- Wallester White Label solution.

- Allows to issue corporate VISA cards.

Wallester Business Review

Wallester Business Review

Advertiser disclosure

Introduction

Wallester Business is an Estonian financial institution specialising in developing advanced financial digital technology and offering VISA card solutions, working with all companies within EEA/UK/US/Canada/Australia and Hong Kong (cards both virtual and physical work worldwide).There are There are 2 main products:

- Wallester White Label solution, allowing companies to issue branded Visa cards to their clients.

- Wallester Business where offers other companies the solution to issue corporate VISA cards for various needs and an in-house built platform for effectively managing corporate expenses.

As an official Visa partner and Visa FinTech Fast Track Member, the company provides various physical and virtual card types, including debit, credit, prepaid, and business cards and can be used by marketing teams, by employees attending conferences, as salary cards, for small and big corporate expenses (domains, subscriptions, office needs, etc).

- EN

- Free Account

- Plans from €199/m

Banking Features

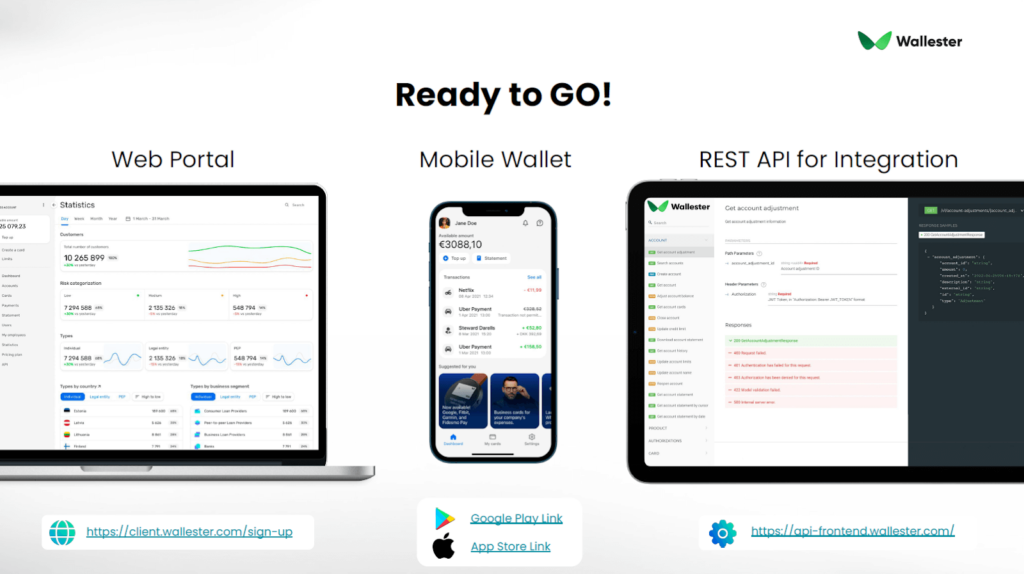

User-Friendly API Platform

It allows businesses to integrate payment functions quickly and easily. The REST API uses OpenAPI Specification (OAS) standard and utilises proven JSON Web Token (JWT) open standard for security. Additionally, Wallester Business provides open-source examples on GitHub of integration with the API to simplify the integration process for businesses’ engineers.

Wallester Business Cards

Wallester Business Cards ideal for efficient financial management and online media buying including physical and virtual corporate cards with instant issuance and express delivery, contactless payment options, individual spending limits, and exclusive Platinum benefits. No top-up fee, 300 cards for free, no fee on transactions in euro. European BIN, cards work great with Facebook/Google/Tiktok and other platforms with a possibility to purchase separate BIN for your company’s needs. Ideal for efficient financial management and online media buying.

Wallester White Label Solutions

Provides a flexible turnkey solution for launching branded credit cards, ensuring fast time-to-market through simplified integration. Wallester Business also ensures compliance with all regulations and directives affecting businesses, with full compliance with KYC and AML requirements.

PSD2 Technology

It is a directive in the EU that increases competition and protects consumers while improving payment efficiency and security. Removing barriers for third-party providers promotes accountability and fair competition, driving innovation for businesses and consumers.

Feature-Rich Reporting

With Wallester Business’s mobile app to create expense reports and account statements that can be exported in Excel, CSV, or PDF formats. The platform also integrates with third-party financial accounting systems via API, allowing for consolidated expense tracking, but it requires developing your integrations.

Expense Control

Provides a centralised platform for businesses to monitor all types of corporate spending, making it an all-in-one solution for effective expense control and financial management. With its extensive range of features and tools, Wallester Business offers businesses a comprehensive suite of solutions to help streamline their financial operations.

Wallester’s Authentication Systems

Complies with PSD2 regulations for safe electronic transactions using two or more independent components: a physical card, client information (PIN, password), and biometric data.

3D Secure Technology

Provides high-level protection for online payments with customisable verification methods. Businesses can optimise the authentication process and simplify cardholder identification while avoiding additional integration costs through third-party suppliers. All cards issued on the Wallester platform support 3D Secure technology.

Fraud Monitoring Systems

Protects monetary operations through an innovative fraud detection and prevention system for enhanced transaction security, preventing the risks associated with online and contactless payments.

Tokenization Technology

It is also a key feature of Wallester Business’s banking solutions, ensuring secure transactions for clients. Tokenisation replaces sensitive data with a unique identifier, preventing unauthorised access to financial information.

Dynamic Spending Adjustments

Dynamic Spending Adjustments Through Wallester streamline business payments by providing fluid adjustments to spending, integration with other tools, rapid order fulfillment, and efficient merchant onboarding.

Business Accounts and Fees

Wallester Business offers four tariff plans that suit businesses of all sizes.

- The Free Plan is ideal for companies that require basic platform features and multi-functional cards.

- The Premium Plan provides advanced functionality to streamline financial processes, expense control, and payment management.

- The Platinum Plan offers complete platform functionality and a variety of Platinum Business cards.

- The Enterprise Suite is a set of personalised solutions for large-scale businesses.

Each plan has various features that businesses can choose from, including up to 15,000 virtual cards, unlimited physical cards, and up to 4 times better exchange rates. In addition, all plans include an expense control app, first-class delivery of physical cards, high spending limits, and integration with accounting systems.

| Free Account | Premium Account | Platinum Account | Enterprise Suite |

| €0 Monthly Fee | €199 Monthly Fee | €999 Monthly Fee | Customer Pricing |

| Basic Platform + Multi-functional Cards | Advanced Features & Functions on Platform | Multiple Platinum Business Cards | Tailored Solutions for Big Businesses with Custom Solutions Across the Board |

| Includes up to 300 Virtual Cards | Includes up to 3000 Virtual Cards | Includes up to 15,000 Virtual Cards | Around-the-Clock Support |

| No Limit to Physical Cards | No Limit to Physical Cards | SOON: Unlimited number of Platinum Business physical cards, luxury hotel collection, premium offers & more. | Personal Account Manager |

| X | X | X | Open Developer APIs |

Free Account

Premium Account

Platinum Account

Enterprise Suite

Security

Wallester Business prioritises online payment security with its advanced cardholder authentication technology. One of its key features is the use of 3D Secure technology, which ensures reliable protection against fraud by requiring an additional authentication step that confirms the transaction within a limited time.

To make sure that clients can customise their authentication methods based on their specific business needs, Wallester Business offers the ability to choose the best verification options. The 3D Secure settings can be managed to optimise the authentication process, making it easier for cardholders to identify themselves without compromising payment security.

Wallester Business cards support 3D Secure technology, eliminating the need for additional integration with third-party suppliers. This saves clients unnecessary integration costs and streamlines the payment process for a more efficient experience.

Moreover, Wallester Business adheres to bank-level safety standards for client funds based on the Electronic Money Regulations 2011, which applies to all European financial organisations. With a multilevel security policy that meets PSD2 Directive requirements, clients can trust the safety of their online payments with Wallester Business.

Wallester is an authorised Payment Service Provider and an official Visa Principal Member and registered under the Estonian Financial Supervision and Resolution Authority with a registration code of 11812882. Copyright © 2023 Wallester AS. All rights reserved.

Support

To get in touch with Wallester Business support, customers can fill out a contact form on the company’s website. After submitting the form, a specialist will respond to the inquiry promptly. Wallester Business is known for its highly responsive customer service and positive interactions with clients.

The support team is available to help customers with any questions they may have about the platform, from technical issues to account management. Wallester Business specialists work closely with clients to find the most suitable solution for their business needs.

- Fast virtual card issuance.

- Unlimited physical cards.

- Advanced expense control features.

- Multiple customizable card options.

- Responsive customer support.

- Restricted to EUR currency.

- Large price jump from free to paid plans.

- Limited to businesses in Europe and UK.

Conclusion

Wallester Business is a payment service provider that specialises in creating advanced digital financial technology and offering VISA card solutions to businesses. The company provides a wide range of physical and virtual card types, including debit, credit, prepaid, and business cards, and operates with businesses registered in the European Economic Area or the UK.

The platform also provides advanced expense control features, customisable card options, and multiple payment integration options. With high spending limits and integration with various accounting systems, and with 24/7 priority support and dedicated account managers, Wallester Business ensures seamless financial operations for your business.