- Physical gold as spendable money

Tally Review

Tally Review

Advertiser disclosure

Cameron Parry is the founder and CEO of the company based in London, England. He envisioned an evolutionary solution that is not a highly volatile cryptocurrency but a daily-mainstream money system.

The four pillars of the Tally banking system include security, transparency, innovation & accountability. Listed with the Financial Conduct Authority (FCA) as an E-Money Directive (EMD) Agent, Tally based on the price of gold, and its value fluctuates relative to GBP.

Customers have access to a Tally Debit MasterCard, Savings Accounts, and ironclad security guarantees and can access this global money system through individual accounts anywhere IBANs are used. This mobile bank solution is available through the Google Play Store or the App Store.

- EN

- £29 activation fee

- 0.5% p.a. account keeping fee

Banking Features

Deposits

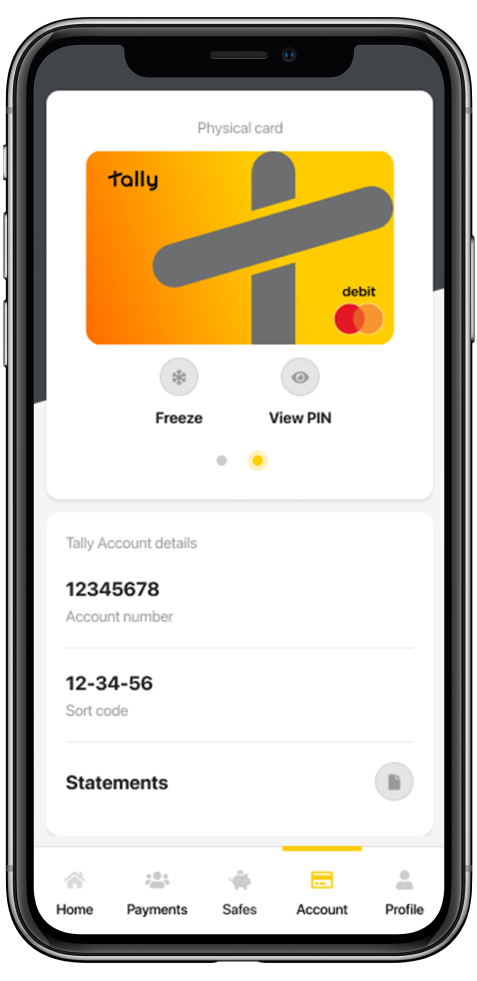

Tally isn’t a cryptocurrency. It functions as mainstream money that can easily be determined when you deposit € or £ into your account. This is done through the prevailing gold price.

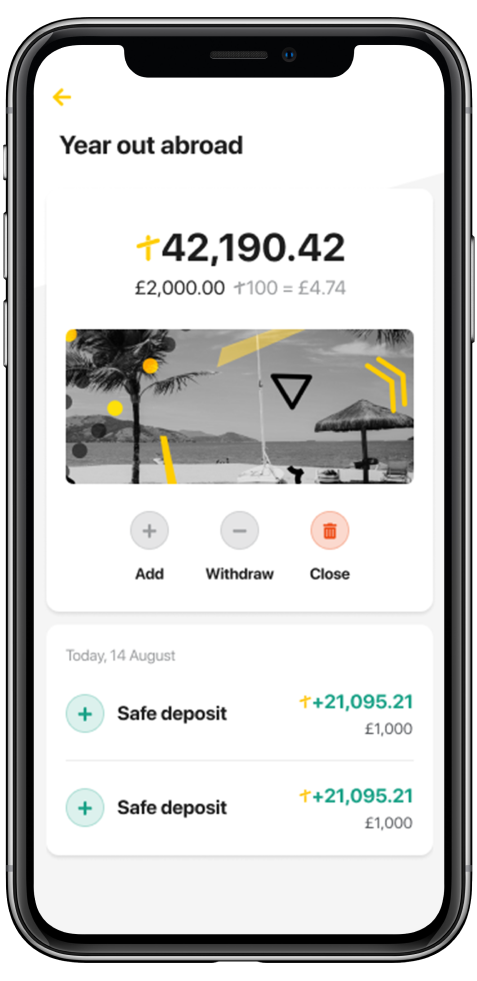

The Tally Card

The Tally Card is a debit Mastercard. It is synchronised with the price of gold on the global markets, and the value of your physical holdings of gold bullion (denominated in your account in Tally) is exchanged for fiat currency when spending on your card at home or abroad. When using your Tally Card, there are no added charges, fees, or commissions on the foreign exchange rate.

Savings Growth

All savings are tethered to the value of gold – a tangible asset. Since it is difficult to increase the supply of gold, the value of your Tally savings remains relatively stable. Over the past five years, the value of gold has almost doubled – significantly better than the value of silver. That’s why it’s an inflation-beating safe-haven asset and preferred over fiduciary currency.

Tally Withdrawals

Tally doesn’t charge account holders any fees or commissions to withdraw funds from cashpoints anywhere globally. But those ATMs may charge fees at their discretion. The Tally Card is convenient and easy to use.

Funds Transfers

Customers can quickly process funds transfers between the Tally Everyday Account and their traditional Bank Account. The conversion is determined at the prevailing exchange rate, based on the global wholesale price of gold, regardless of the amount, allowing access to the 1kg bar price for small deposits Your Tally Account is always debited in tally, not fiat currency.

Payments Processing

There are two ways to process payments with Tally. You can pay merchants online or in-store using your Tally Debit Master card or use the Tally App to transfer funds to Tally and non-Tally accounts. For transfers to merchants and traditional banks, the requisite tally is converted into the fiduciary currency that the merchant or individual is expecting. These include but are not limited to GBP, USD, or EUR. Once again, there are no fees, commissions, or other expenses.

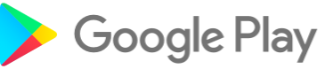

Easy Access Safes

Tally makes it easy for customers to set funds aside with up to 3X Easy Access Safes. Customers can transfer funds back and forth between the Everyday Account and the Easy Access Safes. As a result, you can enjoy the ease of use, flexibility, and a no-fee structure.

Mobile App

Clients can easily download and install the Tally App to access a full suite of banking solutions on the go. It’s easy to send, spend, save, and manage funds via mobile.

Tally Accounts and Fees

A Tally account comes with a sort code and an individual account number.

- activation fee of £29

- account maintenance fee of 0.5% per annum

Security

Security is built into the bedrock of Tally Accounts since all value is held in physical gold bullion. These gold reserves are safely stored in Zürich, Switzerland. It is 100% insured against theft or loss. Daily reconciliations are conducted to guarantee customer holdings. There is no dramatic price volatility since funds are anchored to gold bullion. This protects the long-term value of customer funds.

If the company is ever liquidated, 99% of your gold holdings will be converted into fiduciary currency and transferred to your traditional bank account. The other 1% is required to process the transaction. As tally is not a fiat currency, it is not covered by the FSCS. Instead, a security trustee structure with Woodside Corporate Services Ltd – an FCA-licensed company protects the entire balance in your Tally Account.

Various security measures are in place, including:

- TallyMoney LTD is listed with the FCA as an E-money directive agent under the FCA-Licensed Electronic Money Institution (PayrNet).

- Trustee agreement with Woodside Corporate Services LTD.

- Gold Bullion deposits are insured through the vault provider in Zurich, Switzerland.

Tally Support

You can get in touch with customer support through the email address – support@tallymoney.com – or by using the FAQ section with a full range of pre-populated questions and answers on various topics.

Among others, the help center features FAQs around the Tally Debit Master card, fixed-rate savings, complaints, and payments.

- No added foreign exchange fees (even at ATMs worldwide)

- Minimal fee upfront, with a 0.9% annual fee for account maintenance

- Physical gold as spendable money

- Protected by a trustee agreement

- Google Pay and Apple Pay are not available

- Value of funds not guaranteed by FSCS

Conclusion

Tally is a unique mobile solution that offers a safe and secure way to store your money. Your funds are backed by physical gold bullion, so you can rest assured that your money is safe. The four pillars of the Tally banking system include security, transparency, innovation & accountability.