- Hold and send money in 35+ currencies

- Spend, withdraw and transfer directly from the app

Revolut is a UK-based fintech company offering financial services, offering a range of features, including multi-currency account allowing you to hold money in various currencies, savings, inverstment features and more, seeking modern and efficient financial solutions.

Opening a Revolut account is relatively simple. Once you have downloaded the app, verify your identity and proof of residence, add funds to your account via bank transfer or card, and then order your new Revolut card (delivery fees may apply).

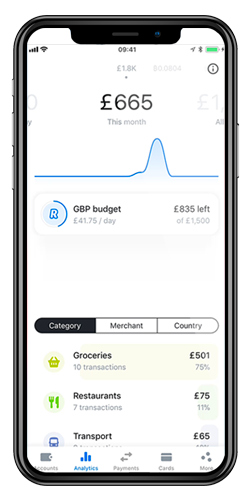

Set and manage your budget and sub-budgets. Budgeting controls: once you set up a budget, Revolut will automatically track progress in real-time, making sure you do not exceed your spending targets. Divide your monthly budget over specific categories and let Revolut alert you when you’re close to reaching the budget limit.

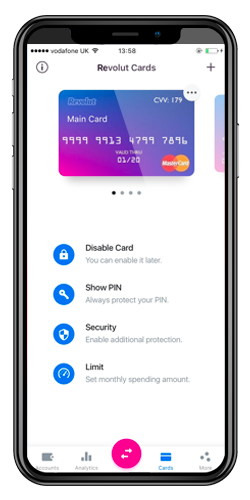

Order a Revolut card to fully benefit from all of its features (delivery fees may apply). Depending on your account, you can order different cards with which you can pay online or in-store.

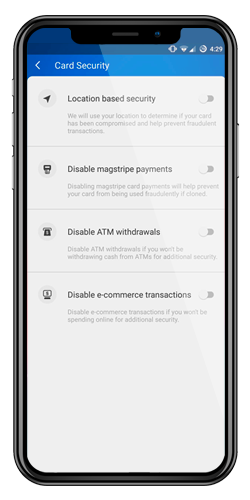

Automatically block payments made from any other location than yours.

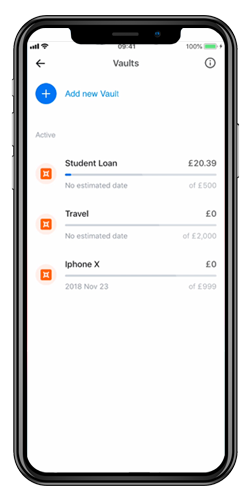

An easy and fast way to work towards your financial goals. Set up in seconds, name it, attach a saving goals and turn on the spare change feature for starters. Round up payments to the closest whole amount and store the difference. Set up a recurring payment straight into your Vault.

Hold and send money in 35+ currencies with real-time foreign exchange to 150+ currencies.

You create a default account when you register, based on the currency used in your location. You can create up to 24 different accounts for different currencies with the default account included.

Pay, share bills with your contacts, transfer money.

In case of a lost card, freeze it in the app. Unfreeze it again when you find it, or report it as lost and get a new one.

Easily adjust what your card can do from the app, i.e. contactless and swipe payments, ATM withdrawals, online transactions, etc.

Spend abroad in over 150 currencies.

€/£200 (amount depends on a plan) in international ATM withdrawals with no withdrawal fee from Revolut.

Revolut Pro is tailored for freelancers, contractors, side-hustlers, sole traders, and more. It offers a suite of simple and convenient tools designed to streamline financial management and empower individuals in various self-employed professions. These tools are available to you for free within your Revolut app!

As a Revolut user, you can choose from three different personal account types and another four business account types to choose from.

| Free | Plus | Premium | Metal | Ultra | |

| Min Age | 16+ | 16+ | 16+ | 16+ | 16+ |

| Price per month | €/£0 | €/£3.99 | €/£7.99 | €/£14.99 | €/£45.00 |

| Free Euro IBAN account | ✓ | ✓ | ✓ | ✓ | ✓ |

| Spend in 150+ currencies | ✓ | ✓ | ✓ | ✓ | ✓ |

| Currency exchange amount with no additional fees, Mon-Fri | up to £1,000/mo | up to £1,000/mo | No monthly limit | No monthly limit | No monthly limit |

| Card Spending (foreign) | ✓ | ✓ | ✓ | ✓ | ✓ |

| Virtual debit card | ✓ | ✓ | ✓ | ✓ | ✓ |

| Google Pay / Apple Pay | ✓ | ✓ | ✓ | ✓ | ✓ |

| International ATM withdrawals with no withdrawal fee from Revolut | £200/mo or 5X | £200/mo | Up to €/£400 p/mo | Up to €/£800 p/mo | Up to €/£2,000 p/mo |

| 24/7 customer support | X | ✓ | ✓ | ✓ | ✓ |

| Discounted international transfer fees | X | X | 20% | 40% | Free |

| Delayed flight, lost or damaged luggage insurance | X | X | X | £1,000/y | £1,000/y |

To learn more about Revolut business accounts, read our full Revolut Business Review.

Revolut’s policies and procedures are designed to protect users’ confidentiality as well as the security of their information, including their non-public personal information. Personal information is stored using third-party servers located in secure data centers protected by firewalls and a ‘restricted access’ policy, in compliance with applicable regulations. All data passed between Revolut’s mobile apps, its servers, and third parties are 2048-bit SSL encrypted.

On top of that, Revolut employs several security settings that can be applied to each of your Revolut cards. Change these at will in the app’s ‘Cards’ section.

Revolut aims to make traveling abroad as pleasant as possible for its users. For users traveling abroad, Revolut offers:

The Revolut Support Center consists of two main parts: Community and the Help Center. The Help Center is a searchable knowledge base that covers all aspects of Revolut’s service, with an obvious special focus on the app, categorized into different sections, each covering a specific aspect of the service.

The community is a Q&A forum that has a number of conveniently chosen subcategories that make it easy to navigate, with additional options to check the latest posts, or the most popular ones. Getting information from other users can be of great help to someone just getting started. In any case, these two support pillars offer a lot of tips, tricks and general knowledge about Revolut’s service and the app.

If you are still left with questions after checking the Support Center and the Community forum, you still have the option to contact Revolut’s customer service. You can call them, but the In-App chat option is much preferred over the automated phone line. The chat is available 24/7, but since Premium users are entitled to priority support, waiting times could be longer than expected for standard users.

Revolut offers a very solid app with a wide variety of great features. It is easy to use and works in a very intuitive way. You can hold different currencies and spend like a local abroad. Revolut values security and, besides encrypting data streams with state-of-the-art encryption, offers a very useful set of security features users can benefit from to keep their Revolut account safe and secure. Revolut is a great alternative to traditional financial solutions, with relatively low fees for basic accounts and even lower fees for premium accounts.