- No credit checks

- Free SEPA transfers

Viabuy Review

Viabuy Review

Advertiser disclosure

Introduction

VIABUY offers a prepaid credit card that you can load through a personal IBAN. The card makes it unnecessary to carry cash, whether within the European Union or abroad. It also enables you to receive money from others.

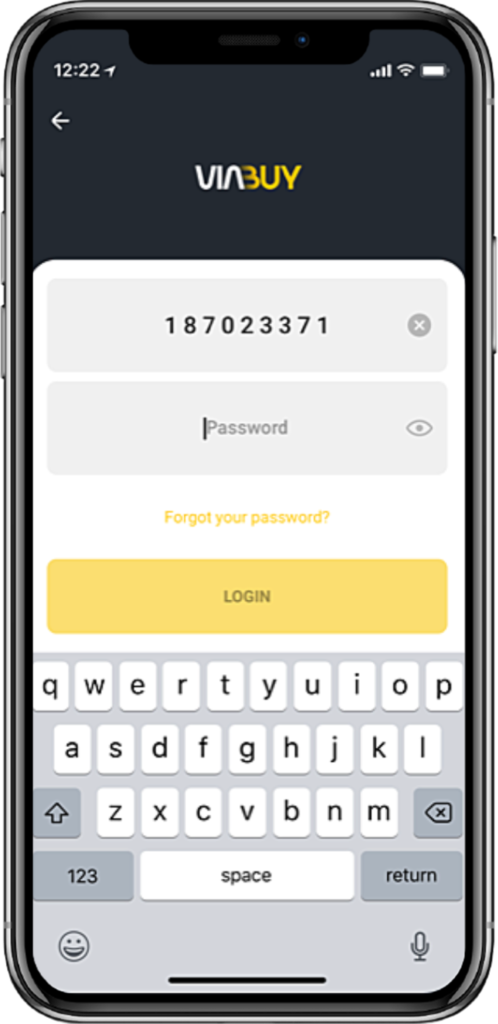

The registration process is straightforward, requiring only proof of your identity and address. The card will ship to you within 24 hours after VIABUY confirms your signup.

- EN

- NL

- ES

- FR

- IT

- PT

- €69.90/ One time issuing fee

Banking Features

The prepaid Mastercard has several convenient features. They include your own dedicated international bank account number (IBAN) and the ability to control your spending.

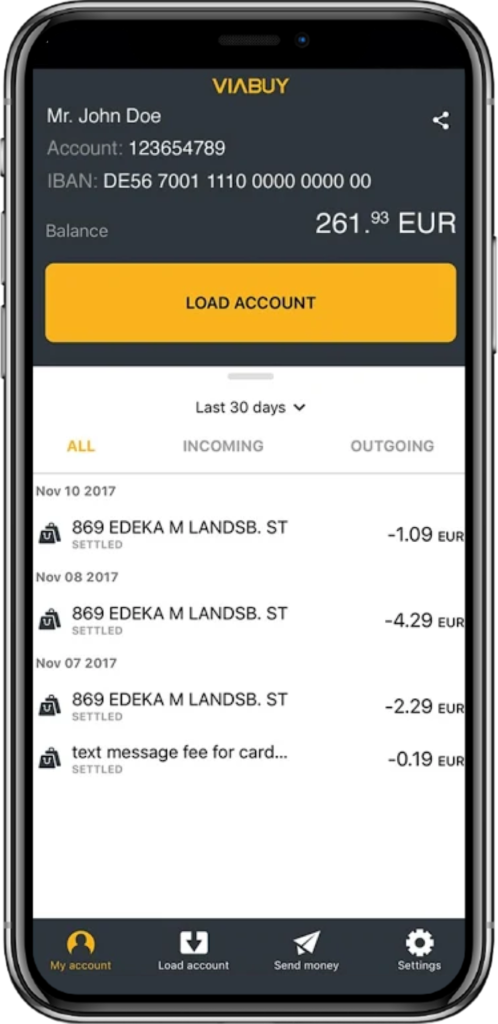

EU IBAN account

When you sign up for your VIABUY card, you’ll receive a personal IBAN that enables you to put money on it via free bank transfer. Using this same account number, your friends or family can send you money. Your IBAN works for both incoming and outgoing bank transfers within the Single Euro Payments Area (SEPA). You can load your card at any time with a free SEPA transfer. You may even choose to receive your salary by using your IBAN.

Prepaid Mastercard

The VIABUY Prepaid Mastercard provides an excellent alternative to a credit card. The acceptance rate is near 100% for European Union residents, even those with a low credit rating or a history of bankruptcy. The prepaid card doesn’t link to your bank account and won’t affect your credit score. You can add money to your card at no cost by using bank transfers directed to your IBAN. There are no overdraft fees, nor interest. When you spend the whole amount you loaded, you won’t be able to use your card until you add more money.

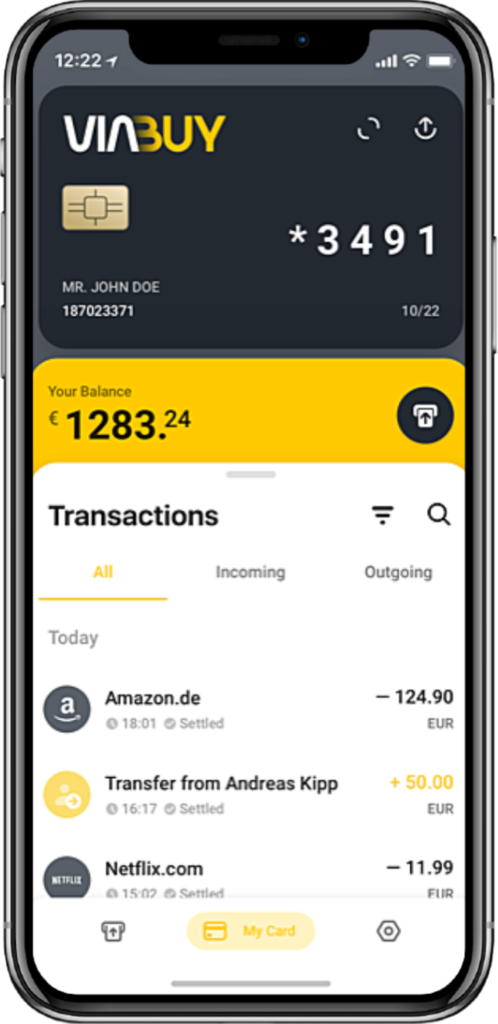

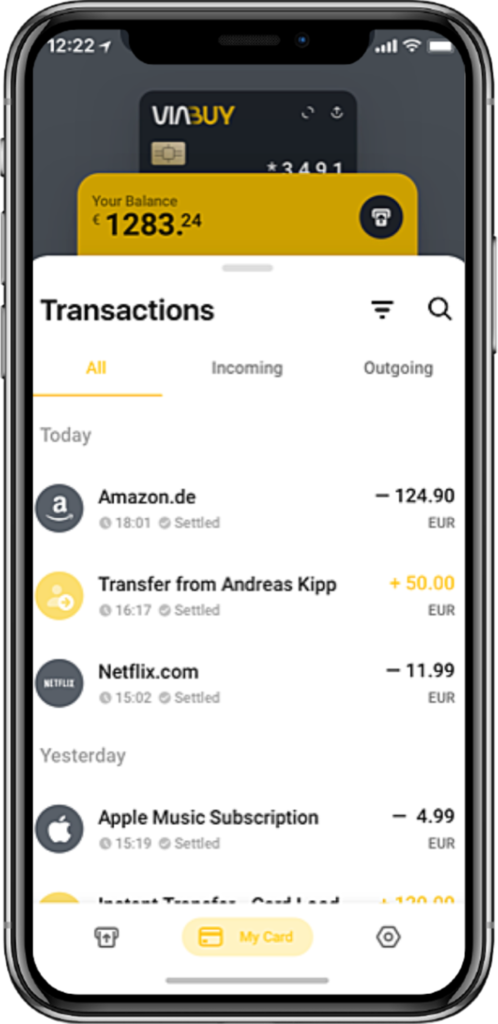

Monitor Your Expenses

You can check your account balance and statement by logging in to the VIABUY website. The information on the site is updated at least daily and shows all transactions, including deposits, withdrawals, and fees. The nature of the prepaid card means you don’t have to worry about limits or overdrafts. You may also choose to receive email or SMS notifications regarding all account transactions. In this way, you can better monitor your expenses, which can help you get out of debt or avoid owing money in the first place. You may request a secondary VIABUY Mastercard to control your kids’ pocket money. As a parent, you can maintain full command of the card you obtain for your child. It can carry your teenager’s name, while you continue in control of the funds.

No Credit Check, No Bank History, No Salary Slips Required

The VIABUY signup process is simple. You visit the site and fill out an application form. To apply for an account, you only need to provide proof of identity and your address. There’s no necessity to prove your income or creditworthiness before using VIABUY products and services.

Viabuy pricing and Fees

You’ll pay a one-time fee to open your account, plus an annual charge for the main card and any additional ones you request. Payments in foreign currencies have extra costs, as do any ATM withdrawals. You can find pricing details in the table below.

| Viabuy account | |

| One-time issuing fee | €69.90 |

| Viabuy card | €19.90/yr |

| Local currency payments | Free |

| Foreign currency payments | 2.75% |

| ATM withdrawals | €5 |

| SEPA transfers | Free |

| International bank transfers | 1.75% |

Viabuy account

The Company Card

If you’re an entrepreneur or own a startup in the European Union, you may find the process of opening a business account to be overly bureaucratic. If you’re in a hurry to get started, a VIABUY Mastercard may be the solution you seek.

You can apply for the card right away, and it typically arrives within three to six business days. The company account is located in an EU country and legal for tax purposes.

Once you receive your card, you can start using it right away. Payments in euros are free anywhere in the world that accepts Mastercard.

The prepaid card is an excellent choice for a business because you decide how much to load on it. Thus, you can entrust it to an employee to make company purchases in the confidence that there’s a limit. You’ll also receive notifications via email or text messages, keeping you aware of spending.

Security

VIABUY pledges to process user data following the terms of the EU General Data Protection Regulation (GDPR). These guidelines lay out how businesses can collect, store and use personal data

The VIABUY Mastercard has safety features like withdrawing money using a chip and PIN. It also offers secure online payments.

Each card possesses a link to the 3D Secure authentication system. Purchase validation can occur through an app or via a temporary authorization number sent by SMS.

If a transaction requires 3D authentication, you’ll receive a notification on your mobile phone. Then, you’ll need to confirm the transaction using this device. The system uses biometric authentication like fingerprints and face scanning to guarantee you’re the one making the purchase.

Using VIABUY Card Abroad

Like any Mastercard, the VIABUY prepaid card is valid worldwide with merchants and point of service terminals with the Mastercard logo. Payments in euros are free, no matter where you are when you make them. You also benefit from Mastercard exchange rates.

You can travel abroad without worrying about what might happen if you lose your card. The security features outlined in the previous section protect you from unauthorized use in case of loss or theft.

Viabuy Support

The VIABUY website provides 24/7 support through their searchable FAQ and instant chatbot responses. When the bot can’t find an answer to your question, the site redirects you to an email contact form. Customer service representatives are available from 8:00 am to 5:00 pm CET, on business days.

- You can make fee-free payments in euros anywhere merchants accept Mastercard.

- The online application is straightforward, with no income or credit score requirements, and your card arrives within just a few days.

- Online customer service is available 24/7.

- You’ll pay a fee for issuing the card, plus an annual rate per card.

- It doesn’t replace your conventional bank account.

- There are charges for ATM withdrawals and foreign currency transactions.

Reviews

Conclusion

VIABUY offers a prepaid credit card that eliminates the need to carry cash. The signup process requires no credit checks or proof of income. You can use your prepaid card within the EU or abroad. A dedicated IBAN allows you to receive money from friends, family or your workplace. You can also easily manage your monthly spending, travel expenses or child’s pocket money using this card.

The product offers excellent value and is suitable for even those with a poor credit history. The only drawbacks are the fees for specific services and the fact that you’ll still need a separate bank account.