- numerous investment options with professional account management for free

Nuri Review

Nuri Review

Advertiser disclosure

Introduction

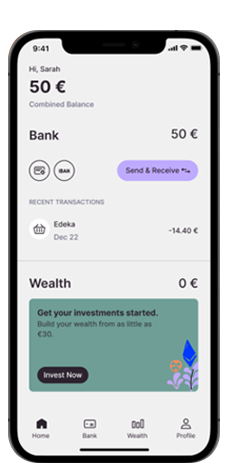

Nuri (formerly Bitwala) is a dynamic mobile banking solution geared toward money management was founded by Jan Goslicki, Benjamin Jones, and Jorg von Minckwitz in 2015. Nuri clients can use the app to invest from a safe and secure legal German bank account.

The founding members have an expert working knowledge of economics, different currencies, and online banking services. These corporate gurus leveraged blockchain functionality to merge traditional and new-age financial systems into a compact banking app.

This FinTech company has enjoyed multiple funding rounds and is based in Berlin, Germany. Solarisbank AG backs Nuri accounts, fully licensed and regulated by BaFin (Federal Financial Supervisory Authority). In addition, client funds are protected by the German Deposit Guarantee Scheme (DGS) for up to €100,000.

- DE

- EN

- Free Account

Banking Features

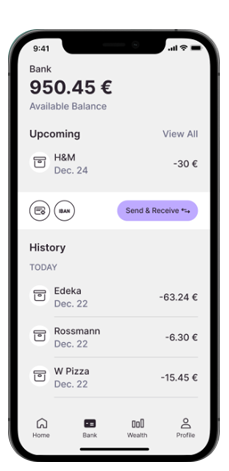

Nuri banking features include many options designed to make mobile banking as seamless as possible. In addition, all clients are given a complimentary debit card with no attendant fees. Nuri comes fully equipped with global payments, SEPA transfers, and a German IBAN.

Visa Debit Card

Clients can use the Nuri Visa debit card anywhere the Visa logo is displayed. In addition, you can create up to 5 online cards on top of your 3 physical cards, and use them immediately. No extra charge required. Also, clients receive push notifications for all recent transactions, so nothing goes unnoticed.

Nuri Bank Account

Nuri bank accounts are guaranteed safe and secure, with various features, functions, and investment options available. With this mobile banking solution, clients can take charge of their finances, with a wide range of resources geared towards saving and investing.

Nuri Investments

Using Nuri Pots, clients can invest in hand selected funds overseen by professional account managers. As a result, investing is a breeze, with various Nuri Pots available to account holders. One such Nuri Pot is known as All-Rounder. It includes a wide selection of internationally successful companies. In addition, clients can schedule debit orders to purchase digital currency through savings plans.

Quick Launch Banking Options

This banking app is easy to get set up. Investments start from as little as €5. There is complete transparency of fees, with a maximum of 1% annual fee for assets under management. In addition, clients can enjoy full access to an array of banking features on the go.

Nuri Accounts and Fees

Bank Account at Nuri

It is free to open a Nuri bank account. Dubbed straightforward banking, the Nuri account is powered by Visa and costs €0.00 per month. Among others, clients can enjoy these benefits:

- SEPA transfers

- Complimentary Visa card

- Replacement cards cost €9.50

- Enjoy free ATM access globally

- Unlimited ATM withdrawals at zero cost

- Maximum online daily card disposal €5,000

- Maximum off-line daily card disposal €3,000

- €100,000 insurance provided by German Deposit Scheme

- Bank account cash withdrawals have a maximum of €1,500

Other bank account features

- In-App learning features

- Mobile access via the app

- Multifactor authentication

- Live chat and email support

There are no fees for opening accounts, managing an account, incoming/outgoing transfers, card payments in Germany, card payments in euro or in other currencies in the SEPA area.

Nuri Pots

Nuri Pots showcase various investment funds that experts manage. Features of Nuri Pots include:

- €5 minimum required

- Allows investment in security tokens

- Maximum 1% annual management fee of your investment volume

- Approximately 0.5% price differential between buying/selling during market hours

| Average Bank | Nuri | |

| App | ✓ | ✓ |

| Support via Chat & E-mail | ✓ | ✓ |

| Biometric authentication & Two-Factor-Authentication | ✓ | ✓ |

| In-app learning | X | ✓ |

| €100,000 deposit guarantee | ✓ | ✓ |

| Account Management | fee-based | free |

| SEPA transfers & standing orders | ✓ | ✓ |

| Debit card | fee-based | free |

| Worldwide cash withdrawals | fee-based | free |

Average Bank

Nuri

Security

Nuri’s blockchain banking service is ironclad and secure. It fuses fiduciary currency such as EUR, USD, and GBP. Since Nuri is in partnership with a regulated German bank, it is subject to strict security standards. It is regulated by Germany’s Federal Financial Supervisory Authority, otherwise known as BaFin. Clients have peace of mind knowing that the Compensation Scheme of German banks provides €100,000 protection guarantees.

In-house security consultants continually monitor Nuri to ensure the highest standards are maintained. All processes are overseen by IT consultants, with powerful encryption technology in place to detect anomalies. 3D Secure known as 3DS is designed to protect card payments online. There are several ways to secure this data, notably a six-digit mTAN through SMS authentication. The mTAN is free of charge and is sent to the account holder’s phone.

Nuri Support

Nuri offers customer support in English and German. Account-holders can contact support representatives directly through the Nuri Chatbot powered by Solvemate. The HELP section redirects to a category-style page with extensive support. Various categories are available, notably:

- Account Registration

- Banking Services and Visa Debit Card

- Wealth Options

- Profile Information

- More Section

Customer support is readily available to account holders and new prospects between 9 AM and 6 PM CET, from Monday through Friday, not on weekends. No support is available during bank holidays and German public holidays.

- Regulated by BaFin

- BaFin protection up to €100,000

- Nuri Pots for investment

- Unlimited free ATM withdrawals globally

- Easy to register

- Only available in English and German

- No telephone support

Conclusion

Nuri is a breath of fresh air in the mobile banking arena. Headquartered in Berlin, Germany, Nuri provides banking services to account holders:

- unlimited ATM withdrawals anywhere globally, and it is fully manageable via the app;

- account management for free

- numerous investment options with in-app learning

- blockchain technology

- Nuri Visa debit card for free

The mobile app is easy-to-use, with a strong focus on functionality.