- Superfast registration process, no proof of address requirement

- Quick and low-fee international transfers

Monese Review

Monese Review

Advertiser disclosure

Introduction

Monese, founded and based in the UK provides current accounts, money transfer services, and other banking services to both the UK and the rest of the European Economic Area (EEA) residents.

- EN

- DE

- ES

- FR

- IT

- RO

- +9

- Free Plan

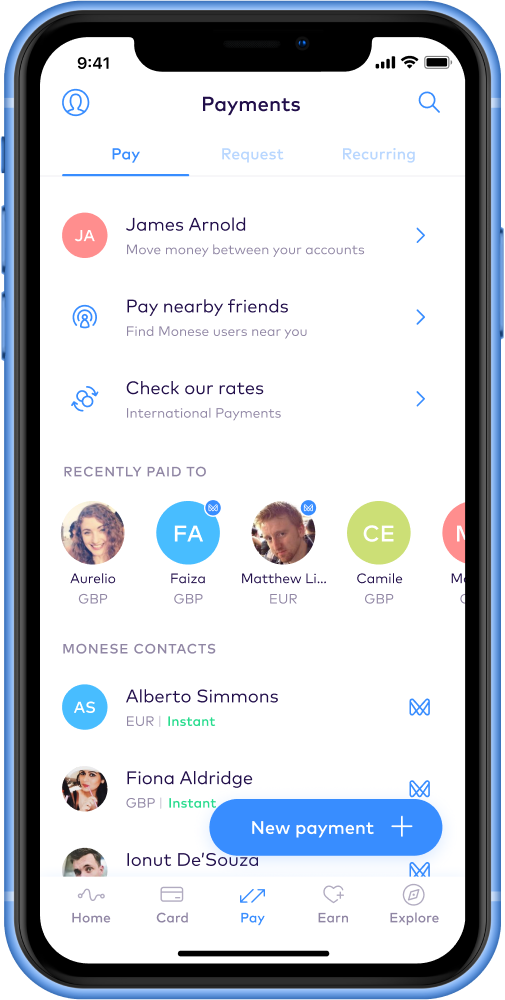

To use Monese, you need to download the Monese app – available in Google Play (Android) and the App Store (iPhone) – to your smartphone. Once registered and verified, the mobile app discloses all of Monese’s services, including managing current accounts and the means to top up that account, the Monese debit card that allows accessing your money across the globe, payment options, budgeting tools, and all the necessary security options to keep your account and your money safe.

Opening a Monese account does not take long. If you live in the UK or a Eurozone country and have a matching ID to prove that fact, along with an email address and a mailing address where your Monese card can be sent to, you’re good to go. No usual proof of address or credit history needed — a huge benefit for travellers and expats.

Banking Features

All-in-one

Make Monese your default account and handle everything (payments, direct debits, online & offline shopping, transfers, withdrawals, etc.) from your app and card.

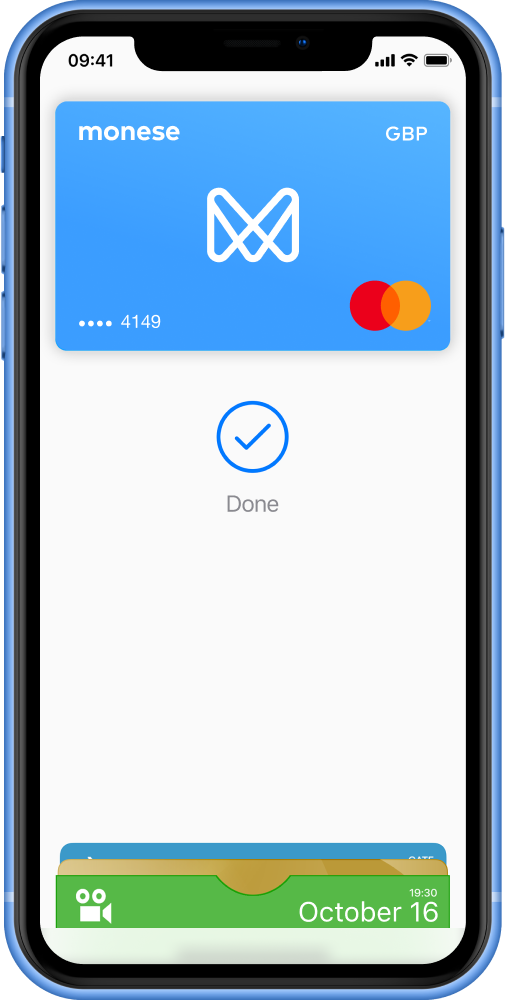

Apple & Google Pay

Add your Monese card to your Apple Pay or Google Pay accounts and enable contactless in-store payments as well as instant, secure online payments with a higher level of security (Touch ID, Face ID).

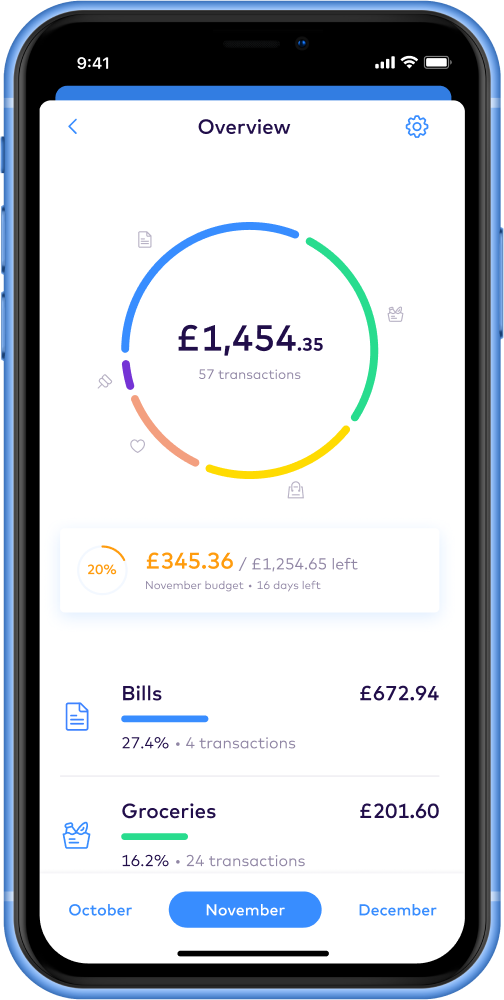

Budgeting

24/7 full insight and control over your account and personal finances with the Instabalance feature that won’t allow you to overspend.

Payments

Pay for goods and services (rent, utility bills, etc.) in real-time, with just a few taps. Pay via bank transfer or use the free Monese-to-Monese option.

Low-cost currency exchange

Travel with your Monese debit card and benefit from fee-free currency exchanges using the interbank exchange rate – wherever you go.

Cheap international transfers

Convert money at the interbank rate and save up to 88% when sending money abroad.

Adding funds

Top-up money straight from your UK or European account, or top-up Cash in Europe via Paysafecash, and in the UK at any post office or PayPoint location. This feature is available for free across all three pricing plans.

Eurozone account

For convenience – especially for those who often travel to Europe.

Monese Credit Builder for customers in the UK

This is a great tool to use in order to save money, build up your credit history, and simultaneously build up your credit score. After a year of monthly repayments on your interest-free Credit Builder loan, you’ll have 12 months of successful repayment history recorded with the credit agencies, plus 12 months of savings ready to spend.

- No credit check or credit card required, for just £7.95pm [Rep APR]

- Improves your credit score with all of the UK’s credit rating agencies

- Credit Builder sits alongside the rest of their Monese account

“Partner Rewards” feature for customers in the UK

Access to the hottest deals from Gousto to Tastecard, Iceland to Three. This is a great way to save money on groceries, clothing, essentials, and gifts.

“Instabalance”

For real-time account balance tracking with push notifications.

App

Available in 15 languages, including English, Bulgarian, Czech, French, German, Italian, Lithuanian, Polish, Ukrainian, Portuguese, Romanian, Spanish, & Turkish.

Global ATM cash withdrawals

Monese offers free ATM withdrawals worldwide, each plan has a different limit. The Simple plan offers up to £/€200 free/m (2% fee after), the classic plan offers up to £/€800 free/m (2% fee after) and the Premium plan offers unlimited free withdrawals.

Avios Integration

Spend your money at selected retailers and travel companies to collect Avios and use them on flights, hotel bookings, activities. (For UK residents only).

Monese Account Types

Monese offers Depending on the country you live in, you have three personal Monese account types and one Joint account to choose from.

Personal account types

| Starter | Classic | Premium | |

| Price per month | £/€0.00 | £/€5.95 | £/€14.95 |

| International transfers | 2.5% fee, additional 1% fee on weekends | From 0.5% fee | Free |

| Local transfers in and out | Free | Free | Free |

| Recurring payments & direct debits | ✓ | ✓ | ✓ |

| Instant Monese to Monese transfers | Free | Free | Free |

| Contactless debit card | Standard card | Holographic edging | Premium card |

| First card delivery | Free | Free | Free |

| Card spending in foreign currencies | 2% fee | Free | Free |

| GooglePay / Apple Pay | ✓ | ✓ | ✓ |

| ATM withdrawals | £/€1.5 fee | £/€500 FREE monthly | £/€1,500 FREE monthly |

| Cash top-ups | 3.5% fee | £/€500 FREE monthly | £/€1,500 FREE monthly |

| PayPal account integration | ✓ | ✓ | ✓ |

| Multilingual customer support | ✓ | ✓ | ✓ |

| Priority customer support access | X | X | ✓ |

Starter

Classic

Premium

Joint account

Monese offers users the option to open a UK Joint account. This is not a separate account; it is connected to a personal account. Opening a joint account requires a user to first open a personal Plus account. For a total fee of £9.95, the user will have both a personal Plus account and a UK joint account. It is easy to separate your joint and personal spendings by using the free, dedicated debit cards.

The Monese joint account has the following specs:

- Quick account setup

- Fast local and international payments

- Joint savings goals

- 2 Monese contactless MasterCard debit

- Instant notifications for every activity

Fees

Monese’s fee structure differs per account. While the monthly fee for the Premium plan is the highest (£/€14.95), the applicable fees are the lowest. We’ll display the different fees per account type, if relevant, below:

| Service | Fee |

| ATM cash withdrawals | £/€1.5 fee (Simple) £/€500 free monthly (Classic) £/€1500 free monthly (Premium) |

| Foreign currency exchange | 2% fee (Simple) Free (Classic) Free (Premium) |

| Cash top-ups | 3.5% fee (Simple) £/€500 free monthly (Classic) £/€1500 free monthly (Premium) |

ATM cash withdrawals

Foreign currency exchange

Instant top-ups

Security

- Monese is a registered agent of PrePay Technologies Limited which is an electronic money institution authorised by the Financial Conduct Authority.

- Encryption: in line with encryption methods used by other banks, Monese uses 128-bit SSL encryption to keep data exchange secure.

- Access PIN: For safety, keep your PIN locked away in the app and access only with your login credentials and your card’s CVV number. The 5-digit PIN keeps your Monese app locked even when your phone gets stolen.

- Real-time account notifications: receive a notification whenever you spend money, top up money, or receive a payment.

- 24/7 monitoring: Monese accounts are being monitored around-the-clock via advanced banking infrastructure.

- Single device installation: it is only possible to access Monese from a single mobile device, which makes it impossible for anyone to hack your account while in another location.

- Lock/ Unlock card: easily lock and unlock your debit card with the app to prevent unauthorised spending if you lose your card or if it is stolen.

- Protection of funds: the money in your Monese account is protected due to the bank’s authorisation by the FCA. Monese does not reinvest customer funds and keeps all client funds separate to ensure customers will be able to receive their full balance at all times.

Using the Monese App Abroad

Monese helps to make traveling easy and convenient, offering users the following perks:

- With Monese, you have the option to always pay in the local currency, saving a lot on undesired, expensive conversions. All users benefit from the interbank rate, with ‘Simple’ users paying an additional 2% fee, and ‘Classic’ users 0.5%. Premium users don’t pay conversion fees.

- The app offers the option to lock the card instantly, which is the advised setting when not using the card. Simply unlock the card when needed to prevent possible fraud (but keep in mind that you need an internet connection to lock/ unlock the card via the app).

- Cash withdrawals fee is 2% (Classic users get to withdraw up to £/€800 per month for free. Premium users don’t pay for withdrawals at all).

- Use your Monese card to pay contactless and save time (no need to enter your PIN), avoid carrying cash, and prevent fraud since you don’t even have to take out the card for smaller payments.

Monese Support

Monese’s Help Center consists of several separate parts. The FAQ section is basically a searchable knowledge bank with a large set of predetermined questions and answers instantly available.. Besides the database, users can open the Live chat option by clicking the Help button in the lower right corner, which opens a pop up from a bot, asking what problem you have (and offering to find the answer), or connecting us to a support team member.

Monese can also be reached by phone, and offers dedicated phone numbers for all the European countries that have access to Monese’s service. Opening hours for phone support are Monday to Friday from 08:00 to 17:00, and Saturday from 10:00 to 16:00.

Monese support can also be reached by email.

- Super fast account setup

- Easy to use mobile app

- Low cost cash withdrawals

- No credit checks or proof of address required

- Standard UK account setup, with additional free Eurozone account option

- 2% fee when transferring money to non-Monese accounts

- Monthly limitations on free withdrawals and free top-ups

- No 24/7 Customer Support

Conclusion

Monese offers a great set of mobile banking features. UK based customers have a small advantage over non-UK citizens (cash top-up options), but Monese is a great option for anyone who spends time away from home on a regular basis. With currency exchange rates based on the interbank rate and the option to pay in the local currency on many occasions, Monese sheds a whole different light on the concept of traveling, making the financial side of it very easy and cheap. The Monese debit card, MasterCard based, can be used for low-cost cash withdrawals the world over, and offers great contactless payment options on top of that. In short: Monese offers a very competitive and complete mobile banking package — definitely a closer look for everyone thinking of a mobile banking solution.