- Fast account setup

- No-fee SEPA payments

Vialet Review

Vialet Review

Advertiser disclosure

Introduction

VIALET offers free signup for a current account and contactless Mastercard. You can register through the smartphone app in just a few minutes. To begin the signup process, you’ll need your smartphone, a selfie and your ID document.

VIALET is a part of VIA SMS Group, which provides a variety of alternative financial services. The company has been operating since 2009 and has expanded to seven countries.

VIALET is one of the leading consumer lenders in the EU. Its legal name is VIA Payments.

- EN

- ES

- LV

- +4

- Free Plan

- Fees & charges apply

Banking Features

Free IBAN Account

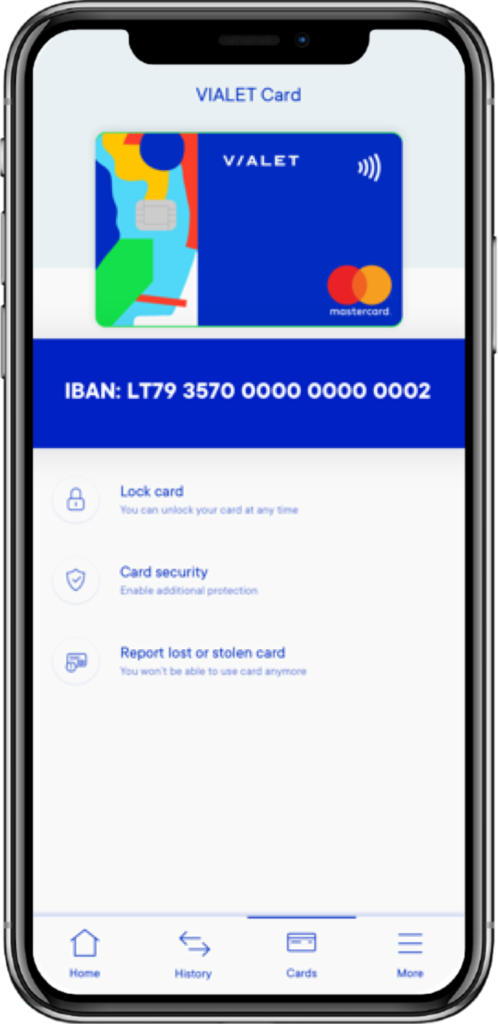

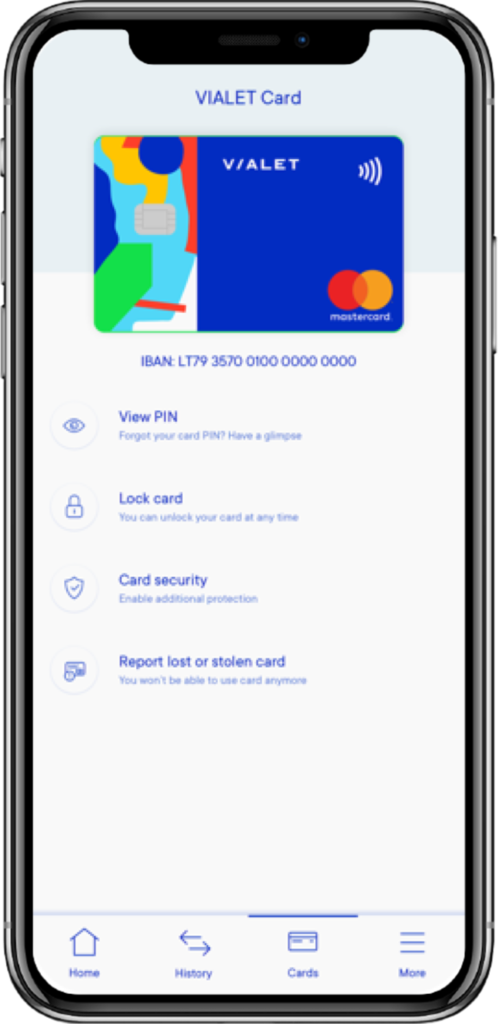

You qualify for a VIALET account if you’re at least 18 years old and have a valid ID. Since the service is app-based, you’ll also need a compatible smartphone. There are no charges to open your current account with VIALET. You’ll need to enter your name and surname, email, date of birth, phone number and country of residence. Then, you’ll create a passcode for your account. After this process is complete, you immediately receive an international bank account number (IBAN). You’ll need to verify your identity after that if you wish to order a card to take advantage of other VIALET services. You can top up your account by making a SEPA transfer or using your bank card. The service is compatible with Mastercard, Visa and Visa Electron.

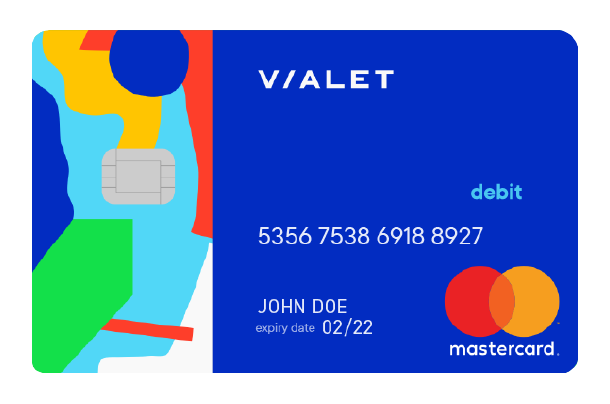

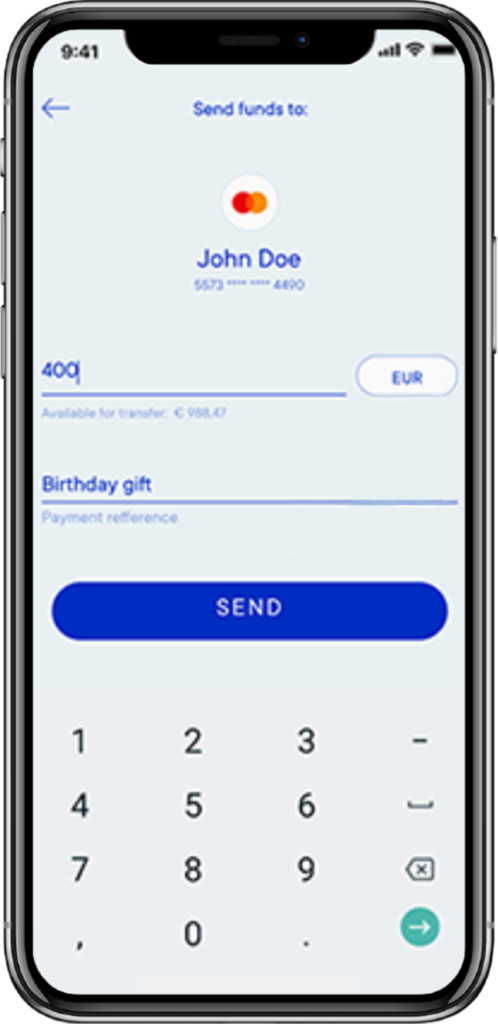

Contactless Mastercard

If you want the convenience of a credit card in addition to the IBAN account features, you can obtain the VIALET Mastercard. There’s no fee to issue the card. The VIALET Mastercard allows you to swipe to pay or use your PIN. Your card is valid online and at physical locations around the world. For international payments, you’ll receive Mastercard exchange rates and pay a one per cent fee per transaction. You can also use your Mastercard to withdraw cash at ATMs around the world.

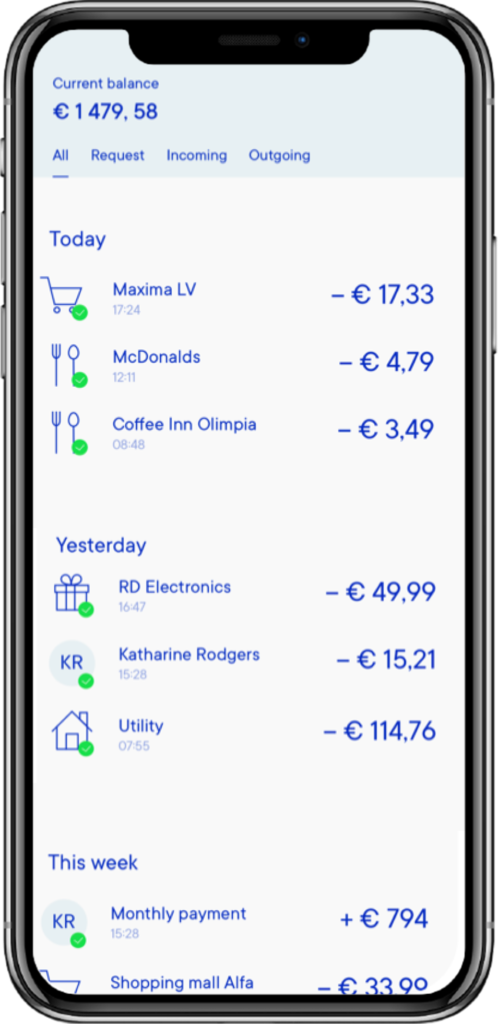

Monitor Your Expenses

VIALET sends customers instant push notifications regarding spending on the account. You can take action on these alerts immediately if you identify unusual activity. The app allows you to block or unblock your card instantaneously. It also gives you 24/7 access to all account functions, such as making payments and sending or requesting money. You can check your card balance and review transactions at any time through the VIA Payments mobile app. VIALET gives you the choice of how to receive your report. You can request a monthly statement via email or opt to see it online at your convenience. VIALET provides a free annual fee report. It’s available in printed form if the customer so desires.

Free SEPA Payments

The VIALET free IBAN account offers no-fee payments and transfers within the Single Euro Payments Area (SEPA). It’s also possible to receive your salary or other incoming payments to your account, as long as they’re from within SEPA.

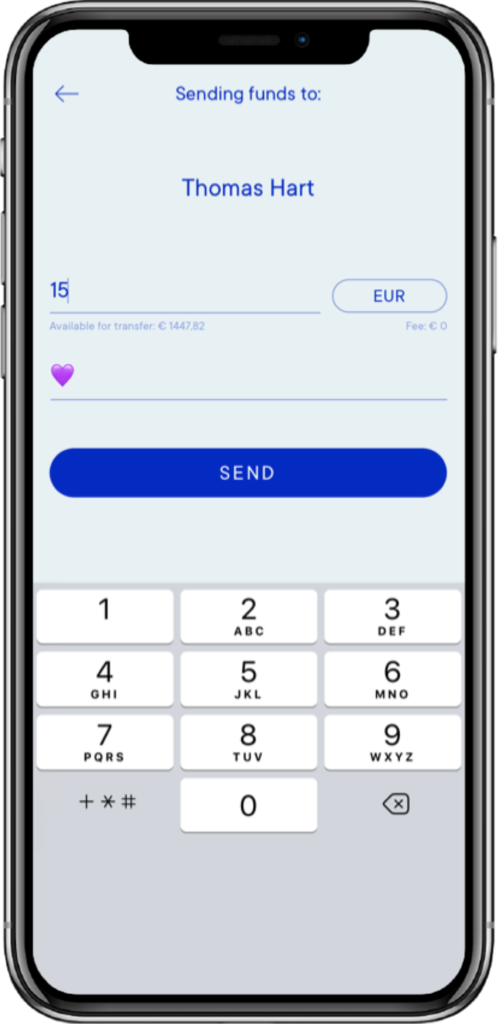

Free Card-to-Card Payments

You can send and receive funds between friends and family if they have VIALET accounts. The card-to-card feature also allows transfers to and from Ukraine and Russia. You can initiate payments to VISA, Mastercard or MIR cards. The funds leave your account in euros and arrive in RUB or UAH. Card-to-card payments are a great option if you’re in a hurry to transfer funds. The money often arrives on the same day. Usually, the maximum time is two business days, but this depends on the receiver’s bank. Such transfers are straightforward to initiate. You only need the recipient’s name (as printed on the card) and their card number. You can transfer money on the go through the VIALET mobile app.

Pricing and Fees

Your first VIALET card is free, as are many transactions. However, some services do incur charges, often a percentage of the amount involved. VIALET has a monthly card maintenance fee.

| Vialet account | |

| EU IBAN account | Free |

| SEPA payments | Free |

| Account top up via card | Free |

| Payment to card | 2€ / payment + 3% exchange rate |

| Card maintaining | 1.4€/m |

| ATM cash withdrawal | 2% (min. 2.5€) |

Vialet Account

Security

The VIALET Mastercard uses the 3D Secure authentication system to make sure it’s you making purchases. The verification process involves one-time passwords for purchase authorization. Such security measures, along with instant notifications, can help protect you from fraud.

VIA Payments doesn’t collect or store your payment card details and doesn’t share client information with online sellers. The company will disclose customer data only if necessary for legal or regulatory purposes.

The Central Bank of Lithuania secures VIALET funds. The company follows applicable EU legislation and pledges to use your funds only for your transactions.

Using VIALET App Abroad

The VIALET app is available for iOS and Android. It’s free to download and is the primary means of accessing your account.

The app works anywhere in the world that you have an internet connection. You can use it for in-app payments or top up no matter where you are.

Be sure to use a secure wifi connection when you access your account from overseas. It’s also essential to understand any fees that may apply, whether from VIALET or your mobile provider.

Support

The VIALET site provides an extensive FAQ page to help you get started or resolve problems you may encounter. You can insert your search terms in the box at the top of the page, and the corresponding information appears immediately.

The website also provides an email contact form and a live chat feature. Help is available by phone for lost or stolen cards.

- Convenient account management through the app

- No hidden fees

- Responsive customer service through multiple channels

- Transaction fees for non-SEPA payments

- Daily ATM withdrawal limit of €600

Reviews

Conclusion

VIALET provides a simple and effective solution for your digital banking needs. Through an IBAN account with a contactless Mastercard, you can make purchases and transfer money around the world. You also benefit from no-fee SEPA and card-to-card payments.

The VIALET smartphone app is easy to use and allows you to initiate transactions anytime, anywhere. VIA Payments keeps you and your money safe through standard data security protocols and 3D Secure card authentication. If you’re looking for a cost-effective alternative to traditional banking, VIALET is an excellent choice.