N26 Business banking for freelancers and the self-employed

Earn 0.1% cashback on all purchases, and enjoy free card payments worldwide!

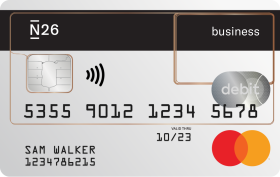

Go global with a Mastercard debit card

N26 Business is the free bank account for freelancers and the self-employed.

Open yours in a few minutes, and start using your virtual Mastercard as soon as you top up your account.

Free + unlimited SEPA transfers

Making and receiving SEPA transfers with your N26 IBAN is easy and free of charge. You can find your IBAN details straight away in the N26 app, when you open your account.

Up to 3 free withdrawals per month

With your N26 Mastercard, get up to 3 free ATM withdrawals per month within the eurozone.

Zero mark-up fees

Whether you’re paying in Pounds Sterling or US Dollars, you’ll only pay for what you spend—without added fees.

Real-time notifications

Stay up to date. Get a push notification immediately after all account activity, including card payments, direct debits, and transfers.

Automatic categorization. Get a breakdown of your spending

The N26 online business bank account uses artificial intelligence to automatically categorize your spending. Forget clunky spreadsheets—it’s all there in a clear overview in the app.

Mobile or desktop

Manage your N26 account 24/7 from the mobile app or the N26 WebApp, using your browser of choice. Download your transaction history in CSV or PDF format along with your monthly bank statements whenever you want

Print your transactions list

We're mobile, but for easier tax returns and invoicing, export and download your transaction list as CSV or PDF files for easy printing.

#Tag your transactions

#client, #office, #bizness… create your own personal hashtags and attach them to your transactions to organize them better.

German deposit security scheme

N26 has a German banking licence. It means your deposits are guaranteed by the German deposit security scheme. Your data is also protected.

Go even further with N26 Business Metal

Why not enjoy even more perks with Business Metal? As our most premium business bank account yet, it comes with an exclusively-designed Mastercard in stainless steel, and lets you earn 0.5% cashback on all purchases. Plus, benefit from added mobile phone insurance and an extended selection of offers from brands like Google Adwords, Fiverr and Boosted. It’s the smartest way to help your business grow.

Get your N26 Business bank account.

It only takes 8 minutes.

Open a new N26 business bank account from your phone or computer in an easy, paperless signup process.

Frequently asked questions

What are the benefits of the free business bank account from N26?

N26 Business Standard is a flexible, free business bank account that makes online banking even easier for freelancers and self-employed individuals. Within seconds of opening the account, get a free virtual N26 Mastercard that lets you pay in stores, apps, and online. Withdraw cash free of charge up to 3 times per month at NFC-equipped ATMs. Send, receive, and request money instantly with MoneyBeam. At the end of the month, see your spending at a glance with Insights, and enjoy 0.1% cashback on every purchase. Find out more in our Terms and Conditions.

Do I need an online business bank account if I’m self-employed?

Generally, it’s a good idea to keep your personal and business expenses separate. The N26 Business Standard free business bank account helps you break down your business expenses and income transparently. As your business grows, this will become more and more helpful when it comes to bookkeeping and taxes. Plus, you can access your free business account at any time and manage your finances directly in the N26 app, or on your desktop computer.

How do I open my free business bank account?

It’s easy to open an N26 Business Standard online business bank account. It requires zero paperwork, and takes only 8 minutes. All you need is your smartphone and your valid photo ID. There’s no minimum deposit amount, and you’ll be able to start using your account and virtual card as soon as your identity is verified!

Go to our Support Center for more details on the requirements for opening a bank account with N26.

Should I open my free business bank account in my own name or in my company’s name?

At N26, our free business bank account is designed for self-employed individuals and freelancers who do business under their own name. Therefore, you have to open the account in your own name. This is the name that will appear in your account and on your virtual N26 Mastercard.

How do I receive my cashback for purchases I made with my N26 Mastercard?

We calculate 0.1% cashback for every purchase you make with your N26 Mastercard automatically. We’ll credit your free business bank account with the total cashback amount once per month—you don’t need to lift a finger.

I am looking for a modern business bank account that allows me to deposit cash. Does an N26 Business Standard account offer this?

Yes, with an N26 business bank account you can deposit cash at over 11,900 partner stores in Germany. Simply deposit money while shopping at REWE, Penny, dm, Rossmann, and other partners. Create a barcode right in your N26 app with just a few taps and show it to the cashier—that's it! Note that we charge a small fee of 1.5% for all cash deposits.

Can I have both a private and a business account with N26?

No. You can only have one account with N26. If you already have a personal account with us and want to open a free business bank account, you’ll have to close the private account first, and then open the N26 Business Standard account.

What happens if I use my online business bank account for private expenses?

Since N26 Business Standard is intended for business purposes, you should primarily use it for your business expenses. This includes overheads like rent for your company premises or expenses for business trips. Still, you can use your free business bank account for private expenses from time to time—as long as this is not the majority of your expenses.

I already have a business bank account with another bank. Can I switch to N26?

If you already have a business bank account with another bank and you would like to switch to N26, you can do so quickly and easily with our free account switching service. Simply head to this page and search for your current bank, then automatically transfer standing orders, direct debits, and incoming payments to your new N26 business account.

What are the monthly fees for an N26 Business Standard account?

If you’re wondering about account management fees for the N26 Business Standard account, we have good news: There are none! N26 Business Standard is a current account with no account maintenance fees, and no minimum deposit.

Your free business bank account comes with a virtual Mastercard, which you can use to pay online, in apps, and in stores. If you'd rather have a physical card, you can order one right in your N26 app for a one-time delivery fee of just €10.

Will I pay negative interest with an N26 Business Standard account?

We do not charge negative interest on deposits to your N26 Business Standard account.

Are small business owners eligible for the N26 free business bank account?

If you’re self-employed and have a small business, the free N26 business bank account may be a good choice for you. Please note that N26 Business Standard is designed for freelancers and self-employed persons who work under their own name. Therefore, you cannot open a bank account in your company’s name.

I have a small business ('Kleingewerbe' in German) and am looking for a business bank account. Is an N26 Business Standard account right for me?

Small businesses that operate under their own name are eligible for our N26 Business Standard account. If this applies to you, then you can open an N26 business account. Please note that you cannot open an account under your company’s name with N26.