- Manage accounts in 28 currencies

- Raise, send and track invoices

Revolut Business Review

Revolut Business Review

Advertiser disclosure

Businesses can now enjoy a cutting-edge financial solution featuring international currency exchange, low fees, and instant payments. But more than that, Revolut Business brings ‘future-tech’ financial solutions to your business on mobile. Revolut’s breakthrough business financial services were launched in 2019. The app serves as a dynamic domestic and international money transfer solution for businesses.

- EN

- DE

- ES

- FR

- +10

- No monthly fee

- Plans from £19/m

Revolut already boasts 10 million+ customers worldwide, with over 350M transactions posted, exceeding £40 billion.

Features

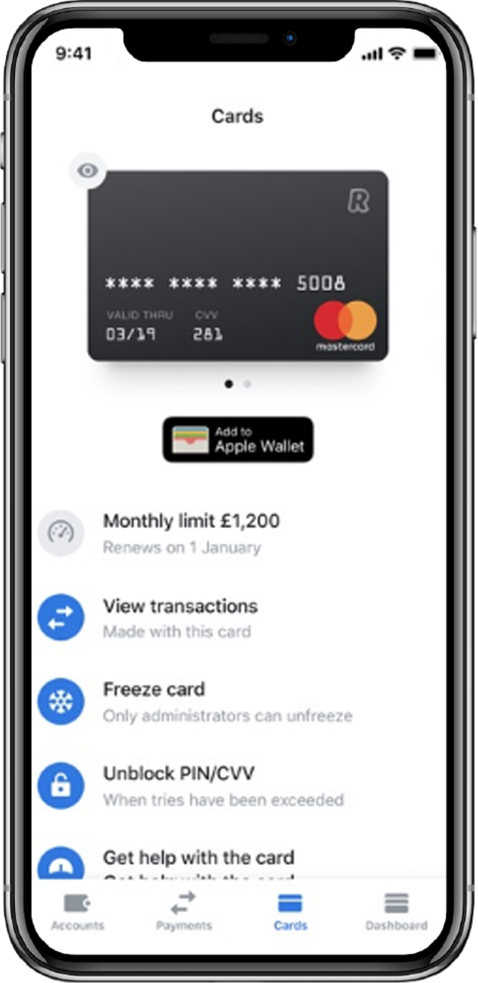

This ‘power-packed’ app is loaded with features and functionality. Notable among its best functions are quick and easy money transfers domestically and abroad, with local payments solutions including EUR, and GBP. Up to 28 currencies are supported, with full transparency, competitive rates, and a virtually unlimited number of multi-currency corporate cards which can also be added to ApplePay.

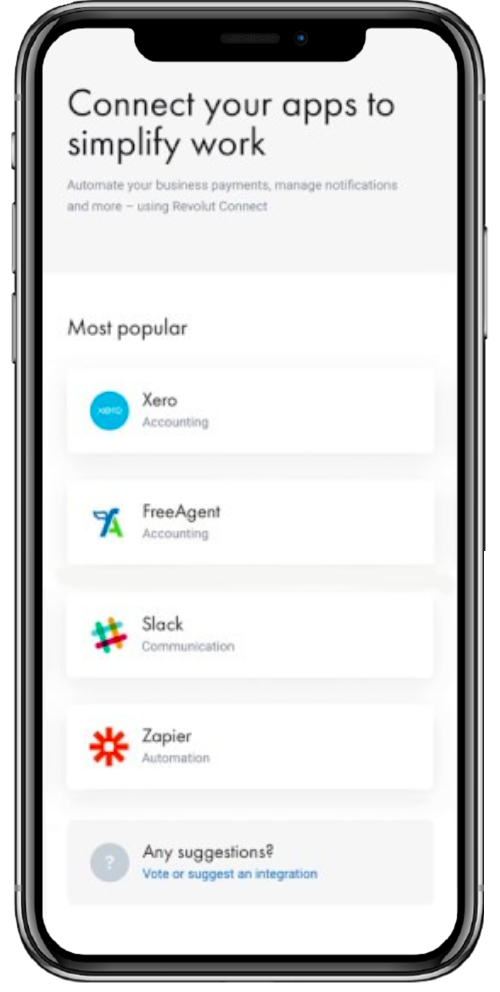

Other features include seamless registration, automated workflows, smooth onboarding, and the ability to process up to 1,000 payments in a few clicks. Businesses can implement flexible permissions for users, and the app can be seamlessly integrated with many other solutions such as Slack, Zapier, Xero, and FreeAgent. Revolut is readily available to clients in Switzerland, and EEA countries.

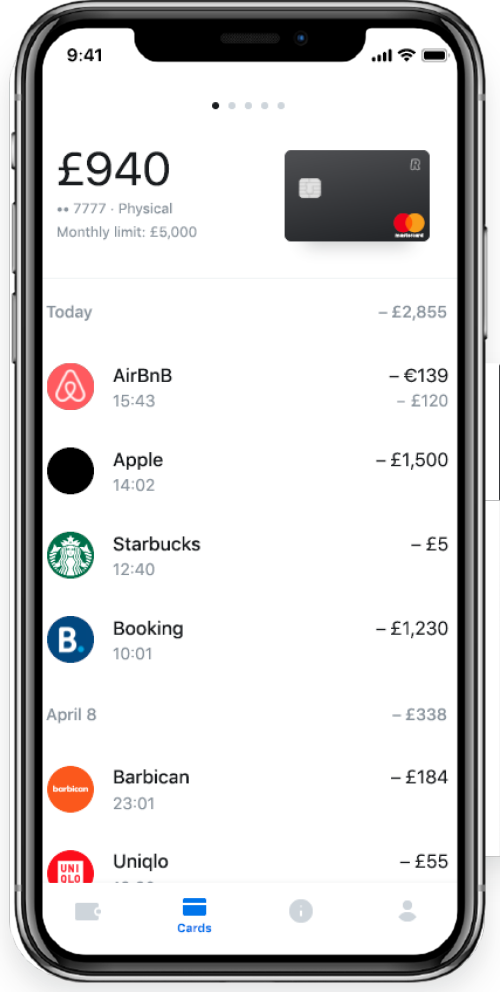

Payments

Revolut features an impressive array of business payments services. These include a bulk payments for payroll or invoices, scheduled payments, and recurring payments. Business clients can manage their finances easily from the Revolut app for iOS or Android smartphones.

Further, Revolut facilitates international and local money transfers in 28 currencies. Full transparency is provided on exchange rates and fees, and competitive pricing is available with accounts denominated in NOK, EUR, PLN, GBP, and EUR.

Revolut completely supports SEPA (Single Euro Payments Area) transfers to/from your business account. In fact, Revolut automatically identifies the best system for your transfer.

Corporate Card Management

Revolut provides multi-currency corporate cards. This mobile financial solution is available in physical cards, and virtual cards. Businesses can easily set monthly limits on individual cards, enjoy multi-currency accounts and track transactions. These corporate cards are SSL secure, with location-based security features, enhanced security for ATM functionality, and a unique set of business card designs for VISA and MasterCard.

Accounting Integrations

Open API facilitates streamlined business processes, with payments, accounts, counterparties, web-hooks, authentication, and transactions. Revolut enables bookkeeping and invoicing. Among the included integrations: Sage, Xero & FreeAgent

Users and Permissions

The Revolut Business solution allows you to set up accounts with ease. Permissions for accountants, colleagues, associates, and other stakeholders are easily established. These can be restricted based on the position of the employee in the organization. Everything is managed via the Settings tab in the Revolut app. Permissions for each team member can be set at the business owner’s discretion. The Revolut Business app allows users to grant admin access to your account to multiple team members (depending on your plan type).

Business Account Types & Plans

As a business owner, you can open an account within 10 minutes, in EUR or GBP. It takes up to 7 days for the application to be reviewed and processed by the Revolut support staff. Any legitimate business currently registered as a company with a physical presence in the EEA and Switzerland can access Revolut Business Services.

| Basic | Grow | Scale | Enterprise | |

| Price per month | £/€0/m | £/€19/m | £/€79/m | Pricing Upon Request |

| Infinite payments | ✓ | ✓ | ✓ | ✓ |

| Free Team Members | Unlimited | Unlimited | Unlimited | Unlimited |

| Free Local Transfers | 5 | 100 | 1,000 | Custom |

| Free international transfers | X | 5 | 25 | Custom |

| Currency exchange at the interbank rate | £1,000 | £10,000 | £50,000 | Custom |

| GBP and EUR local accounts | ✓ | ✓ | ✓ | ✓ |

| Hold/Exchange 28 currencies | ✓ | ✓ | ✓ | ✓ |

| IBAN for worldwide transfers | ✓ | ✓ | ✓ | ✓ |

| Prepaid debit cards and mobile Apps for cardholders | ✓ | ✓ | ✓ | ✓ |

| Virtual cards, connect and open API | ✓ | ✓ | ✓ | ✓ |

| 24/7 customer support | ✓ | ✓ | ✓ | ✓ |

| User permissions | ✓ | ✓ | ✓ | ✓ |

| Bulk payments | X | ✓ | ✓ | ✓ |

| Expense management | X | ✓ | ✓ | ✓ |

Basic

Grow

Scale

Enterprise

Security

If anomalies are spotted, the account will be frozen. Additional security systems in the form of 2 FA (Two-Factor Authentication) strengthen the protections available to clients, courtesy of email and SMS notifications. From a business perspective, it is possible to enable additional control over corporate cards at company level. Any feature can be disabled or enabled, and accounts can be frozen at the discretion of the business owner. New security features that will soon be available to business account holders include Google SSO and Google Authenticator.

Revolut Business Support

Business clients can get in touch with customer support representatives at Revolut by clicking on the Help button. This drop-down menu introduces you to the Community, the Help Center, Security, and System Status Options. The Help Center provides information on a range of topics including Getting Started, Transactions, Cards, Profile, Tax, Security, and more. It is possible to contact the customer service team via telephone, or by using the in-app chat function.

Chat is available between Monday and Friday (24 hours a day), or between Saturday and Sunday (24 hours a day). For the Premium plan users and Metal plan users, Priority service is available. Revolut maintains an active presence on social media channels including Facebook, Instagram, Dribble, LinkedIn, and Twitter. Revolut’s UK-based users can visit the company for face-to-face communications at the Westferry Circus address, in London.

- Powerful mobile business resource

- Physical and virtual card numbers available

- Lots of flexibility in terms of plans and pricing

- Amazing mobile functionality for Android and iOS

- Multi-currency holding options available for businesses

- Competitively priced exchange rates and fees on money transfers

- No desktop version available at the moment

- No deposits of cash permitted on the account

- Limited number of free transactions in free account

- All accounts must pay 2% ATM fees

- Several features in development such as Google Authenticator, and Google SSO

Conclusion

This app is a power-packed dynamo, with plenty of neat features. Any business that requires lots of flexibility in terms of its payments processing capacity, bookkeeping, business expense management, money transfers, and mobile account management, will benefit from using Revolut. Plus, there are competitively-priced plans available to business users, including a Free Account, Grow Account, Scale Account, and Enterprise Account. Each option is unique in terms of pricing, features, and scale. There are fees levied on withdrawals, and this should be borne in mind, since it will impact your business’s bottom line if you repeatedly withdraw via ATMs.