- Advanced accounting integrations

- Receipt capture

Employee credit cards have historically been a challenge at the end of every month. Expense reports and reimbursements can give headaches to even the most up-to-date company. Pleo promises to make these hassles a thing of the past.

Pleo is part of the Mastercard brand family. It initially worked like a prepaid card, drawing funds from an attached account for transactions. The cards are now changing from prepaid to commercial, increasing their usefulness.

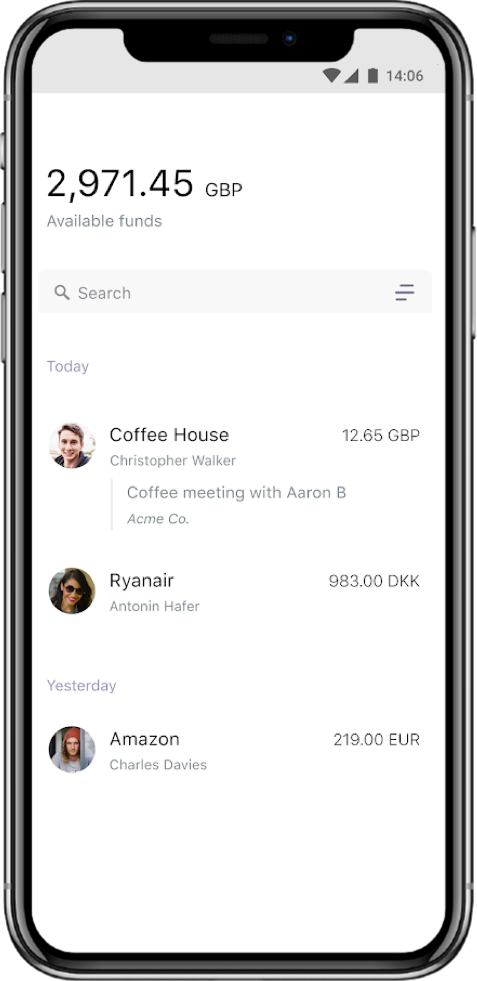

The new setup will bring increased safety and fraud protection to customers. Employees will still be able to access funds for expenses and supplies. Management will be able to continue to view transactions in real-time with notifications of purchases instantly recorded.

Transferring from prepaid to commercial cards will improve their relevance at more locations. It also provides better security features. Over the next several months, administrators will need to replace existing cards and activate the new ones to ensure a smooth transition.

Pleo is a Mastercard product. Companies set up a separate account from their primary bank account specifically for employees to use their cards for business transactions. The cards look like ordinary credit cards, with chips and pins for in-store or contactless purchases.

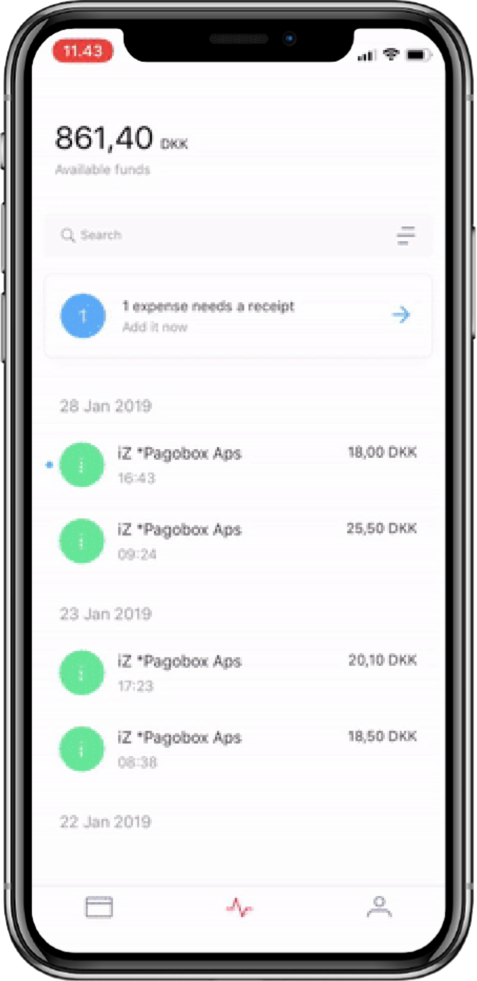

Employees paying for business expenses with either the physical or virtual card have to take a few steps to use it. They take a photo of the receipt, add details using the mobile app, send it off, and they’re done. Never again will they have to fill out and submit reimbursement forms or reports.

Companies can download a statement to keep track of the wallet balance. Statements are sent daily to the auditor from the webpage. It’s important to note that the statements will include settled expenses only.

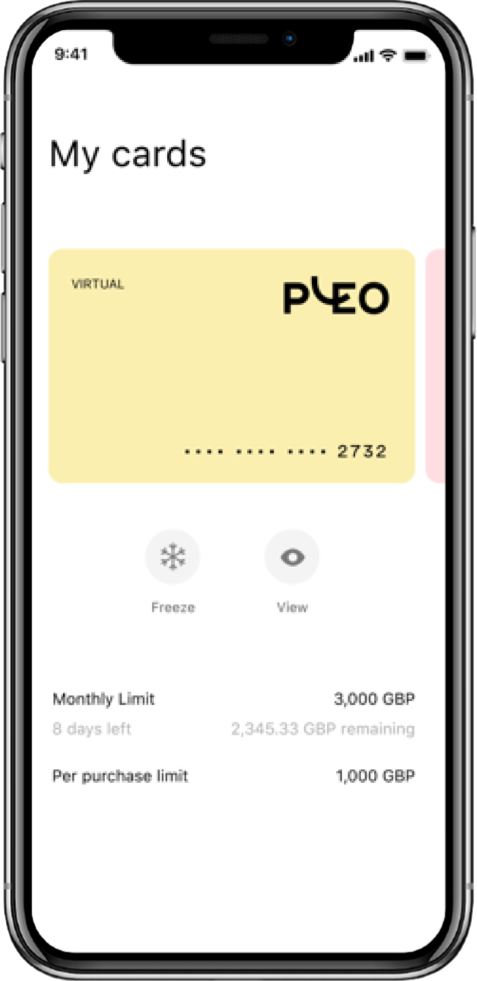

There are two versions of a Pleo card. First, there’s a physical plastic debit card. It’s helpful to the employee that needs to pay for travel expenses and other on-the-go items. It’s accepted worldwide at over 30 million locations. Secondly, there’s a virtual card. A virtual card works like any other card, but it’s only for internet-based payments. Virtual card details are on the Pleo App under the My Cards section. They’re secure and easy to use for subscription and online purchases. Employees can have both a physical plastic card and a virtual card. If necessary, they can pay with a physical card for online purchases. It comes in handy for those online purchases that need more verification, such as airline tickets or room reservations.

Many companies rely on a system that requires employees to submit expense reports for out-of-pocket costs. This can be a tedious process for both the employee and management. Now employees can add their receipt to the expense. Pleo helps create trust and transparency between management and employees. The accounting department has a complete view of company spending, and it’s not a complicated process for employees to submit expenses. No more chasing down receipts or trying to figure out a confusing transaction. Pleo Assurance helps highlight expenses that may need some extra attention. Administrators can set up thresholds that trigger a review process for expenses that are equal to or exceeds the settings. Reviewers can request updated expenses with more details from the employee.

In the rare situation that a receipt is missing, flag the transaction in the app and add explanatory notes about the situation. It’s helpful to submit extra documentation. Pleo automatically sends out weekly notifications to users with missing receipts as a reminder. Fetch is a tool for Pleo that emails receipts to customers by vendors. This tool works with Microsoft 365, Outlook, and Gmail. It needs access to email accounts to work this way, but Pleo only retrieves and stores receipts while respecting data security laws. If Fetch is not an option that the company feels comfortable with, there are other methods to upload invoices and receipts. The share option on the mobile app works well with both iOS or Android. When submitting from a desktop, the drag and drop, copy and paste, a screenshot, or manual uploading are extra options that work well.

The digital receipt capture feature is a real time-saver for employees. It takes only seconds to open the app and take a photo of a receipt. It’s a quick, painless process, and there are no worries about misplaced or lost receipts.

All purchases appear right away on the dashboard. Receipts are automatically categorized to match company accounting procedures. It’s a way to customize and simplify processes and make tedious paperwork disappear.

Employees need to make sure that pictures of their receipts are clear and readable. Take multiple pictures to record all the information on a receipt or upload multipage receipts. Even though only the first page shows in the expenses view, all pages go in the export file.

Handling a mileage expense or having a situation where a card is not accepted results in out-of-pocket expenses. Pleo Pocket is a tool that tracks mileage and cash expenses easily. Photo receipts and details submitted as usual using the Pocket section on the mobile app.

A manual money transfer is necessary to reimburse the employee. Transfers to the employee are in cash or through payroll, whichever way works for the company best. Pleo is working on a streamlined solution that’s in the works to cut the manual work.

Pleo can import client expenses seamlessly between accounting systems. The most supported systems are Quickbooks, Fortnox, Xero, e-conomic, Visma Ekonomi, and Billy. It provides a comprehensive way to manage business spending.

An external accounting practice can have access to the company Pleo account. Access levels are adjustable and are set up in the Accountant tab. The Partner Portal is where a bookkeeper can manage accounts.

The Value Added Tax (VAT) is a complicated process to navigate. Eligible claims are for:

Premium plan customers can let Pleo sort out the foreign VAT. Each year, Pleo Reclaim reviews the previous year’s expenses and submissions to each country that the VAT was charged to reclaim the funds. The process can take a few months, and a fee is charged to cover the claim’s cost when successful.

Communication is essential during this process, and emails will be sent out from pleoreclaim.com. These are time-sensitive and safe communications from the reclaim team, but if in doubt, contact them by chat. Any funds reclaimed will be put into the Pleo Wallet and an invoice submitted to your company.

Billing for Pleo services is deducted every month from the wallet balance. The number of users and coverage levels determines the cost of the service

| Starter | Essential | Advanced | |

| Price per month | £/€0 | £/€35 | £/€65 |

| Pleo company cards (plastic/virtual) | ✓ | ✓ | ✓ |

| Real-time expense tracking | ✓ | ✓ | ✓ |

| Automated expense reports | ✓ | ✓ | ✓ |

| Manage & pay invoices | ✓ | ✓ | ✓ |

| Xero and more accounting system integrations | ✓ | ✓ | ✓ |

| Apple Pay & Google Pay | ✓ | ✓ | ✓ |

| Spending limits per user or purchase | X | ✓ | ✓ |

| Spend analytics dashboard | X | ✓ | ✓ |

| Review spend per team | X | ✓ | ✓ |

| Reimburse employees with or without Pleo cards | X | ✓ | ✓ |

| Reimburse cash expenses and mileage | X | ✓ | ✓ |

| Manage company subscriptions | X | ✓ | ✓ |

| Live chat support | X | ✓ | ✓ |

| Foreign VAT reclaim | X | X | ✓ |

| Open API access | X | X | ✓ |

| Chat, email, and phone support | X | X | ✓ |

| Assisted onboarding session | X | X | ✓ |

| Dedicated Customer Success Manager | X | X | ✓ |

The security of client data is a priority. The cards are regulated by the Financial Supervisory Authority (FSA) in Denmark. Personal data is not used for marketing purposes unless agreed upon between the client and Pleo.

Customer data is not processed for any purpose other than what is necessary. Pleo carries PCI-DSS certification and adheres to PCI Security Standards Council requirements. Know Your Customer (KYC) processes are in place to identify customer requirements and identify fraud risks.

Mastercard SecureCode or 3-D Secure is an extra layer of protection for fraud prevention. A verification code for authentication sent to the user’s phone adds an extra layer of protection. Newer cards will trigger a push notification for approval of purchases.

Over 30 million worldwide merchants accept Pleo – wherever Mastercard is accepted. Use the card as usual when travelling abroad for business. Some extra fees may apply when using ATMs or using services abroad in foreign currencies.

Purchases made using foreign currency amounts will appear in that currency. That amount is automatically converted to the currency used by the business using Pleo. The converted amount is deducted from the company’s Pleo wallet.

Both the plastic card and virtual cards are compatible with MobilePay. Choose a name for your card(s) and link through the MobilePay App. Save a photo of your receipt and then upload it to the Pleo App to submit.

Customer support is accessible in several ways. Access support chat, information videos, and FAQs online. The website has an extensive and searchable help centre and the option to email questions to them at support@pleo.io.

A blog on the website is organized into categories, including customer stories. Here are accounts of how Pleo customers have been positively affected that use the service with their business. Update posts and related business articles keep everyone current.

Pleo empowers business teams while maintaining control and reducing the drudgery of administration. Companies can save time by simplifying bookkeeping and eliminating expense reports. It works with all the programs a company finance team uses daily to export data, all with one click.

Users give excellent feedback for the innovative solutions to everyday business problems. Over 12,000 companies have become part of the family, using it as a solution to their business expense issues. A business tool like Pleo is beneficial to simplify the administrative processes.