- A free Euro account in the UK

- No monthly fees

Starling Bank Review

Starling Bank Review

Advertiser disclosure

UK-based Starling Bank, founded in 2014 offers personal and business banking via a mobile app. The company delivers the services of a classic bank, but with no physical branches and with lower fees.

The Starling personal account works as a regular current account, enabling users to set up direct debits and standing orders. Starling Bank offers overdrafts of up to £5,000 with 15% EAR but no additional fees. The amount of overdraft one receives, however, depends on a credit check.

Applying for a Starling Bank account takes minutes, the process is paperless, and a debit card is sent via post within 2-3 business days.

- EN

- Free Account

Banking Features

Free EUR account

In addition to a GBP account, as a secure and fast way to send and receive euros on a regular basis. This is a great feature for those who live in the UK, but get paid in EUR, or those who want to send pounds to other European countries.

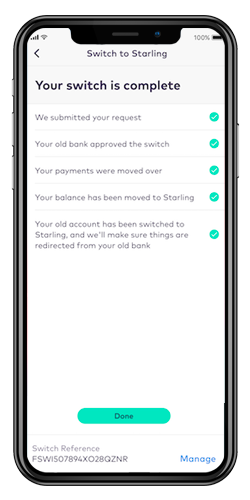

Current Account Switch Service (CASS)

You can switch seamlessly from an old current bank account to Starling. Starling deals with the whole transition including all your incoming and outgoing payments, direct debits and standing orders. It will also transfer all the money over to Starling and close your old account for you. Only works with UK current bank accounts.

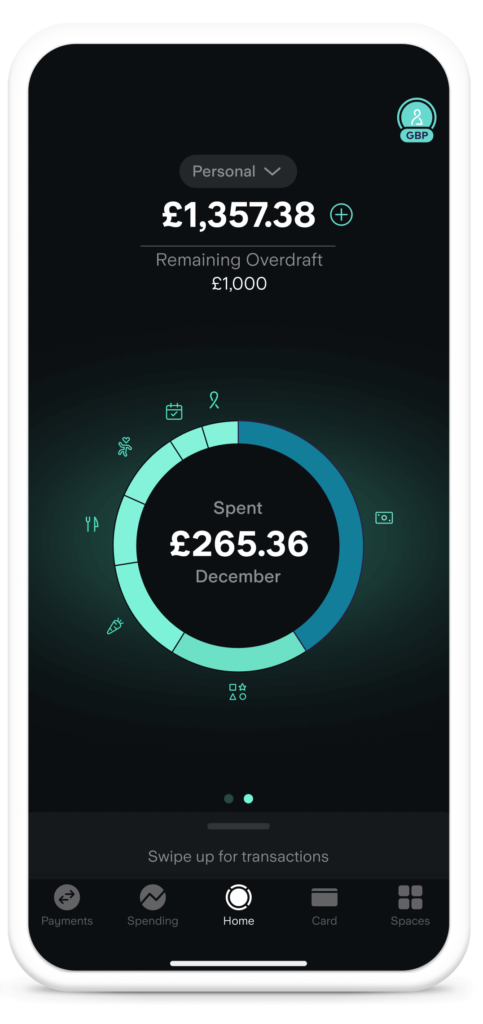

Spending

Get a record of your spending, categorized by the type of transaction (e.g. shopping, eating out).

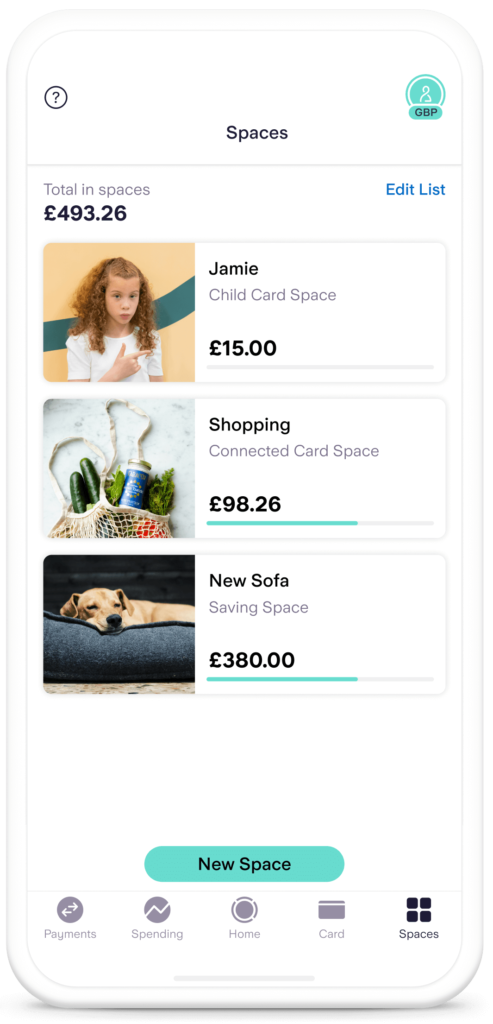

Spaces

Users can set financial spaces and put money away either manually or automatically, in order to keep saving and reach the goal faster.

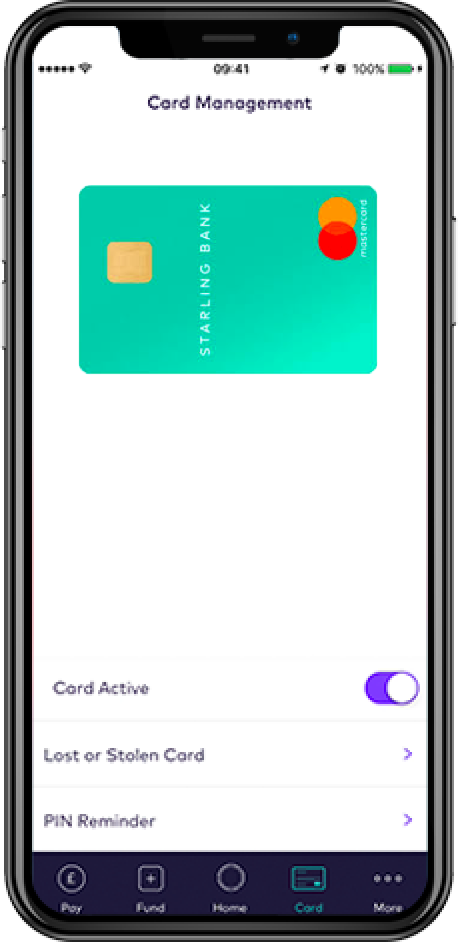

In-App Card Control.

A Starling Bank card can be activated and manually deactivated from within the app, if it gets lost or stolen.

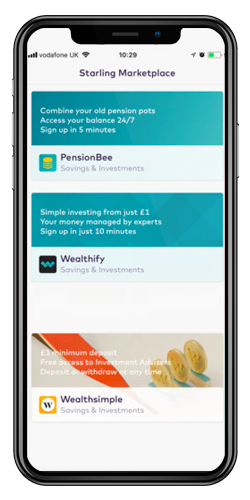

Starling Bank Marketplace

An interesting feature that gives users access to a number of third-party partner services from within the Starling App. Starling Marketplace partners include mortgage broker “Habito”, mobile insurance “ So-Sure”, life insurance provider “Anorak”, pension provider “PensionBee”, digital investing services “Wealthsimple” and “Wealthify”, life insurance provider “Anorak”.

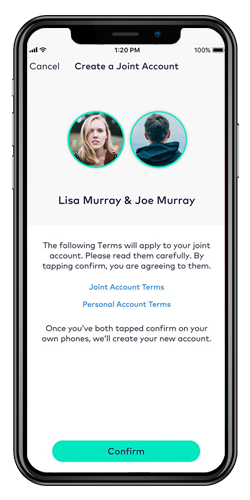

Joint accounts

Joint accounts to use with your family or close friends.

Split payments

Split payments with other Starling users.

Apple Pay & Google Pay

Apple Pay & Google Pay can be connected with a Starling Account and used for payments, as well as Garmin Pay and Fitbit Pay.

Deposits

Personal and joint customers can deposit £1,000 each calendar year free of charge at the Post Office. For all deposits greater than this, Starling Bank will charge you a fee of 0.7% of the amount over £1,000 that you deposit.

Smart savings

Round up your spendings and store the excess amounts as savings.

In other aspects it lacks some features that are common for its competitors:

- No monthly budgets setting is available.

Starling Account Types

Starling currently offers Personal Current Accounts, Business Accounts, and Joint Accounts.

| Starling Current Account | Starling Business | |

| Price per month | £0.00 | £0.00 |

| Free ATM withdrawals (£) | A maximum total withdrawal per day of £300 | A maximum total withdrawal per day of £300 |

| Free payments | ✓ | ✓ |

| Google Pay & Apple Pay | ✓ | ✓ |

| Free withdrawals worldwide | A maximum total withdrawal per day of £300 + Mastercard currency exchange rate | A maximum total withdrawal per day of £300 + Mastercard currency exchange rate |

| Dedicated Customer Support | ✓ | ✓ |

| Saving Pots | ✓ | ✓ |

| Xero, FreeAgent & Quickbooks tools | X | ✓ |

| Categorized spending | ✓ | ✓ |

| Organized expenses | ✓ | ✓ |

| International payments | 0.4% fee | 0.4% fee |

| Priority delivery with SWIFT | £5.50 | £5.50 |

| Payments with a link | ✓ | ✓ |

Starling Current Account

Starling Business

Fees

There’s no monthly fee, card payments and ATM withdrawals come for free both in the UK and abroad. However, fees may apply to some of the services.

While Starling does not impose any withdrawal charges on customers, ATM providers in your country of destination may charge their own fee. The cost of withdrawing from ATMs differs in different countries and locations. You have a maximum daily withdrawal limit of £300.

Transferring money in the same currency as your Starling account is free, however, sending money abroad with Starling costs money: transfers imply £5.50 delivery fee.

Starling also applies a 0.4% currency exchange fee for international transfers.

| Service | Fee |

| Starling foreign ATM cash withdrawals | Free (With a maximum total withdrawal per day of £300) |

| Starling transfer fee | £0.30-5.50 |

| Currency exchange fee for international transfers | 0.4% |

Security

Starling is regulated by the FCA (Financial Conduct Authority, UK) and covered by the Financial Services Compensation Scheme (FSCS), meaning users’ money is completely safe and refundable up to £85,000. Additionally, 3D Secure is a fraud protection tool that helps keep you safe when you’re making online card purchases.

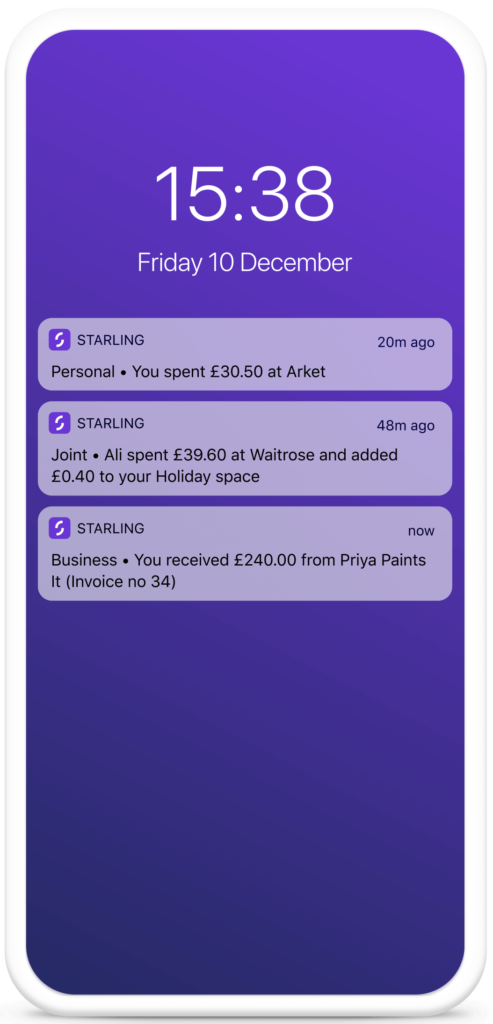

Instant Notifications

The app will send instant payment notifications to keep an eye on a real-time balance.

- The app itself uses up-to-date methods of data encryption, storing technologies, and users’ verification.

- If a card is lost or stolen, the owner can immediately block it right from the app and then unblock if it is found.

- Users get to set & manage which operations are available for your card, for instance, whether your card can make ATM payments or specific transactions.

Using the Starling Bank app abroad

First and foremost, Starling has a built-in Euro account, in addition to a local GBP on. It is a great feature for those who live in the UK, but get paid in EUR, or whose who want to send pounds to other European countries. Users can switch between your pound and euro accounts and convert currency between them for a 0.4% fee, all in one app.

On both, GBP or EUR accounts, there’s no monthly fee, card payments and ATM withdrawals come for free both in the UK and abroad and you get Mastercards live exchange rate.

Starling Bank Support

Starling Customer service is available 24/7 via an in-app live chat service.

You can also contact Starling Customer Support via Phone within the UK business hours.

- Apply for an account in minutes

- Fully licensed by the FCA and PRA

- Starling “Marketplace” with services from other Fintech companies

- Limited range of services

- Only available to legal UK residents.

Conclusion

Starling seems like a decent option for UK-based youngsters, who want to experience more streamlined and efficient banking. Completely paperless, no branches, a regulated bank via a mobile app: all the elements of a modern mobile bank’s standard. The service and its features are pretty similar to those of Monese, Monzo, and others, but Monese is the only service in this list that fits for non-UK residents.

The interesting feature is a marketplace, giving the Starling users access to other handy and lucrative Fintech services, without leaving the mobile app.