers | X | X | X | ✓ |

N26 Standard

N26 Smart

N26 You

N26 Metal

Premium Plans

N26 Smart

N26 Smart account is a seamless, personalized, premium membership that fits best to travelers and digital nomads.

- Banking without borders: No ATM fees or transaction fees when traveling abroad. Free transfers in foreign currency.

- Extensive insurance package that covers not only travels but also common needs, e.g. medical & luggage cover.

- Partner deals & discounts.

- Priority customer support.

N26 Metal

Want to receive more from N26? sign up to N26 Metal and get car rental insurance while traveling and mobile phone theft and damage cover on top on all N26 you account benefits.

Business account types

N26 Business banking was mainly created with freelancers and self-employed in mind.

A free business bank account that earns 0.1% cashback on all purchases you make, and provides free card payments worldwide.

- Online or in-store global payments with no fees and Mastercard’s official exchange rate

- Instant push notifications about any account activity

- Mastercard 3D Secured payments

- Transactions Tagging: #client, #office, #bizness

- Automatic spending categorization, done by artificial intelligence

- No minimum deposit needed

- Transaction list exportable and downloadable as CSV or PDF files (for easier tax returns and invoicing)

- Web application to access the banking account from a desktop or other device

| N26 Business | N26 Business Smart | N26 Business You | N26 Business Metal | |

| Price per month | €0.00 | €4.90 | €9.90 | €16.90 |

| Free ATM withdrawals (€) | up to 3 | up to 5 | unlimited | unlimited |

| cashback | X | X | 0.1% | 0.5% |

| Google Pay & Apple Pay | ✓ | ✓ | ✓ | ✓ |

| No ATM fees | X | ✓ | ✓ | ✓ |

| Allianz insurance package | X | ✓ | ✓ | ✓ |

N26 Business

N26 Business Smart

N26 Business You

N26 Business Metal

Fees

N26 charges fewer fees on their services than a traditional bank, with many features offered free of charge. However, fees do still apply on some of the services N26 supplies, such as:

| Service | Fee |

| N26 Debit card ATM cash withdrawals | 5 free withdrawals per month €2 per withdrawal thereafter |

| N26 Maestro card ATM cash withdrawals | €2 per withdrawal |

| N26 Mastercard** cash withdrawals in currencies other than EUR | 1.7% of amount drawn Free for N26 You, Metal & Business You accounts |

| N26 Maestro card cash withdrawals in currencies other than EUR | €2 + 1.7% of amount drawn |

| Approved/ tolerated overdraft | 8.9% p.a. debit interest |

| CASH26 deposits (Germany only) | 1.5% on amounts over €100 |

Security

One of, if not the most important aspect of mobile banking is security. N26 offers a range of security options making your mobile bank account as safe and secure as possible:

Real-Time Account Notifications

Users receive instant push notifications after all account activity, keeping them informed about the status of their account and their funds.

N26 card blocking / unblocking

Instead of canceling your credit card when it disappears, you can lock it straight from the app and simply reactivate it when you find it. If it is really lost, you can order a new card straight from the app.

Customized Security Settings

N26 Mastercard permissions and restrictions can easily be customized. With a few taps, set/change permissions for:

- Making payments abroad

- Making online payments

- Withdrawing cash

License

N26 has a banking license from BaFin (Germany’s financial regulatory authority).

Deposit protection

Every N26 bank account is guaranteed by the Compensation Scheme of German Banks, up to the amount of €100.000.

Security procedures

three-tier security procedure protects all N26 accounts and transactions:

- an account can only be paired to one smartphone at a time

- you must log in with a password or fingerprint

- all online and offline transactions must be verified with a PIN.

N26 Bug Bounty Program

N26 offers cash rewards to encourage security researchers to report bugs or vulnerabilities, so they can be fixed before damage is done.

General security tips

N26 offers users a list of useful tips to make their online experience as secure as possible, covering general topics such as phishing, pharming, etc. as well as tips for a more secure mobile banking experience.

Using the N26 App Abroad

When traveling or relocating abroad, you can take advantage of the following borderless-banking benefits from N26:

- Free ATM withdrawals in Euros

- Free payments in any currency

- Free withdrawals worldwide (N26 You/Metal) – standard users pay 1.7% conversion fee on withdrawals outside the Eurozone

- Real-time exchange rates, provided by Mastercard

N26 doesn’t hide fees or add an unexpected foreign exchange rate, nor does it charge extra for rare currencies or for paying on weekends (common with alternative mobile banks such as Revolut).

N26 Support

N26’s customer support is available in five languages: English, German, French, Spanish and Italian. In addition to the Q&A support resources found on N26’s website, you can contact N26 via live chat in the app. The support team is available for chat sessions Monday-Friday from 08:00-21:00 and Saturdays from 08:00-20:00

- Easy & fast account setup

- Free cash withdrawals in EUR

- Free debit card

- Free payments abroad, in any currency

- Strong focus on app security

- Excellent integrations (Google Pay, Apple Pay, MoneyBeam)

- 1.7% charge for foreign currency withdrawals

- Customer Support not 24/7 available

- Limited number of free cash withdrawals

Reviews

Conclusion

N26, Europe’s first real mobile bank, has created a revolution in banking. In our ‘mobile first’ era, it makes total sense to use a mobile bank instead of a physical institute from the ‘old world’ that charges high fees on virtually everything it does, or its customers do for that matter. N26 is cheap, easy to use, flexible and fast, and you run things from wherever you are – with your smartphone. N26 Web can be used on any device, including PC/laptop and smartphone. You can’t go wrong with N26.