Top Online Business Accounts | UK

Top Online Business Accounts

UK

– April 2024

UK

– April 2024

- Regulated banking services.

- Best for SMBs and sole proprietors.

- Integrate with accounting softwares.

Advertiser disclosure

| Business Bank | Pricing | Card | Regulation | Main Advantages | Score | Open an Account | |

|---|---|---|---|---|---|---|---|

|

1

Our Top Choice

|

|

FCA

|

|

9.8

|

Quick sign-up. Same-day company registration for free.

|

||

|

2

|

|

FCA

|

|

9.5

|

|||

|

3

|

|

FCA

|

|

9.1

|

|||

|

4

|

|

FCA

|

|

8.8

|

|||

|

5

|

|

DFSA

|

|

8.5

|

|||

- Pays the incorporation fee on your behalf

- Manage business operations via the app

- Multi-director access to your account

- In-app card locking & custom card settings

Why business account?

It’s important to establish a financial identity for your business, whether you’re a freelancer, sole trader, partnership, or corporation. A business bank account is geared towards business activity and is intended to confer the same benefits as a personal bank account.

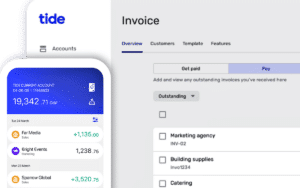

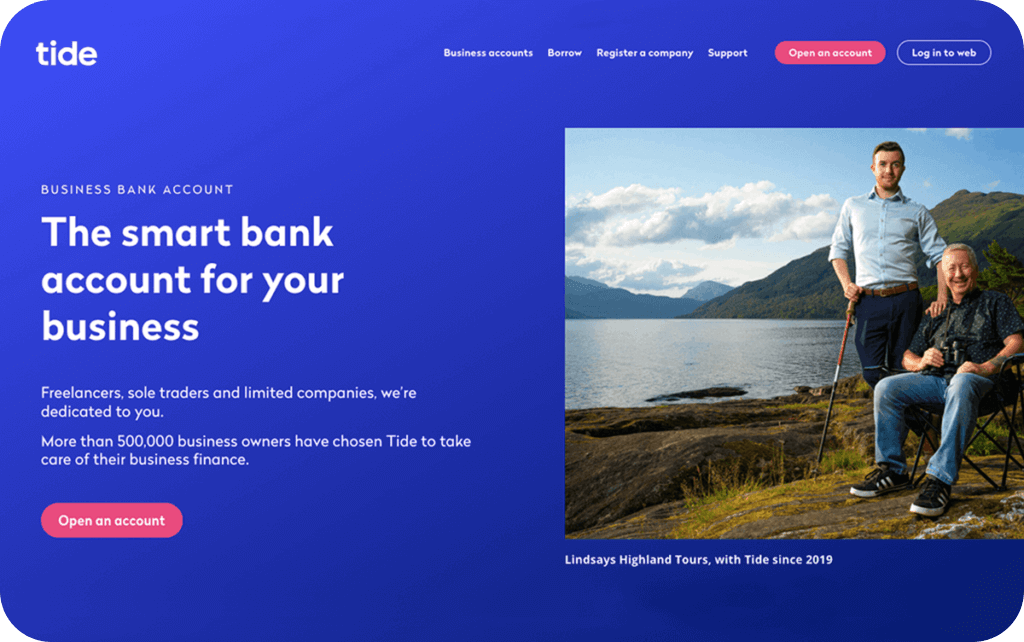

Tide

Tide is a financial platform of digital banking for small businesses and freelancers.

- Send, pay and track invoices in the app.

- Expense cards keep track of who’s spending what.

- Set up sub-accounts to set aside money for expenses.

Most Chosen by Business Owners

| Business Bank | Pricing | Card | Regulation | Main Advantages | Score | Open an Account | |

|---|---|---|---|---|---|---|---|

|

1

Our Top Choice

|

|

FCA

|

|

9.8

|

Quick sign-up. Same-day company registration for free.

|

||

- Pays the incorporation fee on your behalf

- Manage business operations via the app

Business Account Features

Monthly Fees

The leading business banking providers offer the free account. Many of them also offer premium plans, offering additional benefits, so you only have to pay a small fee for the services you use.

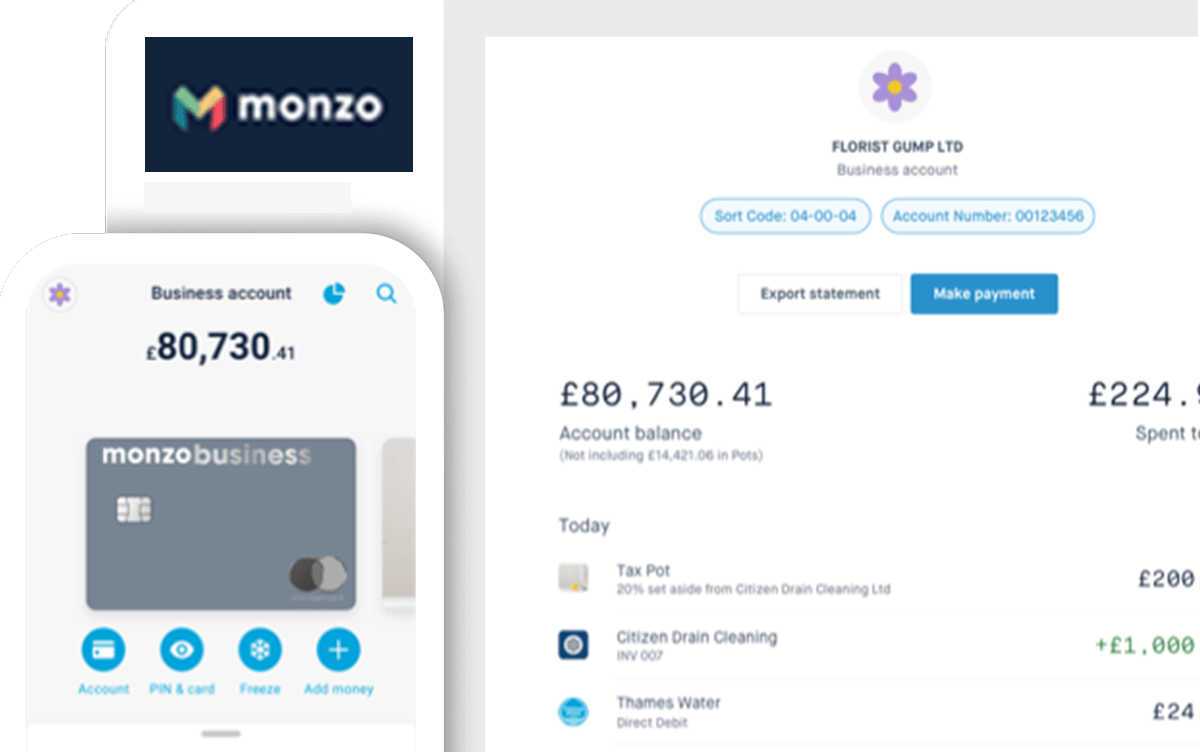

Account Access

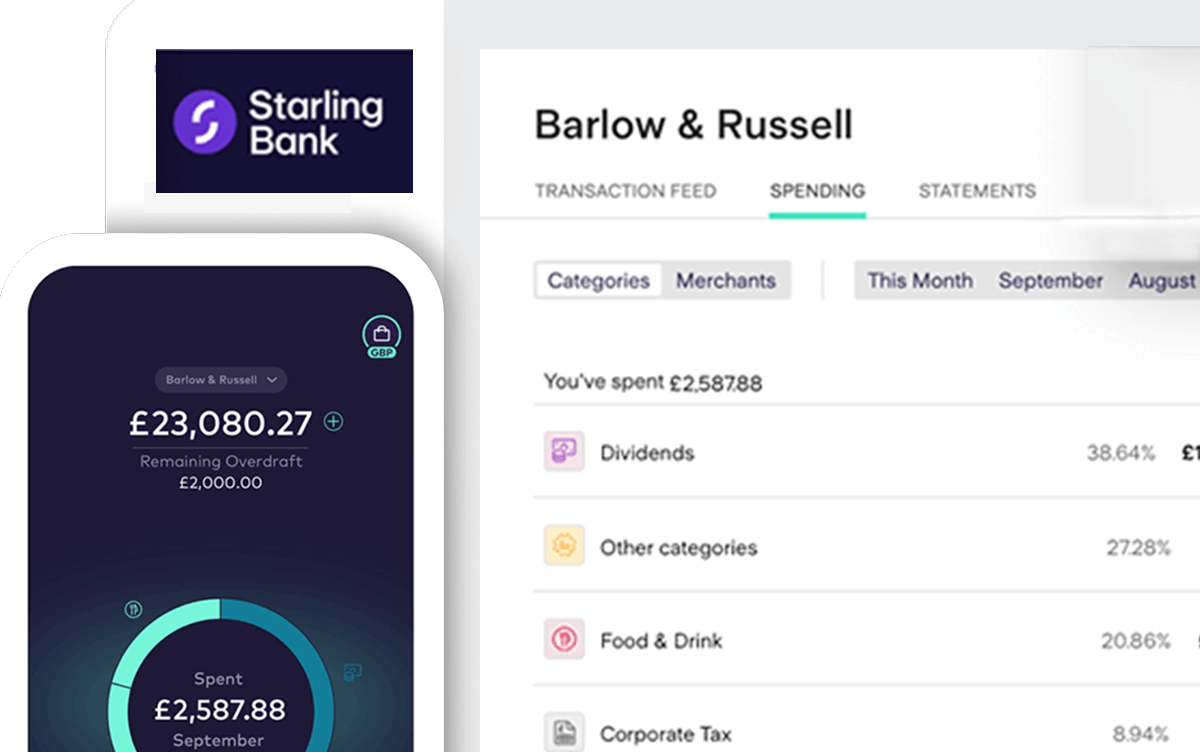

There are some banks today that allow customers access to their accounts 24 hours a day, 7 days a week. Most providers offer mobile and desktop/web access, but some business banks offer only one or the other, so make sure your bank offers what you need.

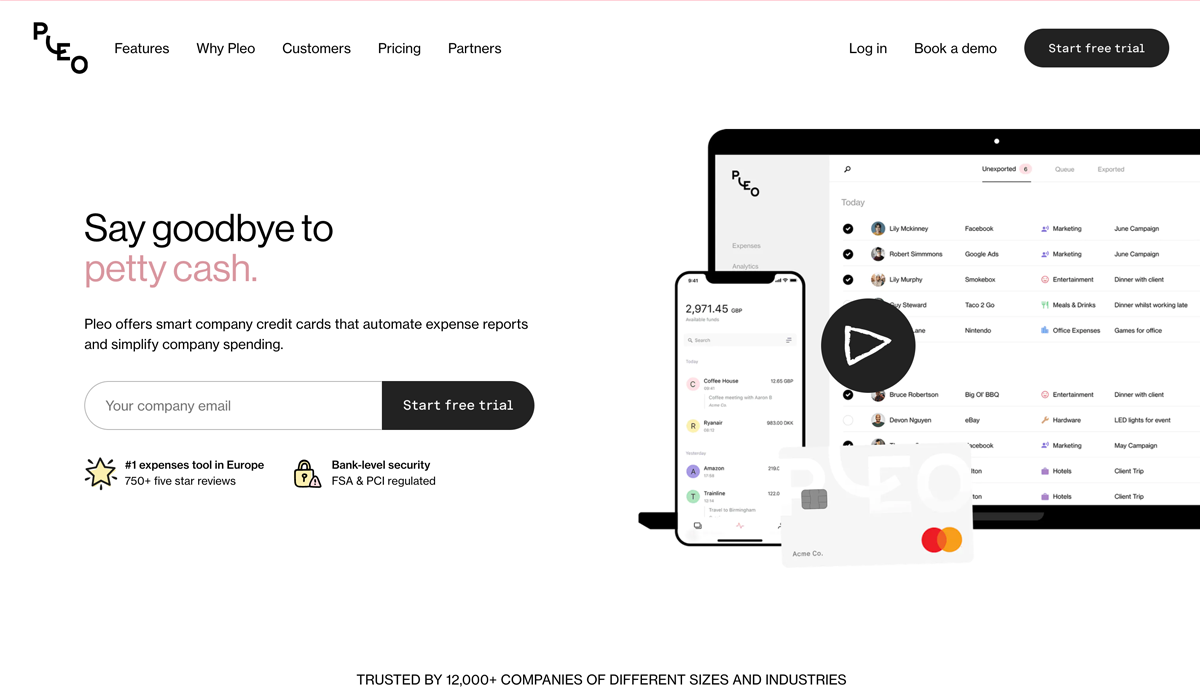

Payments

Consider payment options, local and international money transfer services, account types, and currencies available, as well as invoicing and bookkeeping tools.

Accounting tools

Make sure the system has built-in expense reporting, recurring payments, and direct debits. The majority of banks also integrate seamlessly with accounting and bookkeeping software.

Corporate Cards

All business accounts include corporate cards for you and your employees. Find out how many cards are included in your chosen plan and the cost of any additional cards you might require.

Mobile banks vs Traditional banks

Mobile banks (and EMI/ financial apps) are revolutionizing personal banking by providing an alternative to traditional brick-and-mortar banks with with fast, secure, and easy-to-use apps for iOS and Android. These digital banks offer competitive services like current accounts, savings accounts, loans, insurance, and debit/credit cards at affordable rates. With transparency, convenience, and fewer restrictions, mobile-only banks are reshaping the future of hassle-free and borderless banking.

Security

The leading mobile banks, including those on this website, adhere to the highest safety standards, ensuring your money and data are protected 24/7. The mobile banks compared and reviewed by top10mobilebanks.com are authorised and regulated by local authorities.

Go paperless

One of the frustrating things about traditional banks is the amount of documents, contracts and letters that are sent to your mailbox. With mobile banks everything you need is in the app and all communications are sent to your app or your email.

Lower fees

As a mobile-only platform, mobile banks can offer lower fees than traditional banks – especially when it comes to interest rates, monthly fees, ATM withdrawals, money exchange/transfer and payments abroad.

Get approved fast

Opening an account with a mobile-only bank is simple, with no lengthy paperwork. Just download the app, prove your identity, top up your account and you’re ready to go.

24/7 availability

No matter where you are, at home or abroad, you can access your bank account via the app, check your account balance, control your savings, get customer support, make payments and even lock your debit card if needed. No need to make appointments, stand in line and lose working hours to manage your finances.