- Best multicurrency account

- Free SEPA transfers & currency exchange

Paysend Global Account Review

Paysend Global Account Review

Advertiser disclosure

On the back of their money transfer services’ success, Paysend now offers a Global Account for multicurrency transactions on the go. It’s a new way to spend or send money in multiple currencies using an app and a bank card. Users are also able to hold funds in the account until they need them.

The app allows clients to make payments to merchants or transfer funds. It further grants clients the ability to set the cards to the currency required. A physical card is available for those travellers who need to be able to withdraw funds from any ATM around the world.

Best of all, the Global Account charges no fees for payments and withdrawals from anywhere. We review this account in more detail to find out how it works and the benefits for users.

- EN

- DE

- RO

- FR

- +8

- Free Account

- Low fees apply

How to Open a Paysend Global Account?

The process to open a Paysend Global Account is straightforward. You need to download the mobile app, which is available on Android and iOS. The app is accessible via the Apple App Store or on Google Play.

To register an account, users must enter their full names, date of birth, residential address, phone number and a valid email address. Once all the details are in, you will have access to the account immediately. Only individuals who are over 18 are allowed to register an account with Paysend.

To increase certain limits and enable the PayLater facility, you need to verify your identity via the automated process. A Bot takes you through the steps required and guides you through the process to make it quick and painless.

Banking Features

Banking services are set apart from each other by the unique features each one offers. Paysend has several features that make it beneficial for account holders, and we look at each one more closely.

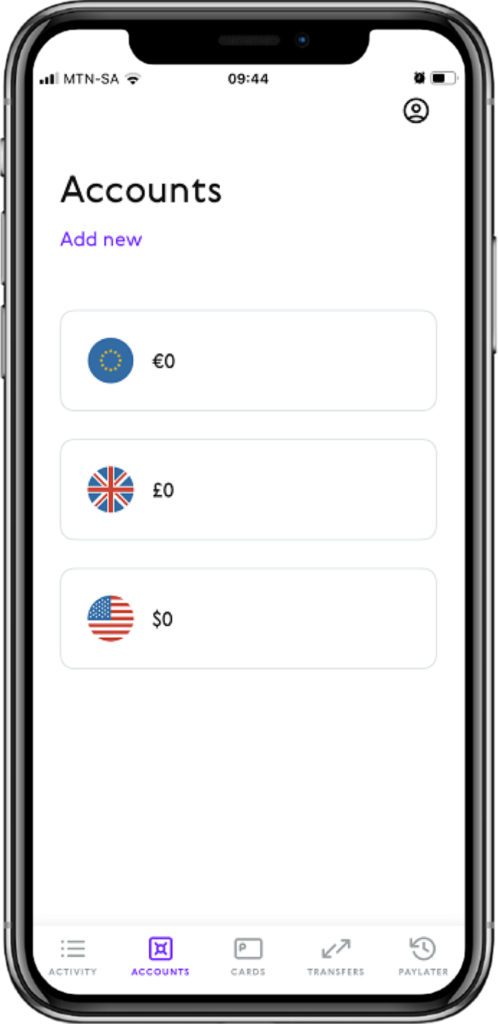

Multicurrency account

Users can add or hold funds in British Pounds, Euros, US Dollars, Chinese Yuan, Russian Rubles, and Swiss Francs. The company is presently working towards a partnership with Bitstamp to incorporate cryptocurrencies as well.

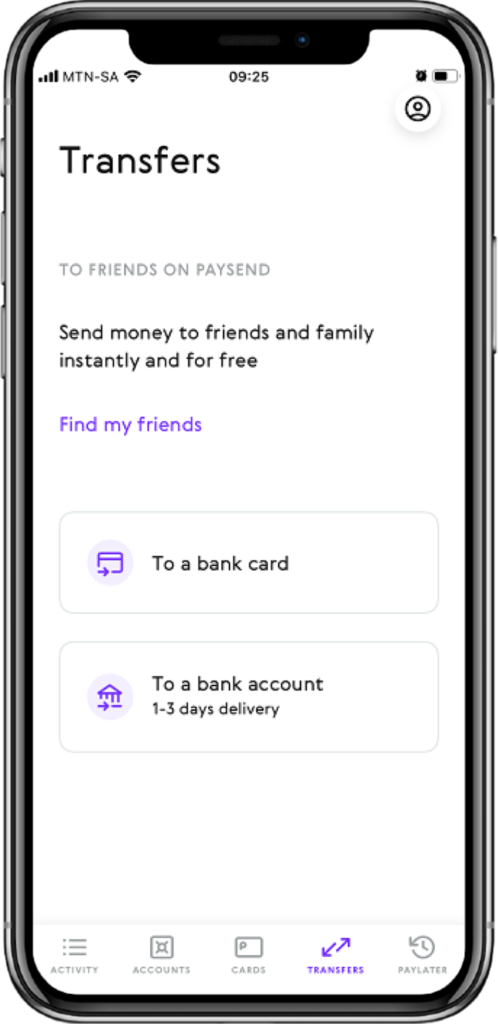

Money transfer

The Global Account offers free SEPA transfers as an option to send money abroad to an individual’s bank account. The Global Account supports withdrawing funds and spending worldwide in a vast amount of currencies. Paysend also offers interbank exchange rates at no charge.

Payments & Categorizations

Payments can be made anywhere around the world where Mastercard is accepted. It includes online stores and withdrawals from ATMs. Payments will be sent immediately as soon as the request goes through. The easiest is to transfer from one Paysend Global Account to another, as it’s immediate and free.

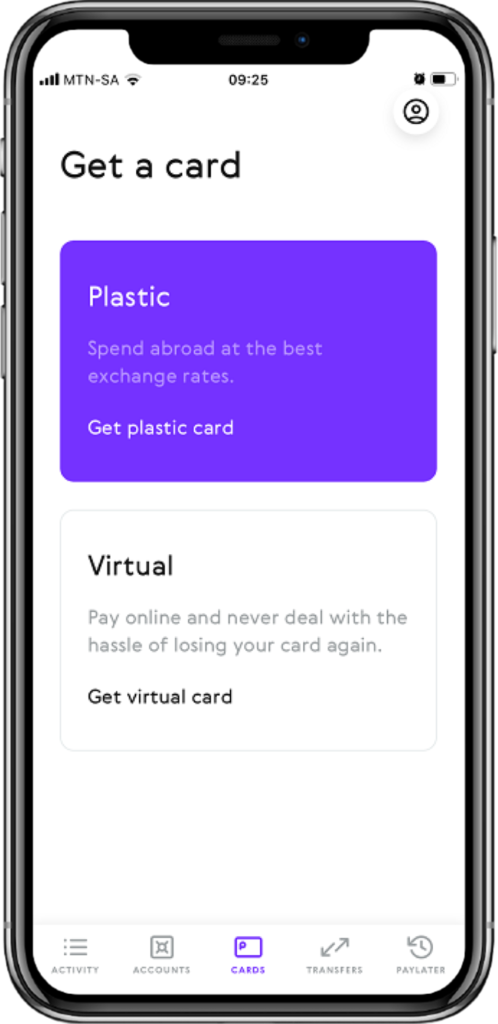

Virtual cards

The Global Account comes with a prepaid virtual Mastercard which you can generate and access via the app, as soon as you register. You can use this virtual card to make online payments and purchases. If you prefer a physical card, then you can order one via the app as well. The cards are accepted anywhere in the world where the Mastercard mark is displayed.

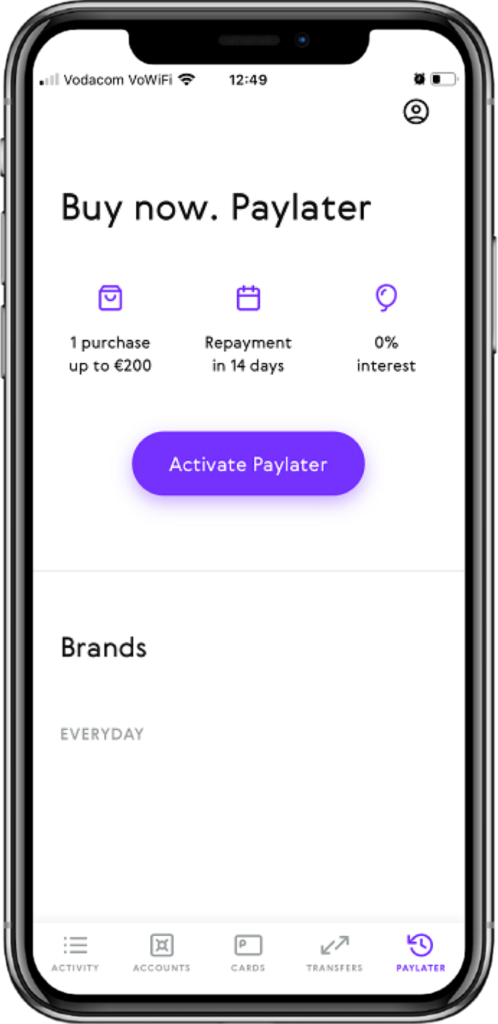

PayLater interest-free credit

A unique feature is that account holders can borrow a small amount to pay back within 14 days. Currently, the amount allowed is between €50 and €200 at 0% interest. To enable the credit facility, the client must verify their identity. The process involved automated face-recognition, which the system uses to verify credit eligibility. Users need to upload a photo of their legal EU document and a selfie to confirm identity.

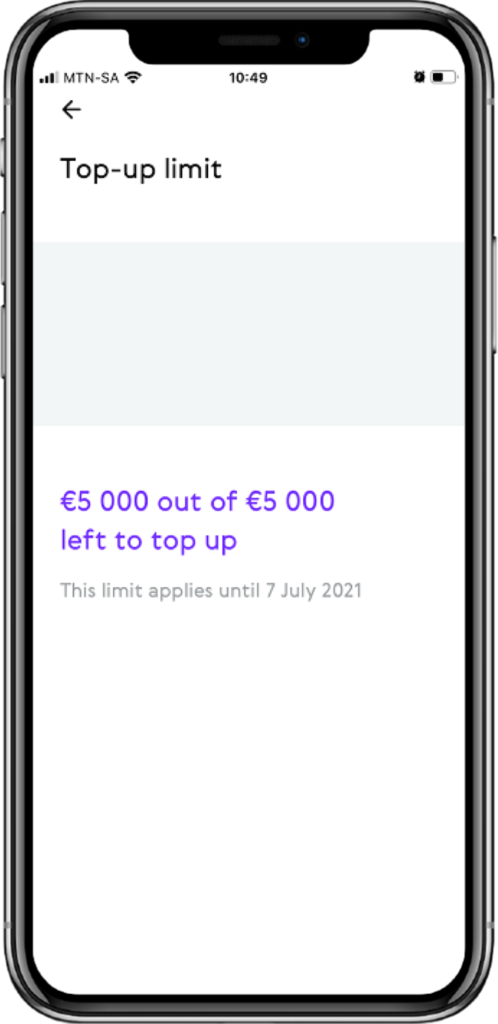

Funds Top-up

To be able to use the account clients need to top-up the facility via the mobile app. Currently, only GBP and EUR are used to top-up the Paysend Global Account, depending on the client’s base currency. Even though the app tops up with the two currencies mentioned above, this does not limit which one you can use for payments, transfers, and withdrawals.

Pricing and fees

As with most banking products, there are specific fees for the various services. Paysend Global Account doesn’t charge fees on most of its facilities, the main cost is during card transfers, and there is a set fee for delivery in the EU of the physical card.

Card payments, transfers to a bank account, and topping up the account are free of charge. More detailed payment information is on the table below.

| Global Account | |

| Price per month | Free |

| Physical card delivery fee | £4.99 / €5.99 |

| Money top-ups | Free |

| Cash withdrawals | Free |

| Currency exchange | Interbank exchange rates |

| SEPA transfers | Free |

| International money transfer | £1, $2 or €1.5 |

Global Account

Security

Paysend Plc. is a registered and regulated financial institution. The company is licensed and authorised in the UK by the Financial Conduct Authority (FCA). One of the regulations of this authority is that the client’s funds must stay in a separate bank account which isn’t available for the operational or business activities of Paysend.

All financial transactions are processed on an internal technical platform, certified by MasterCard and protected by its rules. The integrity of data is protected according to the highest PCI DSS standards with integrated fraud prevention systems in place, as well as AML-risk management and monitoring systems.

The account can link to one currency account at a time. Whenever you use the card, the money is deducted from your balance immediately. Should a card transaction appear as pending, it means the merchant hasn’t accepted it yet. It will be resolved within 14-days, and any purchase that fails will result in the funds crediting back to your account.

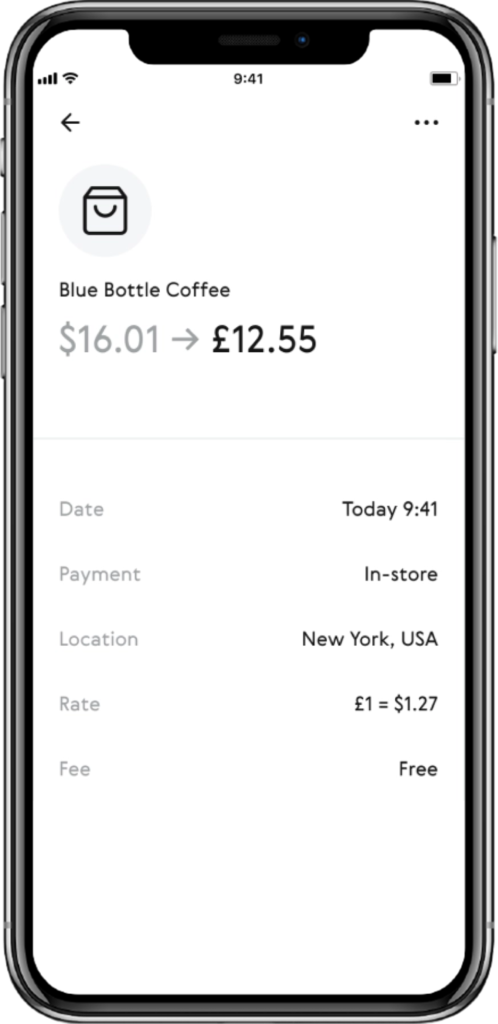

Using the app abroad

This Global Account is a useful tool when travelling abroad and making multiple purchases from various vendors around the world. There are no fees for using the virtual or physical card abroad. When you use the account, the transaction goes through in the relevant currency of the country you are currently visiting.

To check which currency your card links to, click on ‘cards’ on the apps main screen. It will show you the card details, and which tender you’re using by displaying the country flag. Withdrawals are also free for the Global Account.

To be able to withdraw funds, you’ll need to get a physical card to use at the ATMs. The card enables users to withdraw funds from any ATM around the world in their currency of choice. The current withdrawal limits are £2,200 / €2,500 per year, but this can increase when you’ve completed the verification procedure.

The amounts go up to a maximum of £4,500 / €5,000 per annum. As the company and product evolve, we’re sure that these limits will be revised and altered according to clients needs.

Paysend Support

The app contains a lot of information to better assist clients with any queries they might have. Sections containing various topics are listed on the support page and match what is available on the website version. The questions and answers are insightful and detailed, leaving little doubt as to how the account works.

If you need to contact the customer care centre, the options available on the app are WhatsApp, In-app Chat and Email. Choosing any of the three will link you automatically with the relevant service for direct contact without you having to exit the Paysend app.

- Cashless virtual account for safer international spending.

- Free withdrawals and transfers.

- User-friendly app, with a quick registration process.

- Virtual and Physical cards available.

- Low monetary limits on withdrawals and payments.

- Currently only able to top-up in GBP or EUR.

Reviews

Conclusion

As a financial product and service, Paysend is one of the easiest to use when it comes to international cashless spending. The account provides clients with a multicurrency account with the ability to top-up in EUR or GBP. Funds can be held in for an unlimited period, or transferred to a bank card, bank account, or other Paysend User.

With no fees on payments or withdrawals, travellers can enjoy the benefit of cashless safe spending and have full control via the mobile app. If you find yourself a little short on cash, then you can take advantage of the PayLater credit facility. Designed with short term lending in mind, clients can make online credit purchases from a specific list of brands.

The most important feature is that account holders can spend in any country using the local currency, without having to worry about exchange rates or fees. It’s a revolutionary product that was designed with simplicity in mind for financial transactions that are usually complicated. It’s a must-have for individuals who need to move money in various currencies, without the hassle of standard forex procedures