- Fast and simple verification

- Free EU IBAN account

Rewire Review

Rewire Review

Advertiser disclosure

A relative newcomer to the market, Rewire was first launched in Israel in 2015. It initially focused on money transfers and in 2018 the company launched its introductory prepaid Mastercard. The Rewire Euro IBAN account is predominantly focused on migrants in Europe.

It provides convenient banking services for accepting salaries and making payments. Its user-friendly app allows clients to track expenses and send money to several countries around the world. The low fees ensure that the account is accessible to anyone.

This financial provider tries to present a comprehensive service network by supporting its customers in their preferred language. It goes a long way in breaking down the communication barrier that exists in most banking institutions.

- EN

- PH

- CN

- AK

- HA

- SW

- More

- Flat fee up to 1% per international transfer

How to Open a Rewire Account?

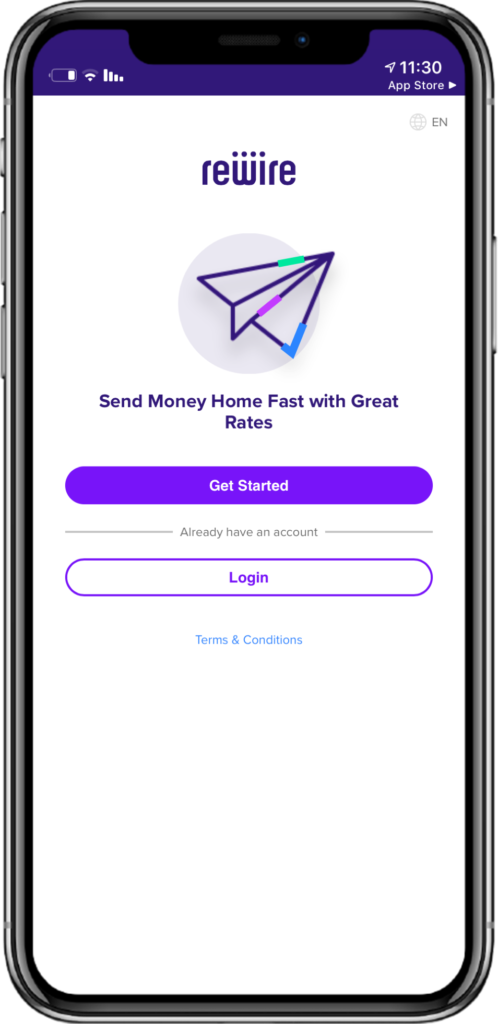

The registration process with Rewire is straightforward and easy. Clients can open an account online on the website or via the mobile app. To verify your identity, you will need to take a selfie to match your submitted document. So it’s vital you have access to a camera on either your computer or mobile phone.

After downloading the app, you can follow the signup steps. You will need to enter your full name, contact number, and valid email address. You will be prompted to choose a password, and the system will verify your cell number using an SMS code*.

We suggest you create a safe access code using random alphanumeric characters and symbols. Once your contact information is cleared, your account is ready to use, and you can order a complimentary Mastercard. In some instances, this can take up to one business day.

Banking Features

The Euro IBAN account is a useful financial service that can be used by immigrants without the hassles of opening a traditional bank account. There are several features and benefits on offer, and we touch on each one below.

Fast and Simple Verification

No Need for a Government Identification Number, Address, or a Residency Permit. To use the account, you only need to verify yourself, and there’s no need to provide an address or residency permit if you don’t yet have one in the country you are situated in. To verify your identity, you will need to supply either a passport, driver’s license, or a residence card.

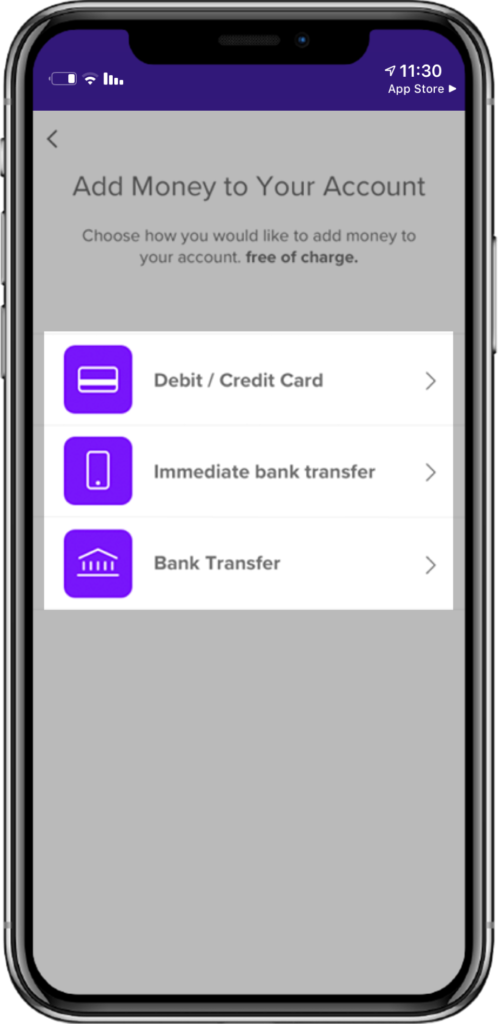

Money Transfer

For local EU transfers, there is no charge, and for the international moving of funds, the fees are an affordable 1% based on the amount you transfer. The easiest way to transfer funds is between two Rewire accounts. However, if the recipient doesn’t have one, then you can transfer money from yours directly to the recipient’s bank account. Rewire supports over ten different currencies.

Deposit Salaries

One way of increasing the funds in your Rewire account is to have your salary deposited directly. You need to give your IBAN account details to your employer for payment purposes. Take note that the amount you can receive is based on the limits as per the regulatory process. Once the funds reflect in your account, you can use them to send money to various countries such as China, India, Kenya, Thailand, Nigeria, and many more. You can also send money to any recipients who have an EU bank account within Europe.

Tracking Payments

With the convenience of the mobile app, you can keep track of all your transactions. You’re able to view all your purchases by going to the history tab of your Rewire account. Track details for your payments, credits, and transfers directly from your phone*. If you make a payment to a merchant, it’s processed the same day. If something goes wrong, you can contact customer support for assistance using the features on the app.

Support in Your Native Language

The information presented on the company’s website boasts that their support department can assist customers in their language of choice. Some of the languages supported are English, Filipino, Chinese, Akan, Hausa Kiswahili and many more*. You can also follow and chat to Rewire on its various social media platforms, namely YouTube, Medium, Facebook, Instagram and LinkedIn. For general questions, the website does offer a FAQ section in English, which addresses the most common issues.

Pricing and Fees

Rewire tries to keep it’s EU account fees as low as possible since it’s primary target market is immigrants based in Europe. Most of the services are free, and others are capped at economical prices. We explore the charges in detail in the table below.

| Rewire IBAN Account | |

| Price per month | Free |

| International transfer | Flat fee of up to 1% |

| Local online transfers | Free |

| ATM withdrawals | Free |

| Debit Mastercard | Free |

Rewire IBAN Account

Security

The company takes the safety and security of its customer’s information seriously. In keeping in line with the international rules and regulations, you need to supply it with proof of identity. The verification will allow you to have unlimited access to all of the provider’s services. This process is followed to secure all your data privacy and personal information.

Rewire has all the necessary licenses to operate within Europe, and institutions in the EU monitor its activities. Transactions are protected by SSL certifications and firewall protocols to uphold the integrity of user data. The Mastercard is also safe to use and features Zero-Liability protection for clients, and safeguards against third-party interception of personal information.

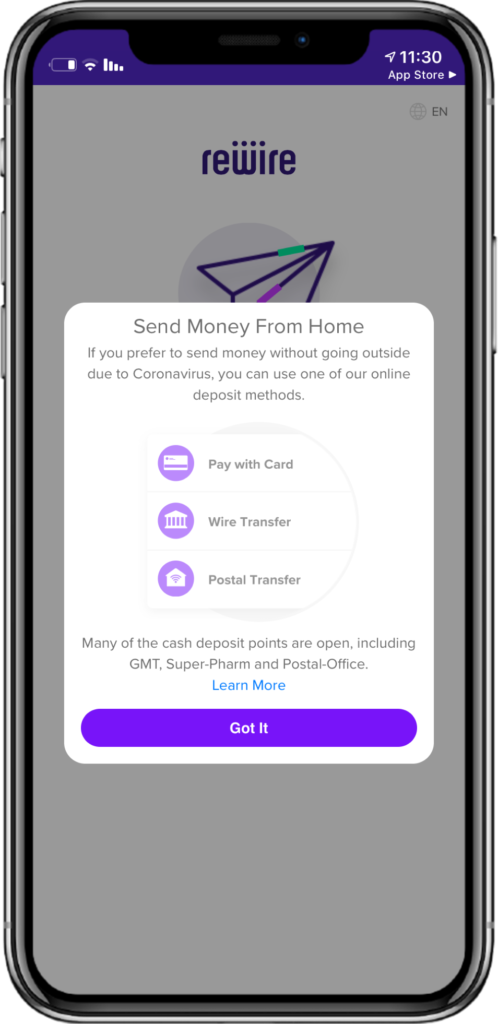

Using the App Abroad

Money transfers and payments can be made from the app as soon as the account is activated. You can use the virtual card to make payments, but you won’t be able to withdraw cash at an ATM without a physical one.

Sending money within Europe is free and international money transfers have a small charge.

As part of the account features, you’re able to apply for a Mastercard. The card will be sent to the address stipulated on registration.

You can use it for withdrawals and payments anywhere in the world. The card is accepted at any place that displays the Mastercard symbol. There are no charges for using the card for payments, and if you need to draw cash, the fee will be based on the ATM service provider.

Support

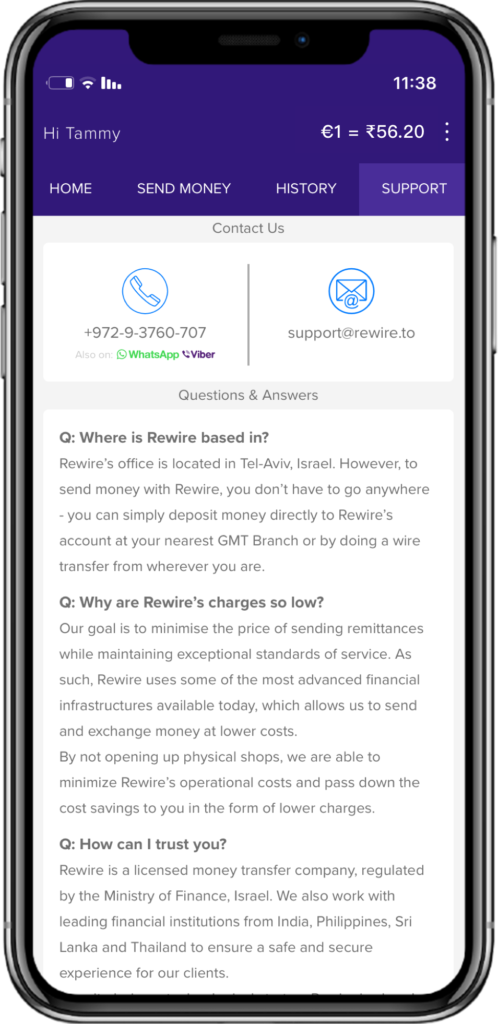

You can make use of several options to contact customer support. Online you can use the live chat function, or email the department. Socially customer support is available on Whatsapp, Viber, and Messenger. For those who prefer to speak to someone, there is a telephone option available.

The customer care department is available seven days a week but only at certain times. Sunday-Thursday you can get hold of them from 7 am until 6 pm. Fridays they’re open 7 am-1 pm. On Saturdays, only emails are accepted between 10 am and 6 pm.

- Salary deposits accepted.

- Customer support in several languages.

- Cost-effective with 1% commission fees on transfers.

- Support is available seven days a week but for limited hours.

- Monthly transfer limit of €2500

Conclusion

The innovative Rewire online banking account provides immigrants and travellers with an easy way to manage money in a cashless environment. The app offers instant access to payments and transfers from any mobile device supported by iOS or Android. Without the need for proof of address, the verification process is quick.

Within a matter of minutes, you can be set up with an account that can be used internationally. The physical Mastercard allows users to withdraw cash and make payments wherever they see the Mastercard acceptance logo.

It provides clients with the freedom of forex payments without the hassle of the usual foreign exchange delays. It’s an excellent facility to have if you’re not able to get a traditional bank account in a foreign country