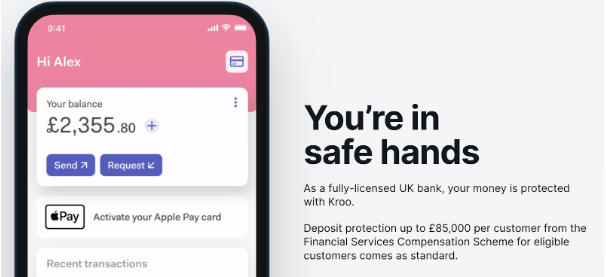

- A full banking license – FSCS deposit protection of up to £85,000

- Earn 4.35% AER / 4.27% Gross (variable) interest on balance up to £500k

Kroo Review

Kroo Review

Advertiser disclosure

Introduction

Kroo Bank Ltd is a financial institution that was established with a mission to change banking for good. Founded in 2016, the bank was granted a full banking license in 2022, and it has since launched a current account that is protected by the Financial Services Compensation Scheme (FSCS). As part of Kroo’s commitment, it has partnered with One Tree Planted to plant two trees for every new customer, intending to plant 1 million trees by the end of 2023.

Kroo’s current account comes with zero fees on foreign spending, deposit protection of up to £85,000, and an overdraft. The bank provides customers with the security of a high-street bank and the flexibility and intuitive customer service of a FinTech. In the future.

Kroo is registered in the capacity of payment services and/or electronic money agent (Modulr FS LTD) and provides electronic money (e-money) debit cards to existing customers.

- EN

- Free Account

Banking Features

Current Account

Kroo’s current account allows customers to earn a high-interest rate of 4.35% AER / 4.27% Gross (variable) interest on balance up to £500k. Only one current account per client is permitted at Kroo. Also, it provides a prepaid e-money account for existing UK clients.

Security

Kroo prioritizes the security of its customers’ data by using multi-factor authentication, ensuring it always remains safe and protected. Deposit protection of up to £85,000, and an overdraft. In addition, the Kroo app allows customers to freeze and unfreeze their cards easily, giving them greater control over their finances and an added layer of security.

Customer Support

Kroo has a UK-based customer service team. Customers can message the team in-app for prompt and efficient assistance, ensuring that issues or concerns are managed effectively.

Overdraft Facilities

Kroo provides an overdraft of up to £2,500 with a representative interest rate of 24.9% EAR/APR (variable), with no fees or penalties. The overdraft is by invitation only, and customers must first open a Kroo current account. The overdraft service guarantees customers that they are covered for unexpected expenses without hidden fees or penalties.

Travel Perks

Kroo’s current account offers fee-free spending worldwide with Visa’s real exchange rate. Customers can quickly check the exchange rates by clicking on a button that leads to Visa’s exchange rate calculator. In addition, customers have unlimited ATM withdrawals abroad with zero fees (some ATM providers may charge a separate fee for using their ATM) and track shared expenses easily with the Groups functionality feature.

Kroo Services & Fees

The Kroo current account has no opening fees, no maintenance fees, and zero commission on spending abroad. Thanks to spending insights and fully transparent fees, customers can easily manage their finances.

The tables below provide customers with an overview of the fees for using the account’s main services, helping them to compare these fees.

Monthly fees

| Service | Fee |

| Maintaining the account | £0 |

Cards and cash

| Service | Fee |

| Debit card payment in pounds | £0 |

| Debit card payment in a foreign currency | £0 |

| Cash withdrawal in pounds in the UK | £0 |

| Cash withdrawal in foreign currency outside the UK | £0 |

Payments (excluding cards)

| Service | Fee |

| Direct debit | £0 |

| Standing order | £0 |

| Sending money within the UK – Faster Payments | £0 |

| Sending money within the UK – CHAPS payment | £20 |

| Sending money outside the UK * | X |

| Receiving money from outside the UK * | X |

Overdrafts and related services

| Service | Fee |

| Arranged overdraft | 24.9% EAR/APR variable |

| Unarranged overdraft | 24.9% EAR/APR variable. Kroo will not charge more than £15 interest for any month |

| Refusing a payment due to lack of funds | £0 |

| Allowing a payment despite lack of funds | £0 |

Other services

| Service | Fee |

| Cancelling a cheque | Service not available |

| Obtaining a Kroo card | £0 |

| Fee for a replacement Kroo card if you lose it | £0 (first two replacement cards) |

| Allowing a payment despite lack of funds | £0 |

| Card delivery outside the UK | £10 |

Security

A full banking license is granted to Kroo Bank Ltd and deposits are protected up to £85,000 by FSCS.

Moreover, Kroo provides customers with various security features, such as biometric and multi-factor authentication on its app. Customers can also easily freeze and unfreeze their cards using the app.

In addition, Kroo uses credit reference agencies and fraud prevention services to check customers’ information and prevent fraudulent activities.

Support

Customers can chat with humans in-app by tapping “Profile” and navigating to “Help & Support.” Alternatively, customers can email help@kroo.com.

If customers have a complaint, they can submit it by emailing complaints@kroo.com.

- A full banking license – deposit protection by FSCS of up to £85,000

- No opening or maintenance fees

- Earn 4.35% AER / 4.27% Gross (variable) interest on balance up to £500k.

- Overdraft facilities of up to £2,500

- Allows a payment despite lack of funds with £0 fees

- Obtaining a Kroo card and first two replacement cards for free

- UK-based customer support

- Sending and receiving money outside the UK is not available

- Delivery Kroo card outside the UK is £10

Conclusion

Kroo Bank Ltd has a full banking license and deposit protection by FSCS of up to £85,000 allowing it to earn 4.35% AER / 4.27% Gross (variable) interest on balance up to £500k. The Kroo app for Android and iOS provides customers with biometric and multi-factor authentication features. While Kroo has limitations, such as restricted overdraft of up to £2,500 and no physical branches, it remains a top choice for UK residents looking for a reliable and innovative banking experience.