Latest News on Mobile Banks – 2021

Advertiser disclosure

Mobile banking has blown up lately. Fintech companies are seeing more customers interested in their services every day, and the number of mobile banks has also grown. As a result, the already established ones keep improving their value to customers.

Let’s take a look at the October updates for three prominent industry names, Paysend, Holvi, and Bunq.

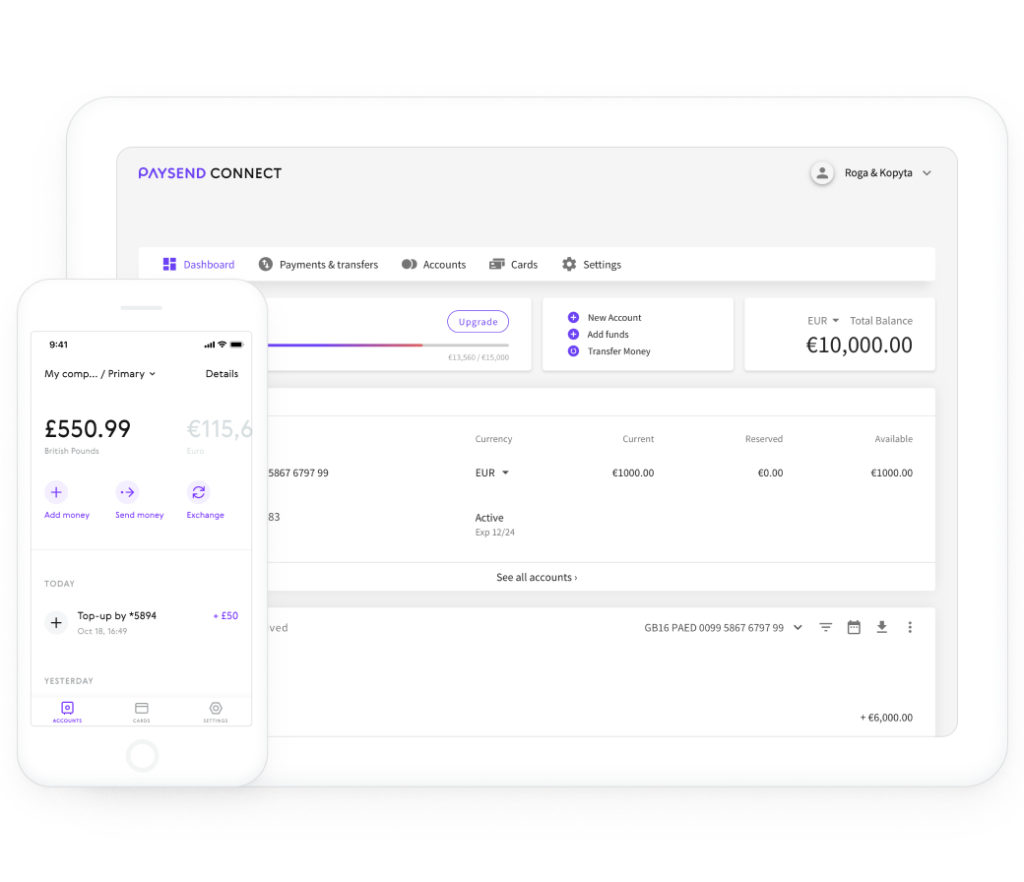

Paysend

Paysend is famous for its quick, safe, and seamless money transfers that cut the need for ques, forms, and visits to a bank for a low cost. Today, they operate in over 70 countries and counting.

Its business account saw some refurbishment in recent months. You can now open multi-currency accounts, make SWIFT/SEPA transfers, process payments online, and issue corporate Mastercards with Connect.

The Paysend Global Account for business comes with an eCommerce tool, allowing customers to quickly and conveniently pay for your company’s goods and services. It accepts Mastercard, Visa, and many alternative payment methods.

The Business Account incorporates global transfers, allowing you to move funds to a card or a bank account in over 90 countries. You can use the cards in 25 different currencies with fair exchange rates, ideal for global businesses. No matter which one you use, there’s a low, flat transfer fee.

Thanks to Crassula, an open-banking platform collaborating with Paysend, businesses can integrate their accounting operations with other business tools and software.

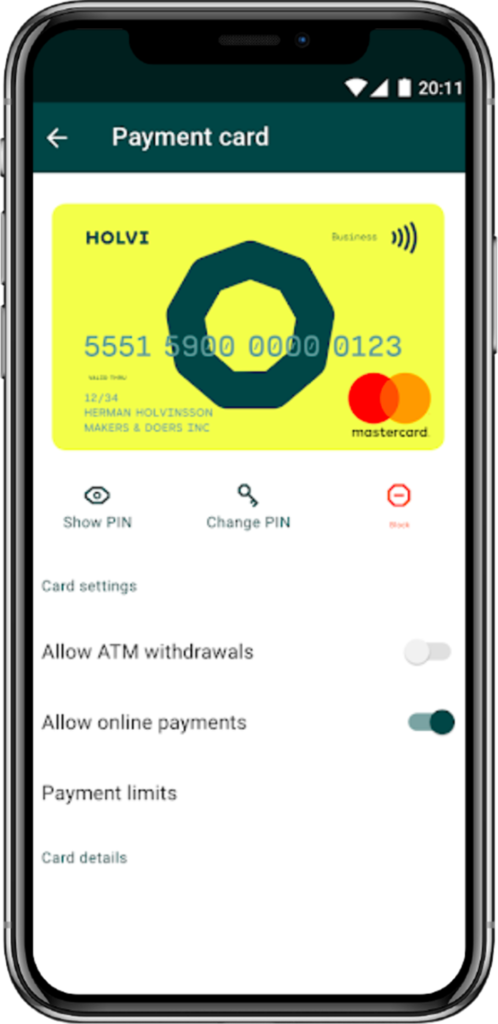

Holvi

Holvi seeks to simplify all accounting functions of a company, from invoicing to receipts, reporting, and providing detailed statements.

There’s already a prepaid MasterCard for Holvi users. The offer comes with the standard use policy and limits, but with added security features. Soon, Holvi will launch Business MasterCard 2.0.

The management team at Holvi took advice from its users, who requested higher card acceptance and support for digital payments. From the looks of it, the 2.0 will contain both.

As the CEO says, the priority is to expand card acceptance, increasing it across the board. The card will also become digitized, including integration with Apple Pay and Google Pay.

That way, your card will become available immediately upon purchase, and you won’t depend on its physicality.

The company has mapped out the next three months of development. It intends to obtain the Mastercard Community Principal membership. The card design and packaging improvement will follow. The final stage consists of card distribution.

The updates will serve personal and commercial card users, who’ll enjoy more flexibility. Holvi could become people’s primary payment management source. Read our full Holvi review to learn more.

Bunq

Bunq became popular after launching its technological breakthrough of eco-friendliness, the Green Card. The metallic card costs €99 a year and allows people to contribute to environmental preservation.

Bunq purchasers combat worldwide deforestation by engaging in regular spending. The company plants trees for every €100 spent on the card. It’s already planted 1 million, with many more to come.

It’s no more challenging for clients to apply Bunq than other mobile banking services. There’s a mobile app that tracks expenses and plants accordingly. As a bonus, the metal cards last 50% longer than their plastic counterparts.

The Green Card works with any bank, allowing you the convenience of not switching banks. The payments are effortless, and you can use ATMs globally. All spending information and insights are available on the app, too.

You can dedicate your investments to European eco-friendly companies that support ecosystem protection initiatives, too.

The Green Plan is ideal for anybody looking to do their part but lacks time to take proactive actions alone. Bunq lets you do so by living your everyday life. Read our full bunq review.