- Wirex Rewards

- PCI DSS Level 1-certified

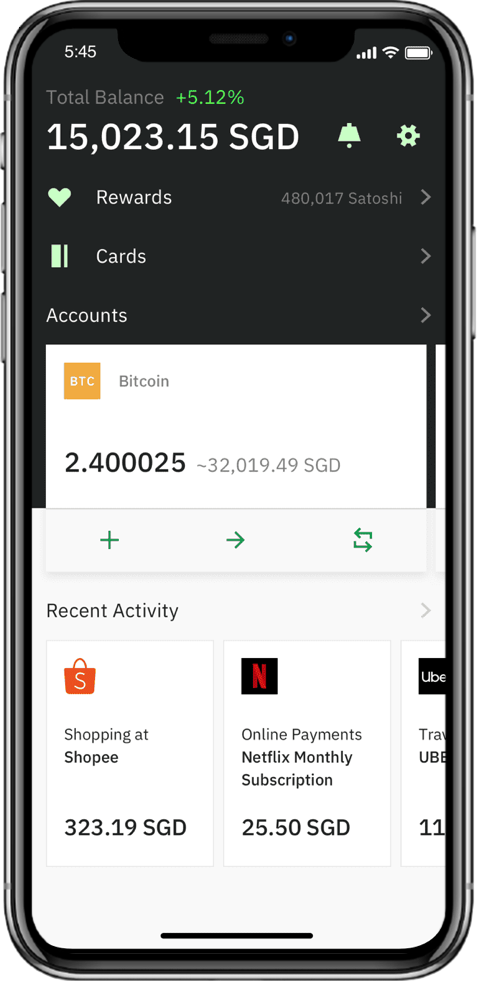

Wirex is a powerful wallet application (not a bank) featuring cutting-edge MasterCard payment options for routine purchases in fiat currency, as well as purchases backed by digital currencies. This borderless mobile payment platform allows clients to enjoy multi-currency management (fiduciary currency and digital currency) in a dynamic wallet app.

The Wirex account provider is UAB Finansinės paslaugos ‘Contis’, and all eligible European clients are issued a Wirex MasterCard. The benefits of a Wirex account include easy sending and receiving of money via SEPA, cards and cash, and ATM balance enquiries. digital currency top-ups can be conducted, bank transfers are free, in and out of client accounts, with SWIFT bank transfers also accommodated.

The Wirex Account is packed chock-a-block full of features, each of which is geared towards maximum client satisfaction, low cost services, and high utility value. Wirex is competitively priced for the most part, and offers 0% FX exchange fees on international transactions.

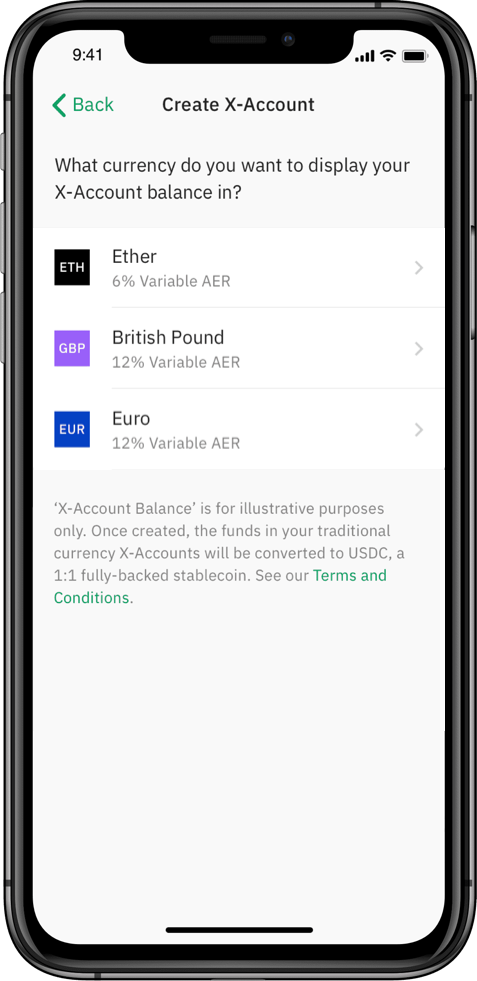

The X-Account feature allows you to earn up to 20% interest on selected currencies in a simple and secure way and withdraw the funds instantly with no fee or spend them using the multicurrency Wirex card.

The Wirex token is known as WXT, and it runs on the Stellar blockchain. Clients can purchase other digital currencies using WXT, and it’s also a great way to receive valuable discounts and client benefits, including the 1.5% Cryptocurrency Wirex rewards.

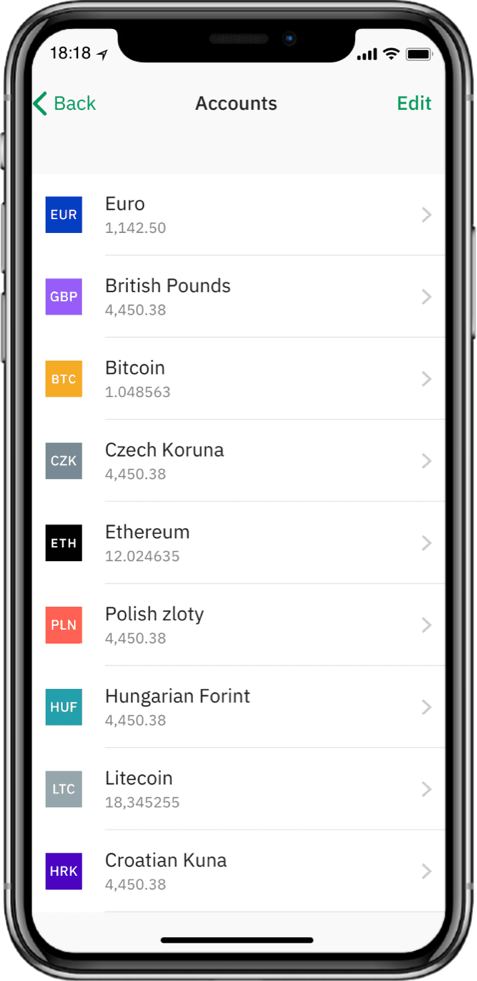

The Wirex Travelcard is also a multi-currency travel card with all the associated benefits of the dynamic Wirex app. 12+ digital currencies and fiat currencies are fully supported. Spend your money, wherever MasterCard is accepted. The Wirex Travelcard is a useful accouterment to your Wirex App account.

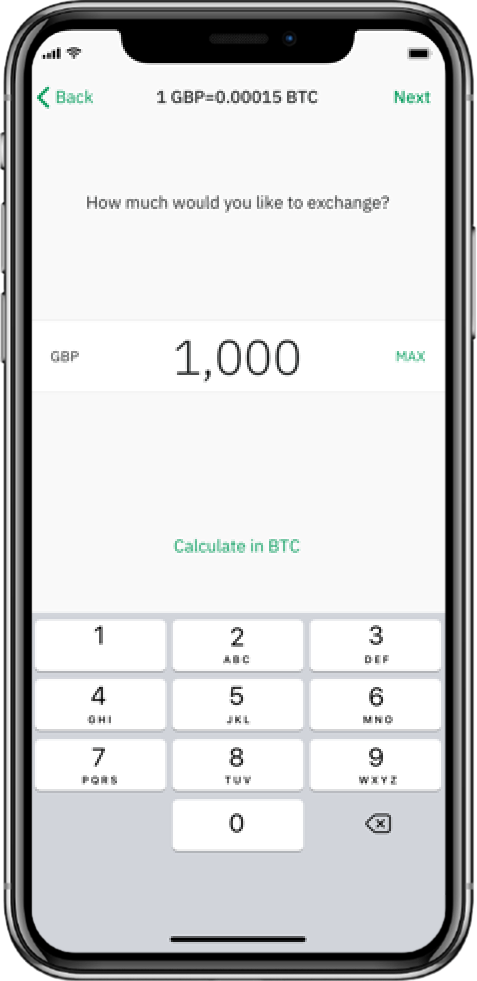

Easily top up your Wirex account, buy, sell, or exchange fiat currency, or transfer digital currency from your account at will. It’s easy to manage all your money with a Wirex account, on the go. Download the app from the Google Play Store, the App Store, or direct from the Wirex website.

With a Wirex account, clients can enjoy free foreign exchange fees in the EEA (European Economic Area). Plus, there is fee-free global spending whenever you use your Wirex card for making overseas payments in the local currency. These transactions are offered at the interbank rate without any FX exchange fees.

Your Wirex account features multiple services, each of which comes with a unique fee structure. The main services provided by your Wirex payment account include a combination of account management fees (monthly maintenance fees and annual fees), additional card issuance fees, top up charges for crypto by external cards, and sundry transaction charges.

The complete fee structure is presented in the table below.

| Wirex Account | |

| Price per month | Free |

| SEPA/SWIFT transfers | Free |

| ATM cash withdrawal | Free up to 400 EUR/m |

| Debit card payments | Free |

| Bank transfers | Free |

| Debit card payment in a foreign currency | 3% of the transaction value |

Wirex presents as a viable solution to managing all of your cryptocurrency and fiat currency from one powerful mobile application. Getting started requires you to register your Wirex account. As a UK or European client, it’s a simple matter of inputting your personal information, and proceeding to the verification stage of the process.

To verify your identity, you must provide proof of ID such as a valid government-issued document that matches all the information presented when you created your Wirex account. Information that is required includes your full name, date of birth, a document expiry or validity date, all of which should be presented in high-definition images.

Acceptable ID documents include government issued licences, ID cards, passports, or travel documents. For nonresidents, a valid work permit must be presented by the host country. All documents must be in English, legible, and legal.

Once you have verified your account, you can place an order for your first Wirex Card. Choose an appropriate address and request that the card be sent there. Next, add funds to your card. You can easily buy digital currency as a Wirex Cardholder. Download the Wirex App for Android or iOS, courtesy of the Google Play Store and the App Store respectively.

It is strongly advised that all clients implement multi-factor authentication (2FA) to secure their accounts.

Your Wirex Account is 100% safe and secure from third-party interception of your funds, or personal data. It is PCI DSS Level 1-certified, the maximum level of protection you can enjoy. Further, Wirex is fully licensed by the FCA (financial conduct authority) as an e-Money issuer.

Multi-seek protection and cold storage crypto accounts guarantee the integrity of your digital currency, 24/7. Thanks to multi-factor authentication protocols (2 FA), and innovative device authorisation technology, only you as the client can access your account.

Viewed in perspective, the security of your Wirex account is guaranteed, like Fort Knox.

Thanks to the universal appeal of your Wirex account, you can use the Wirex app abroad whenever you are away on pleasure or business. It is a low-cost option designed to facilitate multi-currency exchange and purchases. You can easily buy and sell fiat currency and digital currency, thanks to the availability of 9 cryptocurrencies and 12 supported fiat currencies.

Today, Wirex enjoys widespread adoption. The company is a sprawling global enterprise featuring services across 130+ countries, including 54 million locations worldwide. With the Wirex App, you can transfer money anywhere, to anyone, using the interbank exchange rate.

Remember, you can use your Wirex app anywhere MasterCard is accepted.

Getting in touch with Wirex support, for any account-related questions, queries, or complaints is a breeze. For one thing, the Wirex help section is pre-populated with myriad questions and answers for instant results. It features a full array of questions and answers related to multiple personal and business topics.

Categories include: Adding Money, Profile and Verification, Wirex Card, Making Payments, My Accounts, Wirex Rewards, Fees & Rates. Under each category, account holders will find valuable information on a range of topics. If your question is not answered, you can simply create a ticket to ask Wirex your question or scroll through the community forums for answers.

The community.wirexapp.com help system is the best option for getting instant assistance. However, you can also contact customer support representatives via dedicated social media pages on Facebook, Instagram, and Twitter. An active community of users is ready to assist you at any time.

Dedicated email addresses are presented for inquiries, related to press, business, partnerships, affiliate, marketing, and customer support. The company is based at 34-37 Liverpool Street, London, UK. Your point of call should be the Wirex Help Centre.

Clients can access useful assistance from the community of Wirex users at the Google Play Store and the App Store. There are many authentic client reviews with praise and constructive criticism provided, often with Wirex feedback.

The Wirex app is packed full of features, including the option to mingle cryptocurrency and fiat currency in one account. Manage all of your finances from a single app, on the go with traditional currency and digital currency buying and selling, and exchange. There are no foreign exchange fees levied when using your Wirex account abroad, and you will enjoy 5% – 8% savings compared to high street banks with exchanges.

The Wirex app is readily available to clients via the Google Play Store, and the App Store. Registered Wirex account holders attest to enjoying the convenience of the MasterCard card, but withdrawal limits and transaction fees can get costly if you are looking to make regular, incremental withdrawals from the account.